Indexed Adobe PDF (Spring 2011-Full Version) - SUNY Orange

Indexed Adobe PDF (Spring 2011-Full Version) - SUNY Orange

Indexed Adobe PDF (Spring 2011-Full Version) - SUNY Orange

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

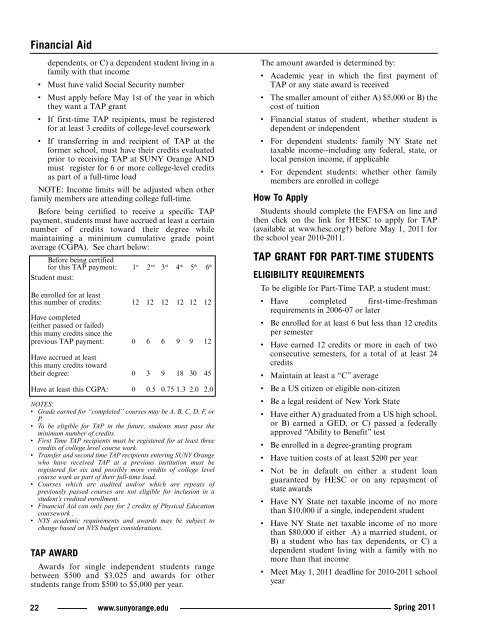

Financial Aiddependents, or C) a dependent student living in afamily with that income• Must have valid Social Security number• Must apply before May 1st of the year in whichthey want a TAP grant• If first-time TAP recipients, must be registeredfor at least 3 credits of college-level coursework• If transferring in and recipient of TAP at theformer school, must have their credits evaluatedprior to receiving TAP at <strong>SUNY</strong> <strong>Orange</strong> ANDmust register for 6 or more college-level creditsas part of a full-time loadNOTE: Income limits will be adjusted when otherfamily members are attending college full-time.Before being certified to receive a specific TAPpayment, students must have accrued at least a certainnumber of credits toward their degree whilemaintaining a minimum cumulative grade pointaverage (CGPA). See chart below:Before being certifiedfor this TAP payment: 1 st 2 nd 3 rd 4 th 5 th 6 thStudent must:Be enrolled for at leastthis number of credits: 12 12 12 12 12 12Have completed(either passed or failed)this many credits since theprevious TAP payment: 0 6 6 9 9 12Have accrued at leastthis many credits towardtheir degree: 0 3 9 18 30 45Have at least this CGPA: 0 0.5 0.75 1.3 2.0 2.0NOTES:• Grade earned for “completed” courses may be A, B, C, D, F, orP.• To be eligible for TAP in the future, students must pass theminimum number of credits.• First Time TAP recipients must be registered for at least threecredits of college level course work.• Transfer and second time TAP recipients entering <strong>SUNY</strong> <strong>Orange</strong>who have received TAP at a previous institution must beregistered for six and possibly more credits of college levelcourse work as part of their full-time load.• Courses which are audited and/or which are repeats ofpreviously passed courses are not eligible for inclusion in astudent’s credited enrollment.• Financial Aid can only pay for 2 credits of Physical Educationcoursework .• NYS academic requirements and awards may be subject tochange based on NYS budget considerations.TAP AWARDAwards for single independent students rangebetween $500 and $3,025 and awards for otherstudents range from $500 to $5,000 per year.The amount awarded is determined by:• Academic year in which the first payment ofTAP or any state award is received• The smaller amount of either A) $5,000 or B) thecost of tuition• Financial status of student, whether student isdependent or independent• For dependent students: family NY State nettaxable income--including any federal, state, orlocal pension income, if applicable• For dependent students: whether other familymembers are enrolled in collegeHow To ApplyStudents should complete the FAFSA on line andthen click on the link for HESC to apply for TAP(available at www.hesc.org†) before May 1, <strong>2011</strong> forthe school year 2010-<strong>2011</strong>.TAP GRANT FOR PART-TIME STUDENTSELIGIBILITY REQUIREMENTSTo be eligible for Part-Time TAP, a student must:• Have completed first-time-freshmanrequirements in 2006-07 or later• Be enrolled for at least 6 but less than 12 creditsper semester• Have earned 12 credits or more in each of twoconsecutive semesters, for a total of at least 24credits• Maintain at least a “C” average• Be a US citizen or eligible non-citizen• Be a legal resident of New York State• Have either A) graduated from a US high school,or B) earned a GED, or C) passed a federallyapproved “Ability to Benefit” test• Be enrolled in a degree-granting program• Have tuition costs of at least $200 per year• Not be in default on either a student loanguaranteed by HESC or on any repayment ofstate awards• Have NY State net taxable income of no morethan $10,000 if a single, independent student• Have NY State net taxable income of no morethan $80,000 if either A) a married student, orB) a student who has tax dependents, or C) adependent student living with a family with nomore than that income• Meet May 1, <strong>2011</strong> deadline for 2010-<strong>2011</strong> schoolyear22 www.sunyorange.edu <strong>Spring</strong> <strong>2011</strong>