1 CHAPTER 1: INTRODUCTION 1.0 Chapter ... - DSpace@UM

1 CHAPTER 1: INTRODUCTION 1.0 Chapter ... - DSpace@UM

1 CHAPTER 1: INTRODUCTION 1.0 Chapter ... - DSpace@UM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

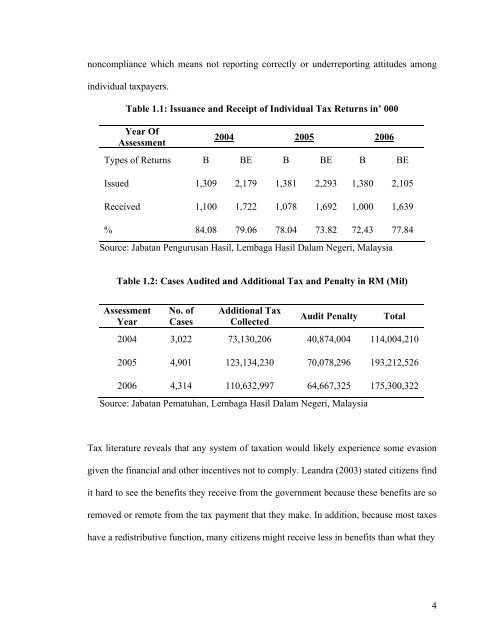

noncompliance which means not reporting correctly or underreporting attitudes amongindividual taxpayers.Table 1.1: Issuance and Receipt of Individual Tax Returns in’ 000Year OfAssessment2004 2005 2006Types of Returns B BE B BE B BEIssued 1,309 2,179 1,381 2,293 1,380 2,105Received 1,100 1,722 1,078 1,692 1,000 1,639% 84.08 79.06 78.04 73.82 72.43 77.84Source: Jabatan Pengurusan Hasil, Lembaga Hasil Dalam Negeri, MalaysiaTable 1.2: Cases Audited and Additional Tax and Penalty in RM (Mil)AssessmentYearNo. ofCasesAdditional TaxCollectedAudit PenaltySource: Jabatan Pematuhan, Lembaga Hasil Dalam Negeri, MalaysiaTotal2004 3,022 73,130,206 40,874,004 114,004,2102005 4,901 123,134,230 70,078,296 193,212,5262006 4,314 110,632,997 64,667,325 175,300,322Tax literature reveals that any system of taxation would likely experience some evasiongiven the financial and other incentives not to comply. Leandra (2003) stated citizens findit hard to see the benefits they receive from the government because these benefits are soremoved or remote from the tax payment that they make. In addition, because most taxeshave a redistributive function, many citizens might receive less in benefits than what they4