Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

Business Valuation of Polo Ralph Lauren Corporation - Mark Moore ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

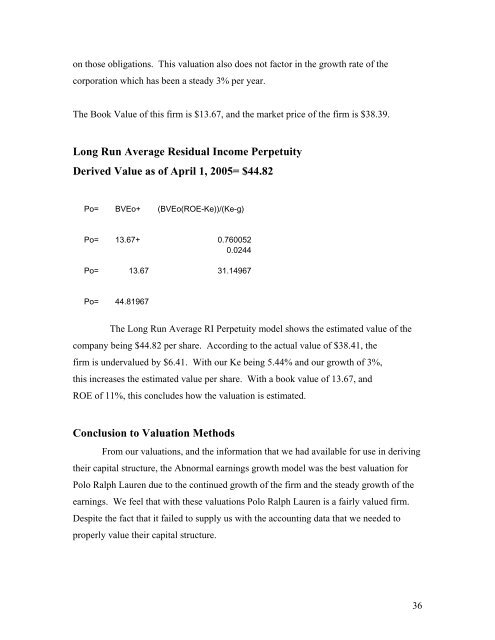

on those obligations. This valuation also does not factor in the growth rate <strong>of</strong> thecorporation which has been a steady 3% per year.The Book Value <strong>of</strong> this firm is $13.67, and the market price <strong>of</strong> the firm is $38.39.Long Run Average Residual Income PerpetuityDerived Value as <strong>of</strong> April 1, 2005= $44.82Po= BVEo+ (BVEo(ROE-Ke))/(Ke-g)Po= 13.67+ 0.7600520.0244Po= 13.67 31.14967Po= 44.81967The Long Run Average RI Perpetuity model shows the estimated value <strong>of</strong> thecompany being $44.82 per share. According to the actual value <strong>of</strong> $38.41, thefirm is undervalued by $6.41. With our Ke being 5.44% and our growth <strong>of</strong> 3%,this increases the estimated value per share. With a book value <strong>of</strong> 13.67, andROE <strong>of</strong> 11%, this concludes how the valuation is estimated.Conclusion to <strong>Valuation</strong> MethodsFrom our valuations, and the information that we had available for use in derivingtheir capital structure, the Abnormal earnings growth model was the best valuation for<strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong> due to the continued growth <strong>of</strong> the firm and the steady growth <strong>of</strong> theearnings. We feel that with these valuations <strong>Polo</strong> <strong>Ralph</strong> <strong>Lauren</strong> is a fairly valued firm.Despite the fact that it failed to supply us with the accounting data that we needed toproperly value their capital structure.36