ANNUAL REPORT 2009 - Saab

ANNUAL REPORT 2009 - Saab

ANNUAL REPORT 2009 - Saab

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

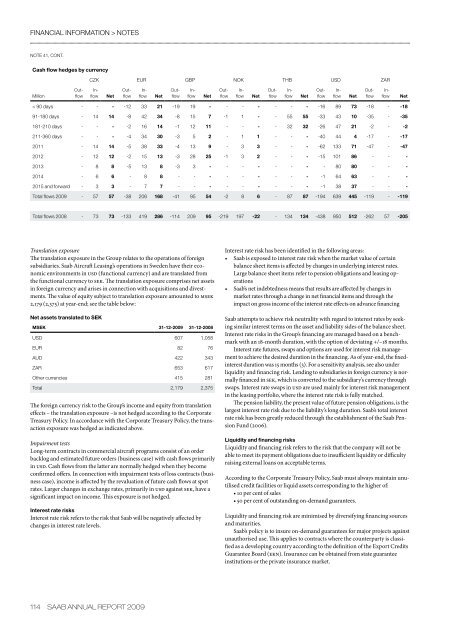

financial information > notesNote 41, cont.Cash flow hedges by currencyCZK EUR GBP NOK THB USD ZARMillionNetNetNetNetNetNetOutflowInflowOutflowInflowOutflowInflowOutflowInflowOutflowInflowOutflowInflowOutflowInflowNet< 90 days - - - -12 33 21 -19 19 - - - - - - - -16 89 73 -18 - -1891-180 days - 14 14 -8 42 34 -8 15 7 -1 1 - - 55 55 -33 43 10 -35 - -35181-210 days - - - -2 16 14 -1 12 11 - - - - 32 32 -26 47 21 -2 - -2211-360 days - - - -4 34 30 -3 5 2 - 1 1 - - - -40 44 4 -17 - -172011 - 14 14 -5 38 33 -4 13 9 - 3 3 - - - -62 133 71 -47 - -472012 - 12 12 -2 15 13 -3 28 25 -1 3 2 - - - -15 101 86 - - -2013 - 8 8 -5 13 8 -3 3 - - - - - - - - 80 80 - - -2014 - 6 6 - 8 8 - - - - - - - - - -1 64 63 - - -2015 and forward - 3 3 - 7 7 - - - - - - - - - -1 38 37 - - -Total flows <strong>2009</strong> - 57 57 -38 206 168 -41 95 54 -2 8 6 - 87 87 -194 639 445 -119 - -119Total flows 2008 - 73 73 -133 419 286 -114 209 95 -219 197 -22 - 134 134 -438 950 512 -262 57 -205Translation exposureThe translation exposure in the Group relates to the operations of foreignsubsidiaries. <strong>Saab</strong> Aircraft Leasing’s operations in Sweden have their economicenvironments in usd (functional currency) and are translated fromthe functional currency to sek. The translation exposure comprises net assetsin foreign currency and arises in connection with acquisitions and divestments.The value of equity subject to translation exposure amounted to msek2,179 (2,375) at year-end; see the table below:Net assets translated to SEKMSEK 31-12-<strong>2009</strong> 31-12-2008USD 607 1,058EUR 82 76AUD 422 343ZAR 653 617Other currencies 415 281Total 2,179 2,375The foreign currency risk to the Group’s income and equity from translationeffects – the translation exposure –is not hedged according to the CorporateTreasury Policy. In accordance with the Corporate Treasury Policy, the transactionexposure was hedged as indicated above.Impairment testsLong-term contracts in commercial aircraft programs consist of an orderbacklog and estimated future orders (business case) with cash flows primarilyin usd. Cash flows from the latter are normally hedged when they becomeconfirmed offers. In connection with impairment tests of loss contracts (businesscase), income is affected by the revaluation of future cash flows at spotrates. Larger changes in exchange rates, primarily in usd against sek, have asignificant impact on income. This exposure is not hedged.Interest rate risksInterest rate risk refers to the risk that <strong>Saab</strong> will be negatively affected bychanges in interest rate levels.Interest rate risk has been identified in the following areas:• <strong>Saab</strong> is exposed to interest rate risk when the market value of certainbalance sheet items is affected by changes in underlying interest rates.Large balance sheet items refer to pension obligations and leasing operations• <strong>Saab</strong>’s net indebtedness means that results are affected by changes inmarket rates through a change in net financial items and through theimpact on gross income of the interest rate effects on advance financing<strong>Saab</strong> attempts to achieve risk neutrality with regard to interest rates by seekingsimilar interest terms on the asset and liability sides of the balance sheet.Interest rate risks in the Group’s financing are managed based on a benchmarkwith an 18-month duration, with the option of deviating +/–18 months.Interest rate futures, swaps and options are used for interest risk managementto achieve the desired duration in the financing. As of year-end, the fixedinterestduration was 15 months (3). For a sensitivity analysis, see also underliquidity and financing risk. Lending to subsidiaries in foreign currency is normallyfinanced in sek, which is converted to the subsidiary’s currency throughswaps. Interest rate swaps in usd are used mainly for interest risk managementin the leasing portfolio, where the interest rate risk is fully matched.The pension liability, the present value of future pension obligations, is thelargest interest rate risk due to the liability’s long duration. <strong>Saab</strong>’s total interestrate risk has been greatly reduced through the establishment of the <strong>Saab</strong> PensionFund (2006).Liquidity and financing risksLiquidity and financing risk refers to the risk that the company will not beable to meet its payment obligations due to insufficient liquidity or difficultyraising external loans on acceptable terms.According to the Corporate Treasury Policy, <strong>Saab</strong> must always maintain unutilisedcredit facilities or liquid assets corresponding to the higher of:• 10 per cent of sales• 50 per cent of outstanding on-demand guarantees.Liquidity and financing risk are minimised by diversifying financing sourcesand maturities.<strong>Saab</strong>’s policy is to insure on-demand guarantees for major projects againstunauthorised use. This applies to contracts where the counterparty is classifiedas a developing country according to the definition of the Export CreditsGuarantee Board (ekn). Insurance can be obtained from state guaranteeinstitutions or the private insurance market.114 saab annual report <strong>2009</strong>

![Proposal long-term incentive programs [pdf] - Saab](https://img.yumpu.com/50411723/1/190x245/proposal-long-term-incentive-programs-pdf-saab.jpg?quality=85)