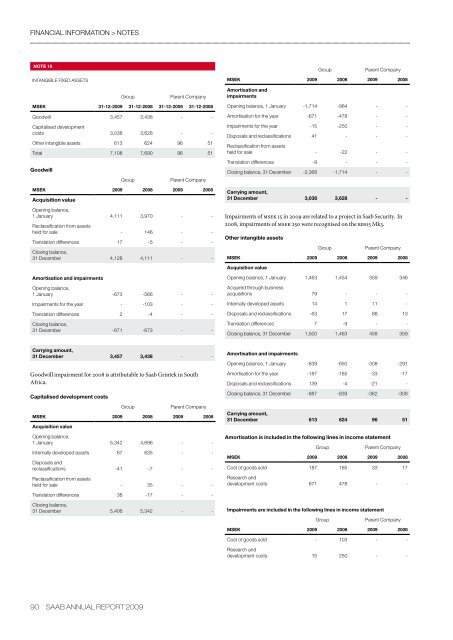

financial information > notesNOTE 16GroupParent CompanyINTANGIBLE FIXED ASSETSGroupParent CompanyMSEK 31-12-<strong>2009</strong> 31-12-2008 31-12-<strong>2009</strong> 31-12-2008Goodwill 3,457 3,438 - -Capitalised developmentcosts 3,038 3,628 - -Other intangible assets 613 624 96 51Total 7,108 7,690 96 51GoodwillGroupParent CompanyMSEK <strong>2009</strong> 2008 <strong>2009</strong> 2008Acquisition valueOpening balance,1 January 4,111 3,970 - -Reclassification from assetsheld for sale - 146 - -Translation differences 17 -5 - -Closing balance,31 December 4,128 4,111 - -Amortisation and impairmentsOpening balance,1 January -673 -566 - -Impairments for the year - -103 - -Translation differences 2 -4 - -Closing balance,31 December -671 -673 - -MSEK <strong>2009</strong> 2008 <strong>2009</strong> 2008Amortisation andimpairmentsOpening balance, 1 January -1,714 -964 - -Amortisation for the year -671 -478 - -Impairments for the year -15 -250 - -Disposals and reclassifications 41 - - -Reclassification from assetsheld for sale - -22 - -Translation differences -9 - - -Closing balance, 31 December -2,368 -1,714 - -Carrying amount,31 December 3,038 3,628 - -Impairments of msek 15 in <strong>2009</strong> are related to a project in <strong>Saab</strong> Security. In2008, impairments of msek 250 were recognised on the rbs15 Mk3.Other intangible assetsGroupParent CompanyMSEK <strong>2009</strong> 2008 <strong>2009</strong> 2008Acquisition valueOpening balance, 1 January 1,463 1,454 359 346Acquired through businessacquisitions 79 - - -Internally developed assets 14 1 11 -Disposals and reclassifications -63 17 88 13Translation differences 7 -9 - -Closing balance, 31 December 1,500 1,463 458 359Carrying amount,31 December 3,457 3,438 - -Goodwill impairment for 2008 is attributable to <strong>Saab</strong> Grintek in SouthAfrica.Capitalised development costsGroupParent CompanyMSEK <strong>2009</strong> 2008 <strong>2009</strong> 2008Acquisition valueOpening balance,1 January 5,342 4,696 - -Internally developed assets 67 635 - -Disposals andreclassifications -41 -7 - -Reclassification from assetsheld for sale - 35 - -Translation differences 38 -17 - -Closing balance,31 December 5,406 5,342 - -Amortisation and impairmentsOpening balance, 1 January -839 -650 -308 -291Amortisation for the year -187 -185 -33 -17Disposals and reclassifications 139 -4 -21 -Closing balance, 31 December -887 -839 -362 -308Carrying amount,31 December 613 624 96 51Amortisation is included in the following lines in income statementGroupParent CompanyMSEK <strong>2009</strong> 2008 <strong>2009</strong> 2008Cost of goods sold 187 185 33 17Research anddevelopment costs 671 478 - -Impairments are included in the following lines in income statementGroupParent CompanyMSEK <strong>2009</strong> 2008 <strong>2009</strong> 2008Cost of goods sold - 103 - -Research anddevelopment costs 15 250 - -90 saab annual report <strong>2009</strong>

financial information > notesNote 16, cont.Development costsCapitalised development costs are amortised over the estimated productionvolume or period of use, up to a maximum of 5 years, with the exception ofacquired development costs, where the maximum period of use is 10 years.The production volume or period of use is set using projected future salesaccording to a business plan based on identified business opportunities. Thesignificant items in the total capitalisation are development costs for radarand sensors, electronic warfare systems, the export version of Gripen and theanti-ship missile rbs15 mk3.Development costs are capitalised only in the consolidated accounts. Inlegal units, all costs for development work are expensed, which means that theParent Company does not report any capitalised costs for development work.Other intangible fixed assetsAmortisation is recognised through profit or loss over the estimated periodsof use for intangible fixed assets, i.e., 5 to 10 years.Significant items in the carrying amount are attributable to the acquisitionof Ericsson Microwave Systems and relate to expenses incurred for customerrelations and values in the order backlog. Of the carrying amount,msek 613, msek 504 is attributable to acquired values and msek 109 is internallydeveloped assets.Impairment tests for goodwillGoodwill attributable to cash-generating units is tested for impairmentannually or when there is an indication of an impairment loss. Goodwill isnot amortised.In connection with business combinations, goodwill is allocated to thecash-generating units that are expected to obtain future economic benefits inthe form, for example, of synergies as a result of the acquisition. In caseswhere separate cash-generating units cannot be identified, goodwill is allocatedto the lowest level at which the operation and its assets are controlledand managed internally, generally by business unit.The following cash-generating units have significant recognised goodwillvalues in relation to the Group’s total recognised goodwill value. Impairmenttesting on goodwill has been done for every cash-generating unit.Variables used to calculate value in useVolume/growthGrowth in the cash-generating units’ business plans is based on <strong>Saab</strong>’s expectationswith regard to the market’s development in each market area. The firstfive years are based on the five-year business plan formulated by Group Managementand approved by the Board. For cash flows in and after five years, theannual growth rate has been assumed to be 0 per cent.Operating marginThe operating margin is comprised of the units’ operating income afterdepreciation and amortisation. The units’ operating margin is calculatedagainst the backdrop of historical results and <strong>Saab</strong>’s expectations with regardto the future development of markets where the units are active. The businessunits <strong>Saab</strong> Bofors Dynamics, <strong>Saab</strong> Microwave Systems, <strong>Saab</strong> Systemsand <strong>Saab</strong> Avitronics have a substantial order backlog of projects that stretchover a number of years. The risks and opportunities affecting the operatingmargin are managed through continuous final cost forecasts for all significantprojects.Capitalised development costsIn the five-year business plans, consideration is given to additional investmentsin development considered necessary for certain units to reach theirgrowth targets in their respective markets.Discount rateThe discount rates are based on the weighted average cost of capital (wacc).The wacc rate that is used is based on a risk-free rate of interest in five yearsadjusted for operational and market risks. The discount rate is in line with theexternal requirements placed on <strong>Saab</strong> and similar companies in the market.All units have sales of defence materiel, unique systems, products and supportsolutions in the international market as their primary activity, and theirbusiness risk in this respect is considered equivalent. However, units with asignificant share of the business plan’s invoicing in the order backlog havebeen discounted at an interest rate that is slightly lower than the units with ashort order backlog. The following discount rates have been used (pre-tax):MSEK 31-12-<strong>2009</strong> 31-12-2008<strong>Saab</strong> Microwave Systems 1,538 1,538<strong>Saab</strong> Bofors Dynamics 487 487<strong>Saab</strong> Avitronics 442 424<strong>Saab</strong> Systems 389 390<strong>Saab</strong> Aerotech 240 240<strong>Saab</strong> Security 112 112Combitech 159 159<strong>Saab</strong> Underwater Systems 74 72Units without significant goodwill values, aggregate 16 16Total goodwill 3,457 3,438Impairment testing for cash-generating units is based on the calculation ofvalue in use. This value is based on discounted cash flow forecasts accordingto the units’ business plans.Per centDiscount rate pre tax (WACC)<strong>Saab</strong> Microwave Systems 11<strong>Saab</strong> Bofors Dynamics 11<strong>Saab</strong> Avitronics 11<strong>Saab</strong> Systems 11<strong>Saab</strong> Aerotech 13<strong>Saab</strong> Security 13Combitech 13<strong>Saab</strong> Underwater Systems 13Sensitivity analysisManagement believes that reasonable possible changes in the above variableswould not have such a large impact that any individually would reduce therecoverable amount to less than the carrying amount.saab annual report <strong>2009</strong> 91

![Proposal long-term incentive programs [pdf] - Saab](https://img.yumpu.com/50411723/1/190x245/proposal-long-term-incentive-programs-pdf-saab.jpg?quality=85)