The Norwegian Code of Practice for Corporate Governance - Statoil

The Norwegian Code of Practice for Corporate Governance - Statoil

The Norwegian Code of Practice for Corporate Governance - Statoil

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

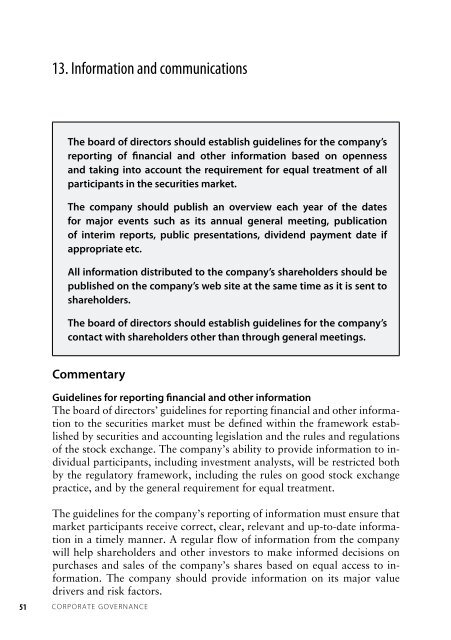

13. In<strong>for</strong>mation and communications<strong>The</strong> board <strong>of</strong> directors should establish guidelines <strong>for</strong> the company’sreporting <strong>of</strong> financial and other in<strong>for</strong>mation based on opennessand taking into account the requirement <strong>for</strong> equal treatment <strong>of</strong> allparticipants in the securities market.<strong>The</strong> company should publish an overview each year <strong>of</strong> the dates<strong>for</strong> major events such as its annual general meeting, publication<strong>of</strong> interim reports, public presentations, dividend payment date ifappropriate etc.All in<strong>for</strong>mation distributed to the company’s shareholders should bepublished on the company’s web site at the same time as it is sent toshareholders.<strong>The</strong> board <strong>of</strong> directors should establish guidelines <strong>for</strong> the company’scontact with shareholders other than through general meetings.CommentaryGuidelines <strong>for</strong> reporting financial and other in<strong>for</strong>mation<strong>The</strong> board <strong>of</strong> directors’ guidelines <strong>for</strong> reporting financial and other in<strong>for</strong>mationto the securities market must be defined within the framework establishedby securities and accounting legislation and the rules and regulations<strong>of</strong> the stock exchange. <strong>The</strong> company’s ability to provide in<strong>for</strong>mation to individualparticipants, including investment analysts, will be restricted bothby the regulatory framework, including the rules on good stock exchangepractice, and by the general requirement <strong>for</strong> equal treatment.<strong>The</strong> guidelines <strong>for</strong> the company’s reporting <strong>of</strong> in<strong>for</strong>mation must ensure thatmarket participants receive correct, clear, relevant and up-to-date in<strong>for</strong>mationin a timely manner. A regular flow <strong>of</strong> in<strong>for</strong>mation from the companywill help shareholders and other investors to make in<strong>for</strong>med decisions onpurchases and sales <strong>of</strong> the company’s shares based on equal access to in<strong>for</strong>mation.<strong>The</strong> company should provide in<strong>for</strong>mation on its major valuedrivers and risk factors.51 CORPORATE GOVERNANCE