ANNUAL REPORT 2009 - Saab

ANNUAL REPORT 2009 - Saab

ANNUAL REPORT 2009 - Saab

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

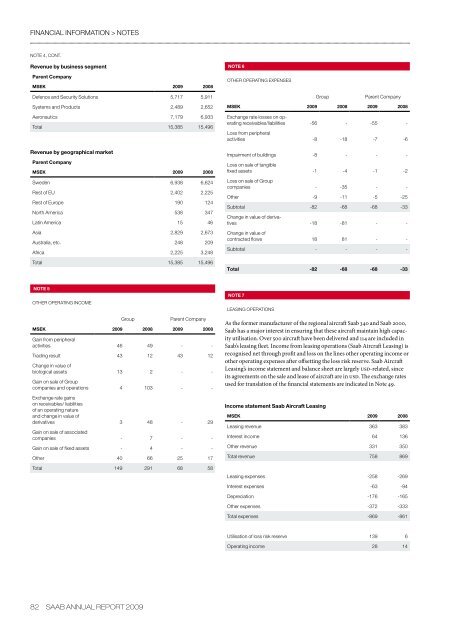

financial information > notesNote 4, cont.Revenue by business segmentParent CompanyMSEK <strong>2009</strong> 2008NOTE 6OTHER OPERATING EXPENSESDefence and Security Solutions 5,717 5,911GroupParent CompanySystems and Products 2,489 2,652Aeronautics 7,179 6,933Total 15,385 15,496Revenue by geographical marketParent CompanyMSEK <strong>2009</strong> 2008Sweden 6,938 6,624Rest of EU 2,402 2,225Rest of Europe 190 124North America 538 347Latin America 15 46Asia 2,829 2,673Australia, etc. 248 209Africa 2,225 3,248Total 15,385 15,496MSEK <strong>2009</strong> 2008 <strong>2009</strong> 2008Exchange rate losses on operatingreceivables/liabilities -56 - -55 -Loss from peripheralactivities -8 -18 -7 -6Impairment of buildings -8 - - -Loss on sale of tangiblefixed assets -1 -4 -1 -2Loss on sale of Groupcompanies - -35 - -Other -9 -11 -5 -25Subtotal -82 -68 -68 -33Change in value of derivatives-18 -81 - -Change in value ofcontracted flows 18 81 - -Subtotal - - - -Total -82 -68 -68 -33NOTE 5OTHER OPERATING INCOMEGroupParent CompanyMSEK <strong>2009</strong> 2008 <strong>2009</strong> 2008Gain from peripheralactivities 46 49 - -Trading result 43 12 43 12Change in value ofbiological assets 13 2 - -Gain on sale of Groupcompanies and operations 4 103 - -Exchange rate gainson receivables/ liabilitiesof an operating natureand change in value ofderivatives 3 48 - 29Gain on sale of associatedcompanies - 7 - -Gain on sale of fixed assets - 4 - -Other 40 66 25 17Total 149 291 68 58NOTE 7LEASING OPERATIONSAs the former manufacturer of the regional aircraft <strong>Saab</strong> 340 and <strong>Saab</strong> 2000,<strong>Saab</strong> has a major interest in ensuring that these aircraft maintain high capacityutilisation. Over 500 aircraft have been delivered and 114 are included in<strong>Saab</strong>’s leasing fleet. Income from leasing operations (<strong>Saab</strong> Aircraft Leasing) isrecognised net through profit and loss on the lines other operating income orother operating expenses after offsetting the loss risk reserve. <strong>Saab</strong> AircraftLeasing’s income statement and balance sheet are largely usd-related, sinceits agreements on the sale and lease of aircraft are in usd. The exchange ratesused for translation of the financial statements are indicated in Note 49.Income statement <strong>Saab</strong> Aircraft LeasingMSEK <strong>2009</strong> 2008Leasing revenue 363 383Interest income 64 136Other revenue 331 350Total revenue 758 869Leasing expenses -258 -269Interest expenses -63 -94Depreciation -176 -165Other expenses -372 -333Total expenses -869 -861Utilisation of loss risk reserve 139 6Operating income 28 1482 saab annual report <strong>2009</strong>

![Proposal long-term incentive programs [pdf] - Saab](https://img.yumpu.com/50411723/1/190x245/proposal-long-term-incentive-programs-pdf-saab.jpg?quality=85)