Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

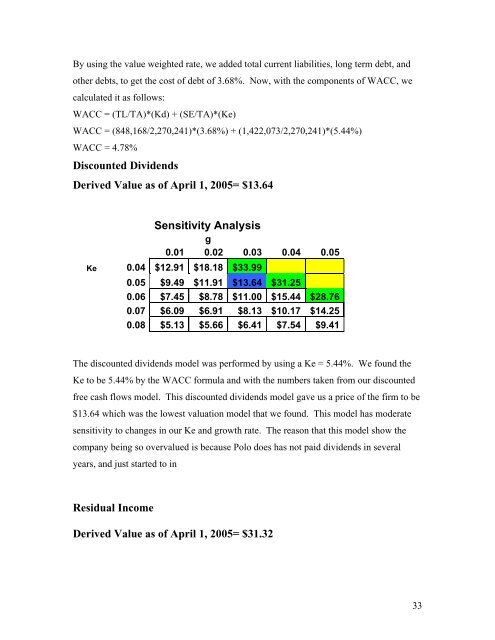

By using the value weighted rate, we added total current liabilities, long term debt, andother debts, to get the cost <strong>of</strong> debt <strong>of</strong> 3.68%. Now, with the components <strong>of</strong> WACC, wecalculated it as follows:WACC = (TL/TA)*(Kd) + (SE/TA)*(Ke)WACC = (848,168/2,270,241)*(3.68%) + (1,422,073/2,270,241)*(5.44%)WACC = 4.78%Discounted DividendsDerived Value as <strong>of</strong> April 1, 2005= $13.64Sensitivity Analysisg0.01 0.02 0.03 0.04 0.05Ke 0.04 $12.91 $18.18 $33.990.05 $9.49 $11.91 $13.64 $31.250.06 $7.45 $8.78 $11.00 $15.44 $28.760.07 $6.09 $6.91 $8.13 $10.17 $14.250.08 $5.13 $5.66 $6.41 $7.54 $9.41The discounted dividends model was performed by using a Ke = 5.44%. We found theKe to be 5.44% by the WACC formula and with the numbers taken from our discountedfree cash flows model. This discounted dividends model gave us a price <strong>of</strong> the firm to be$13.64 which was the lowest valuation model that we found. This model has moderatesensitivity to changes in our Ke and growth rate. The reason that this model show thecompany being so overvalued is because <strong>Polo</strong> does has not paid dividends in severalyears, and just started to inResidual IncomeDerived Value as <strong>of</strong> April 1, 2005= $31.3233