1 CHAPTER 1: INTRODUCTION 1.0 Chapter ... - DSpace@UM

1 CHAPTER 1: INTRODUCTION 1.0 Chapter ... - DSpace@UM

1 CHAPTER 1: INTRODUCTION 1.0 Chapter ... - DSpace@UM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

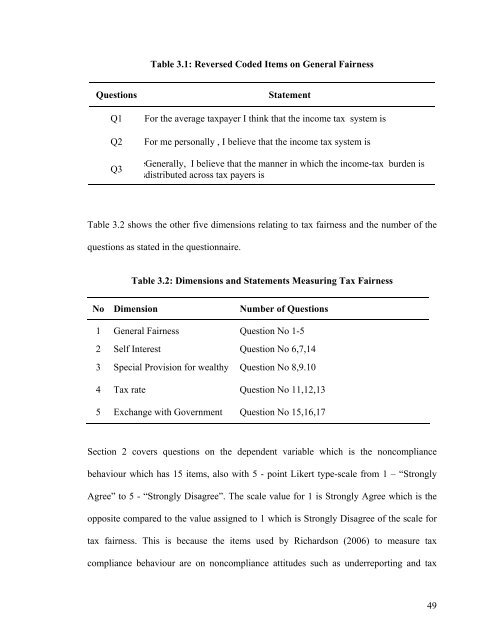

Table 3.1: Reversed Coded Items on General FairnessQuestionsQ1Q2Q3StatementFor the average taxpayer I think that the income tax system isFor me personally , I believe that the income tax system iseGenerally, I believe that the manner in which the income-tax burden issdistributed across tax payers isTable 3.2 shows the other five dimensions relating to tax fairness and the number of thequestions as stated in the questionnaire.Table 3.2: Dimensions and Statements Measuring Tax FairnessNo DimensionNumber of Questions1 General Fairness Question No 1-52 Self Interest Question No 6,7,143 Special Provision for wealthy Question No 8,9.104 Tax rate Question No 11,12,135 Exchange with Government Question No 15,16,17Section 2 covers questions on the dependent variable which is the noncompliancebehaviour which has 15 items, also with 5 - point Likert type-scale from 1 – “StronglyAgree” to 5 - “Strongly Disagree”. The scale value for 1 is Strongly Agree which is theopposite compared to the value assigned to 1 which is Strongly Disagree of the scale fortax fairness. This is because the items used by Richardson (2006) to measure taxcompliance behaviour are on noncompliance attitudes such as underreporting and tax49