Accounting andvaluation principles● 60 <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>1999</strong><strong>Annual</strong> Accounts Act, new developments,principles of consolidation etc.The <strong>Annual</strong> <strong>Report</strong> has been prepared in compliancewith the provisions of the Swedish <strong>Annual</strong>Accounts Act. It has been adapted to the industrywideprinciples stated by the Swedish ConstructionFederation. The <strong>Annual</strong> <strong>Report</strong> complies with theFederation’s recommendation that revenue recognitionin contracting operations take place on apercentage of completion basis.NEW DEVELOPMENTSThe following changes have occurred:– acquired and divested companies are consolidatedor deconsolidated, respectively, from thedate of acquisition/divestment,– remuneration to auditors is stated (see Note 13),– the cash flow statement is drawn up in compliancewith Recommendation No. 7 of theSwedish Financial Accounting StandardsCouncil, “<strong>Report</strong>ing of Cash Flows,”– receivables and liabilities as well as the accountsof foreign subsidiaries are reported in theaccounts according to Recommendation No. 8of the Swedish Financial Accounting StandardsCouncil, “<strong>Report</strong>ing of Effects of Changes inExchange Rates” and– comparative figures have been restated accordingto the new principles, except where specificallyotherwise stated.PRINCIPLES OF CONSOLIDATIONThe consolidated financial statements encompassthe accounts of the Parent Company and thosecompanies in which the Parent Company, directlyor indirectly, has a decisive influence. This normallyrequires ownership of more than 50 percentof the voting power of all participations. In caseswhere holdings are intended for divestment withina short time after acquisition, the company isnot consolidated.<strong>Skanska</strong> has applied Recommendation No. 1of the Swedish Financial Accounting StandardsCouncil in drawing up its consolidated financialstatements. Shareholdings in Group companieshave been eliminated according to the purchasemethod of accounting.The principles for the translation of the financialstatements of foreign subsidiaries complywith Recommendation No. 8 of the SwedishFinancial Accounting Standards Council,“<strong>Report</strong>ing of Effects of Changes in ExchangeRates.” In the consolidated financial statements,the income statements of foreign subsidiarieshave been included at the average exchange ratefor the year and their balance sheets at the yearendexchange rate (current method). For somereal estate companies operating in countrieswhere the functional currency is other than thelocal currency, translation has occurred from financialstatements prepared in the functional currency.The change in initial shareholders’ equitydue to the change in exchange rate from prioryears is reported as an exchange rate difference directlyunder shareholders’ equity. In cases where aloan corresponding to the investment has beentaken out for hedging purposes, the exchange rateadjustment in the loan taking into account tax effectshas been reported directly under shareholders’equity. <strong>Skanska</strong> has applied the transition rulein the recommendation on accumulated exchangerate differences reported before <strong>1999</strong>.ASSOCIATED COMPANIESAssociated companies are defined as companies inwhich <strong>Skanska</strong>’s share of voting power amountsto a minimum of 20 percent and a maximum of50 percent, and where ownership is one elementof a long-term connection. Associated companiesare normally reported according to the equitymethod of accounting. Because the reporting ofholdings in partly owned partnerships and limitedpartnerships, including foreign counterparts,usually already complies largely with the equitymethod in the accounts of each owner company,no adjustment occurs when drawing up the consolidatedaccounts.CONSORTIA (JOINT VENTURES)Companies that were established to carry out specificcontracting projects together with other constructioncompanies are consolidated accordingto the proportional method of accounting.RECEIVABLES AND LIABILITIES IN FOREIGNCURRENCIESReceivables and liabilities in foreign currencieshave been valued at the exchange rate prevailingon the balance sheet date or the exchange rate accordingto forward contracts.OFFSETTING OF BALANCE SHEET ITEMSThe offsetting of receivables against liabilities occursonly in cases where legislation permits offsettingof payments. The offsetting of deferred tax liabilitiesin one company against deferred taxclaims in another company presupposes, in additionto matching time periods, that the companiesare entitled to such tax-related equalizations.PRO FORMA ACCOUNTSBecause of the distribution of Drott and the reclassificationof JM from a subsidiary to an associatedcompany, there is no comparability withthe official consolidated financial statements for1997. Comparative figures are therefore based onpro forma accounts for 1997, based on the assumptionthat the distribution of Drott and thereclassification of JM had taken place on January 1,1997.PUBLISHED ANNUAL REPORTThis published <strong>Annual</strong> <strong>Report</strong> presents figures onshares in various companies and on the numberof employees and wages and salaries in abbreviatedform. Complete figures are found in the versionof the <strong>Annual</strong> <strong>Report</strong> submitted to theSwedish Patent and Registration Office.Income statementNET SALESThe year’s project revenues, deliveries of materialsand merchandise, sales of investment properties,rental revenues and other operating revenues thatare not reported separately on their own line arereported as net sales.Project revenues are reported according to thepercentage of completion method, in compliancewith the industry-wide recommendation of theSwedish Construction Federation on revenuerecognition of contracting assignments. Thismeans that operating income is reported successivelyas a project progresses over time, instead ofbeing listed as a balance sheet item until the projectis completed and a final financial settlementwith the client has been reached.The sale of investment and development propertiesis normally reported as a revenue item inthe year when a binding agreement on the sale isreached.CONSTRUCTION, MANUFACTURING AND PROPERTYMANAGEMENT EXPENSESConstruction, manufacturing and property managementexpenses include direct and indirectmanufacturing expenses, loss provisions, bad debtlosses, warranty expenses and real estate taxes.These expenses include depreciation on fixed assetsused for construction, manufacturing andproperty management. <strong>Skanska</strong> applies straightlinedepreciation based on the estimated servicelife of the assets.SELLING AND ADMINISTRATIVE EXPENSESIn conformity with the industry-wide recommendationfrom the Swedish ConstructionFederation, selling and administrative expensesare reported as one item. This includes customaryadministrative expenses, technical expenses andselling expenses, but also depreciation of goodwilland of machinery and equipment that have beenused for sales and administration. Depreciation ofgoodwill has been based on individual examination(10–20 percent annually on acquisition cost).For goodwill etc. that arose from the acquisitionof Skåne-Gripen, a depreciation rate of 5 percentis applied.EXPENSES FOR OPERATING LEASESInformation on expenses for operating leases includescontracts with remaining fees of at leastSEK 5 M.RESEARCH AND DEVELOPMENT EXPENSESResearch and development expenses are not capitalized,but instead are reported in the same yearthat the expenses occur.SHARE OF INCOME IN ASSOCIATED COMPANIESShare of income in associated companies is apportionedin the consolidated income statementamong “Operating income” (share of income afterfinancial items), “Taxes” and “Minority interests.”

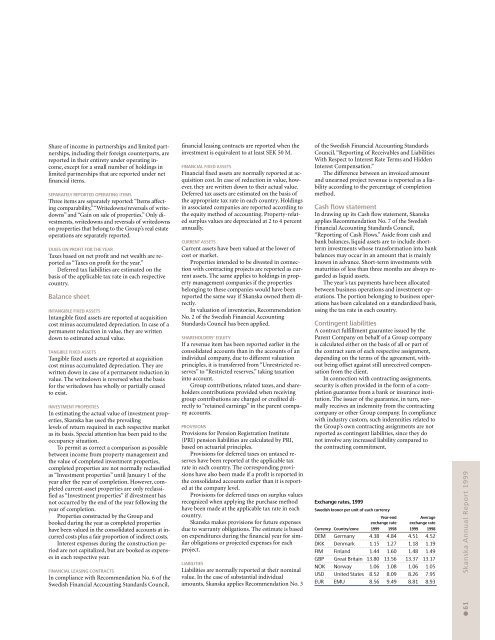

Share of income in partnerships and limited partnerships,including their foreign counterparts, arereported in their entirety under operating income,except for a small number of holdings inlimited partnerships that are reported under netfinancial items.SEPARATELY REPORTED OPERATING ITEMSThree items are separately reported: “Items affectingcomparability,”“Writedowns/reversals of writedowns”and “Gain on sale of properties.” Only divestments,writedowns and reversals of writedownson properties that belong to the Group’s real estateoperations are separately reported.TAXES ON PROFIT FOR THE YEARTaxes based on net profit and net wealth are reportedas “Taxes on profit for the year.”Deferred tax liabilities are estimated on thebasis of the applicable tax rate in each respectivecountry.Balance sheetINTANGIBLE FIXED ASSETSIntangible fixed assets are reported at acquisitioncost minus accumulated depreciation. In case of apermanent reduction in value, they are writtendown to estimated actual value.TANGIBLE FIXED ASSETSTangible fixed assets are reported at acquisitioncost minus accumulated depreciation. They arewritten down in case of a permanent reduction invalue. The writedown is reversed when the basisfor the writedown has wholly or partially ceasedto exist.INVESTMENT PROPERTIESIn estimating the actual value of investment properties,<strong>Skanska</strong> has used the prevailinglevels of return required in each respective marketas its basis. Special attention has been paid to theoccupancy situation.To permit as correct a comparison as possiblebetween income from property management andthe value of completed investment properties,completed properties are not normally reclassifiedas “Investment properties” until January 1 of theyear after the year of completion. However, completedcurrent-asset properties are only reclassifiedas “Investment properties” if divestment hasnot occurred by the end of the year following theyear of completion.Properties constructed by the Group andbooked during the year as completed propertieshave been valued in the consolidated accounts at incurredcosts plus a fair proportion of indirect costs.Interest expenses during the construction periodare not capitalized, but are booked as expensesin each respective year.FINANCIAL LEASING CONTRACTSIn compliance with Recommendation No. 6 of theSwedish Financial Accounting Standards Council,financial leasing contracts are reported when theinvestment is equivalent to at least SEK 50 M.FINANCIAL FIXED ASSETSFinancial fixed assets are normally reported at acquisitioncost. In case of reduction in value, however,they are written down to their actual value.Deferred tax assets are estimated on the basis ofthe appropriate tax rate in each country. Holdingsin associated companies are reported according tothe equity method of accounting. Property-relatedsurplus values are depreciated at 2 to 4 percentannually.CURRENT ASSETSCurrent assets have been valued at the lower ofcost or market.Properties intended to be divested in connectionwith contracting projects are reported as currentassets. The same applies to holdings in propertymanagement companies if the propertiesbelonging to these companies would have beenreported the same way if <strong>Skanska</strong> owned them directly.In valuation of inventories, RecommendationNo. 2 of the Swedish Financial AccountingStandards Council has been applied.SHAREHOLDERS’ EQUITYIf a revenue item has been reported earlier in theconsolidated accounts than in the accounts of anindividual company, due to different valuationprinciples, it is transferred from “Unrestricted reserves”to “Restricted reserves,” taking taxationinto account.Group contributions, related taxes, and shareholderscontributions provided when receivinggroup contributions are charged or credited directlyto “retained earnings” in the parent companyaccounts.PROVISIONSProvisions for Pension Registration Institute(PRI) pension liabilities are calculated by PRI,based on actuarial principles.Provisions for deferred taxes on untaxed reserveshave been reported at the applicable taxrate in each country. The corresponding provisionshave also been made if a profit is reported inthe consolidated accounts earlier than it is reportedat the company level.Provisions for deferred taxes on surplus valuesrecognized when applying the purchase methodhave been made at the applicable tax rate in eachcountry.<strong>Skanska</strong> makes provisions for future expensesdue to warranty obligations. The estimate is basedon expenditures during the financial year for similarobligations or projected expenses for eachproject.LIABILITIESLiabilities are normally reported at their nominalvalue. In the case of substantial individualamounts, <strong>Skanska</strong> applies Recommendation No. 3of the Swedish Financial Accounting StandardsCouncil, “<strong>Report</strong>ing of Receivables and LiabilitiesWith Respect to Interest Rate Terms and HiddenInterest Compensation.”The difference between an invoiced amountand unearned project revenue is reported as a liabilityaccording to the percentage of completionmethod.Cash flow statementIn drawing up its Cash flow statement, <strong>Skanska</strong>applies Recommendation No. 7 of the SwedishFinancial Accounting Standards Council,“<strong>Report</strong>ing of Cash Flows.” Aside from cash andbank balances, liquid assets are to include shortterminvestments whose transformation into bankbalances may occur in an amount that is mainlyknown in advance. Short-term investments withmaturities of less than three months are always regardedas liquid assets.The year’s tax payments have been allocatedbetween business operations and investment operations.The portion belonging to business operationshas been calculated on a standardized basis,using the tax rate in each country.Contingent liabilitiesA contract fulfillment guarantee issued by theParent Company on behalf of a Group companyis calculated either on the basis of all or part ofthe contract sum of each respective assignment,depending on the terms of the agreement, withoutbeing offset against still unreceived compensationfrom the client.In connection with contracting assignments,security is often provided in the form of a completionguarantee from a bank or insurance institution.The issuer of the guarantee, in turn, normallyreceives an indemnity from the contractingcompany or other Group company. In compliancewith industry custom, such indemnities related tothe Group’s own contracting assignments are notreported as contingent liabilities, since they donot involve any increased liability compared tothe contracting commitment.Exchange rates, <strong>1999</strong>Swedish kronor per unit of each currencyYear-endAverageexchange rate exchange rateCurrency Country/zone <strong>1999</strong> 1998 <strong>1999</strong> 1998DEM Germany 4.38 4.84 4.51 4.52DKK Denmark 1.15 1.27 1.18 1.19FIM Finland 1.44 1.60 1.48 1.49GBP Great Britain 13.80 13.56 13.37 13.17NOK Norway 1.06 1.08 1.06 1.05USD United States 8.52 8.09 8.26 7.95EUR EMU 8.56 9.49 8.81 8.93● 61 <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>1999</strong>