ANNUAL REPORT 2009 - Saab

ANNUAL REPORT 2009 - Saab

ANNUAL REPORT 2009 - Saab

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

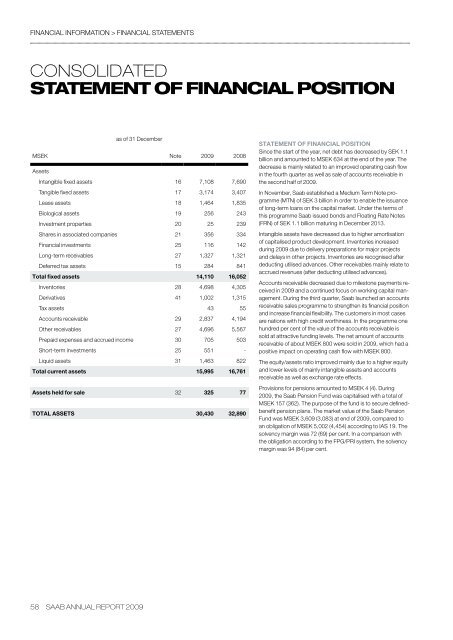

financial information > financial statementscONSOLIDATEDstatement of financial positionas of 31 DecemberMSEK Note <strong>2009</strong> 2008AssetsIntangible fixed assets 16 7,108 7,690Tangible fixed assets 17 3,174 3,407Lease assets 18 1,464 1,835Biological assets 19 256 243Investment properties 20 25 239Shares in associated companies 21 356 334Financial investments 25 116 142Long-term receivables 27 1,327 1,321Deferred tax assets 15 284 841Total fixed assets 14,110 16,052Inventories 28 4,698 4,305Derivatives 41 1,002 1,315Tax assets 43 55Accounts receivable 29 2,837 4,194Other receivables 27 4,696 5,567Prepaid expenses and accrued income 30 705 503Short-term investments 25 551 -Liquid assets 31 1,463 822Total current assets 15,995 16,761Assets held for sale 32 325 77TOTAL ASSETS 30,430 32,890statement of financial positionSince the start of the year, net debt has decreased by SEK 1.1billion and amounted to MSEK 634 at the end of the year. Thedecrease is mainly related to an improved operating cash flowin the fourth quarter as well as sale of accounts receivable inthe second half of <strong>2009</strong>.In November, <strong>Saab</strong> established a Medium Term Note programme(MTN) of SEK 3 billion in order to enable the issuanceof long-term loans on the capital market. Under the terms ofthis programme <strong>Saab</strong> issued bonds and Floating Rate Notes(FRN) of SEK 1.1 billion maturing in December 2013.Intangible assets have decreased due to higher amortisationof capitalised product development. Inventories increasedduring <strong>2009</strong> due to delivery preparations for major projectsand delays in other projects. Inventories are recognised afterdeducting utilised advances. Other receivables mainly relate toaccrued revenues (after deducting utilised advances).Accounts receivable decreased due to milestone payments receivedin <strong>2009</strong> and a continued focus on working capital management.During the third quarter, <strong>Saab</strong> launched an accountsreceivable sales programme to strengthen its financial positionand increase financial flexibility. The customers in most casesare nations with high credit worthiness. In the programme onehundred per cent of the value of the accounts receivable issold at attractive funding levels. The net amount of accountsreceivable of about MSEK 800 were sold in <strong>2009</strong>, which had apositive impact on operating cash flow with MSEK 800.The equity/assets ratio improved mainly due to a higher equityand lower levels of mainly intangible assets and accountsreceivable as well as exchange rate effects.Provisions for pensions amounted to MSEK 4 (4). During<strong>2009</strong>, the <strong>Saab</strong> Pension Fund was capitalised with a total ofMSEK 157 (362). The purpose of the fund is to secure definedbenefitpension plans. The market value of the <strong>Saab</strong> PensionFund was MSEK 3,609 (3,083) at end of <strong>2009</strong>, compared toan obligation of MSEK 5,002 (4,454) according to IAS 19. Thesolvency margin was 72 (69) per cent. In a comparison withthe obligation according to the FPG/PRI system, the solvencymargin was 94 (84) per cent.58 saab annual report <strong>2009</strong>

![Proposal long-term incentive programs [pdf] - Saab](https://img.yumpu.com/50411723/1/190x245/proposal-long-term-incentive-programs-pdf-saab.jpg?quality=85)