Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

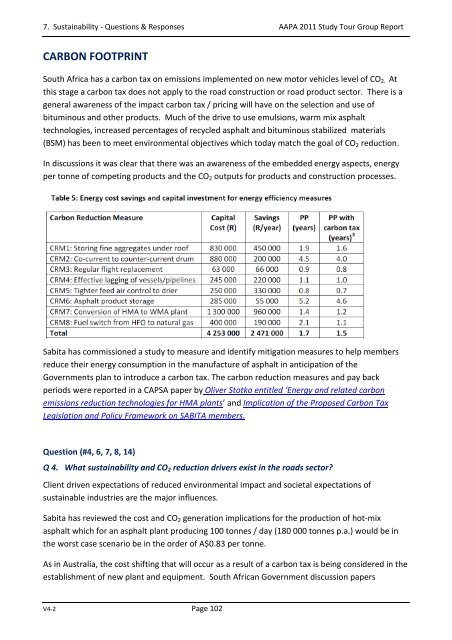

7. Sustainability - Questions & Responses <strong>AAPA</strong> <strong>2011</strong> <strong>Study</strong> <strong>Tour</strong> Group ReportCARBON FOOTPRINTSouth Africa has a carbon tax on emissions implemented on new motor vehicles level of CO 2. Atthis stage a carbon tax does not apply to the road construction or road product sector. There is ageneral awareness of the impact carbon tax / pricing will have on the selection and use ofbituminous and other products. Much of the drive to use emulsions, warm mix asphalttechnologies, increased percentages of recycled asphalt and bituminous stabilized materials(BSM) has been to meet environmental objectives which today match the goal of CO 2 reduction.In discussions it was clear that there was an awareness of the embedded energy aspects, energyper tonne of competing products and the CO 2 outputs for products and construction processes.Sabita has commissioned a study to measure and identify mitigation measures to help membersreduce their energy consumption in the manufacture of asphalt in anticipation of theGovernments plan to introduce a carbon tax. The carbon reduction measures and pay backperiods were reported in a CAPSA paper by Oliver Stotko entitled ‘Energy and related carbonemissions reduction technologies for HMA plants’ and Implication of the Proposed Carbon TaxLegislation and Policy Framework on SABITA members.Question (#4, 6, 7, 8, 14)Q 4. What sustainability and CO 2 reduction drivers exist in the roads sector?Client driven expectations of reduced environmental impact and societal expectations ofsustainable industries are the major influences.Sabita has reviewed the cost and CO 2 generation implications for the production of hot-mixasphalt which for an asphalt plant producing 100 tonnes / day (180 000 tonnes p.a.) would be inthe worst case scenario be in the order of A$0.83 per tonne.As in Australia, the cost shifting that will occur as a result of a carbon tax is being considered in theestablishment of new plant and equipment. South African Government discussion papersV4-2 Page 102