ANNUAL REPORT 2009 - Saab

ANNUAL REPORT 2009 - Saab

ANNUAL REPORT 2009 - Saab

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

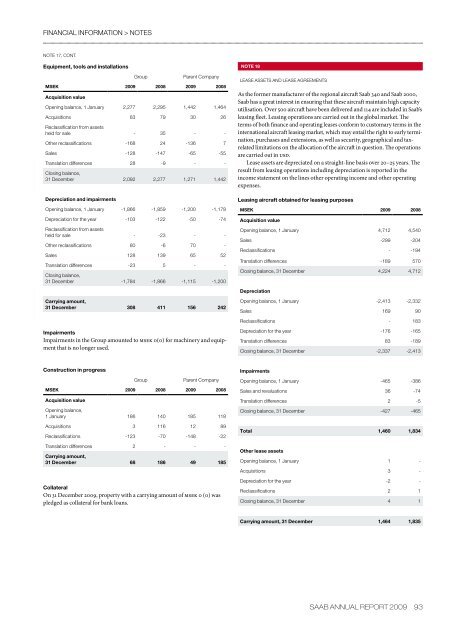

financial information > notesNote 17, cont.Equipment, tools and installationsGroupParent CompanyMSEK <strong>2009</strong> 2008 <strong>2009</strong> 2008Acquisition valueOpening balance, 1 January 2,277 2,295 1,442 1,464Acquisitions 83 79 30 26Reclassification from assetsheld for sale - 35 - -Other reclassifications -168 24 -136 7Sales -128 -147 -65 -55Translation differences 28 -9 - -Closing balance,31 December 2,092 2,277 1,271 1,442Depreciation and impairmentsOpening balance, 1 January -1,866 -1,859 -1,200 -1,178Depreciation for the year -103 -122 -50 -74Reclassification from assetsheld for sale - -23 - -Other reclassifications 80 -6 70 -Sales 128 139 65 52Translation differences -23 5 - -Closing balance,31 December -1,784 -1,866 -1,115 -1,200Carrying amount,31 December 308 411 156 242ImpairmentsImpairments in the Group amounted to msek 0(0) for machinery and equipmentthat is no longer used.NOTe 18LEASE ASSETS AND LEASE agreementsAs the former manufacturer of the regional aircraft <strong>Saab</strong> 340 and <strong>Saab</strong> 2000,<strong>Saab</strong> has a great interest in ensuring that these aircraft maintain high capacityutilisation. Over 500 aircraft have been delivered and 114 are included in <strong>Saab</strong>’sleasing fleet. Leasing operations are carried out in the global market. Theterms of both finance and operating leases conform to customary terms in theinternational aircraft leasing market, which may entail the right to early termination,purchases and extensions, as well as security, geographical and taxrelatedlimitations on the allocation of the aircraft in question. The operationsare carried out in usd.Lease assets are depreciated on a straight-line basis over 20–25 years. Theresult from leasing operations including depreciation is reported in theincome statement on the lines other operating income and other operatingexpenses.Leasing aircraft obtained for leasing purposesMSEK <strong>2009</strong> 2008Acquisition valueOpening balance, 1 January 4,712 4,540Sales -299 -204Reclassifications - -194Translation differences -189 570Closing balance, 31 December 4,224 4,712DepreciationOpening balance, 1 January -2,413 -2,332Sales 169 90Reclassifications - 183Depreciation for the year -176 -165Translation differences 83 -189Closing balance, 31 December -2,337 -2,413Construction in progressGroupParent CompanyMSEK <strong>2009</strong> 2008 <strong>2009</strong> 2008Acquisition valueOpening balance,1 January 186 140 185 118Acquisitions 3 116 12 89Reclassifications -123 -70 -148 -22Translation differences 2 - - -Carrying amount,31 December 68 186 49 185CollateralOn 31 December <strong>2009</strong>, property with a carrying amount of msek 0 (0) waspledged as collateral for bank loans.ImpairmentsOpening balance, 1 January -465 -386Sales and revaluations 36 -74Translation differences 2 -5Closing balance, 31 December -427 -465Total 1,460 1,834Other lease assetsOpening balance, 1 January 1 -Acquisitions 3 -Depreciation for the year -2 -Reclassifications 2 1Closing balance, 31 December 4 1Carrying amount, 31 December 1,464 1,835saab annual report <strong>2009</strong> 93

![Proposal long-term incentive programs [pdf] - Saab](https://img.yumpu.com/50411723/1/190x245/proposal-long-term-incentive-programs-pdf-saab.jpg?quality=85)