Indexed Adobe PDF (Spring 2011-Full Version) - SUNY Orange

Indexed Adobe PDF (Spring 2011-Full Version) - SUNY Orange

Indexed Adobe PDF (Spring 2011-Full Version) - SUNY Orange

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

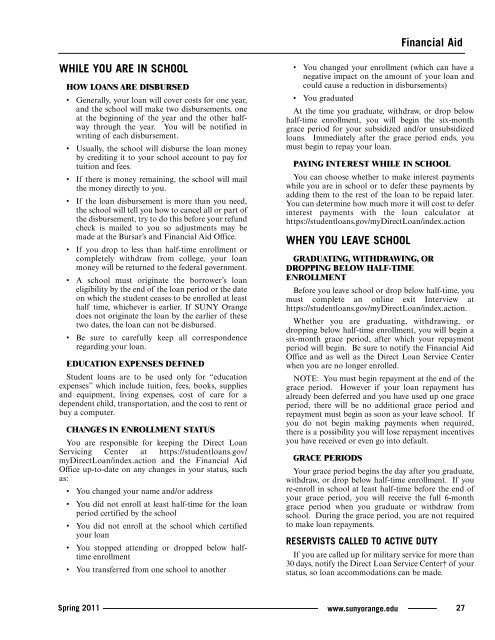

Financial AidWHILE YOU ARE IN SCHOOLHOW LOANS ARE DISBURSED• Generally, your loan will cover costs for one year,and the school will make two disbursements, oneat the beginning of the year and the other halfwaythrough the year. You will be notified inwriting of each disbursement.• Usually, the school will disburse the loan moneyby crediting it to your school account to pay fortuition and fees.• If there is money remaining, the school will mailthe money directly to you.• If the loan disbursement is more than you need,the school will tell you how to cancel all or part ofthe disbursement, try to do this before your refundcheck is mailed to you so adjustments may bemade at the Bursar’s and Financial Aid Office.• If you drop to less than half-time enrollment orcompletely withdraw from college, your loanmoney will be returned to the federal government.• A school must originate the borrower’s loaneligibility by the end of the loan period or the dateon which the student ceases to be enrolled at leasthalf time, whichever is earlier. If <strong>SUNY</strong> <strong>Orange</strong>does not originate the loan by the earlier of thesetwo dates, the loan can not be disbursed.• Be sure to carefully keep all correspondenceregarding your loan.EDUCATION EXPENSES DEFINEDStudent loans are to be used only for “educationexpenses” which include tuition, fees, books, suppliesand equipment, living expenses, cost of care for adependent child, transportation, and the cost to rent orbuy a computer.CHANGES IN ENROLLMENT STATUSYou are responsible for keeping the Direct LoanServicing Center at https://studentloans.gov/myDirectLoan/index.action and the Financial AidOffice up-to-date on any changes in your status, suchas:• You changed your name and/or address• You did not enroll at least half-time for the loanperiod certified by the school• You did not enroll at the school which certifiedyour loan• You stopped attending or dropped below halftimeenrollment• You transferred from one school to another• You changed your enrollment (which can have anegative impact on the amount of your loan andcould cause a reduction in disbursements)• You graduatedAt the time you graduate, withdraw, or drop belowhalf-time enrollment, you will begin the six-monthgrace period for your subsidized and/or unsubsidizedloans. Immediately after the grace period ends, youmust begin to repay your loan.PAYING INTEREST WHILE IN SCHOOLYou can choose whether to make interest paymentswhile you are in school or to defer these payments byadding them to the rest of the loan to be repaid later.You can determine how much more it will cost to deferinterest payments with the loan calculator athttps://studentloans.gov/myDirectLoan/index.actionWHEN YOU LEAVE SCHOOLGRADUATING, WITHDRAWING, ORDROPPING BELOW HALF-TIMEENROLLMENTBefore you leave school or drop below half-time, youmust complete an online exit Interview athttps://studentloans.gov/myDirectLoan/index.action.Whether you are graduating, withdrawing, ordropping below half-time enrollment, you will begin asix-month grace period, after which your repaymentperiod will begin. Be sure to notify the Financial AidOffice and as well as the Direct Loan Service Centerwhen you are no longer enrolled.NOTE: You must begin repayment at the end of thegrace period. However if your loan repayment hasalready been deferred and you have used up one graceperiod, there will be no additional grace period andrepayment must begin as soon as your leave school. Ifyou do not begin making payments when required,there is a possibility you will lose repayment incentivesyou have received or even go into default.GRACE PERIODSYour grace period begins the day after you graduate,withdraw, or drop below half-time enrollment. If youre-enroll in school at least half-time before the end ofyour grace period, you will receive the full 6-monthgrace period when you graduate or withdraw fromschool. During the grace period, you are not requiredto make loan repayments.RESERVISTS CALLED TO ACTIVE DUTYIf you are called up for military service for more than30 days, notify the Direct Loan Service Center† of yourstatus, so loan accommodations can be made.<strong>Spring</strong> <strong>2011</strong>www.sunyorange.edu27