Annual Report 1999 - Skanska

Annual Report 1999 - Skanska

Annual Report 1999 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

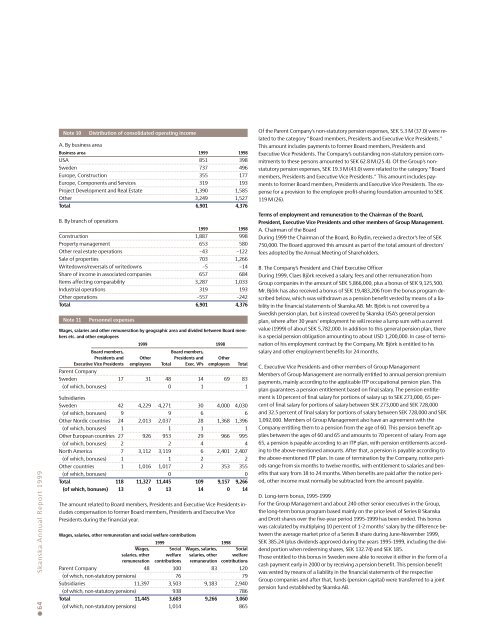

● 64 <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>1999</strong>Note 10Distribution of consolidated operating incomeA. By business areaBusiness area <strong>1999</strong> 1998USA 851 398Sweden 737 496Europe, Construction 355 177Europe, Components and Services 319 193Project Development and Real Estate 1,390 1,585Other 3,249 1,527Total 6,901 4,376B. By branch of operations<strong>1999</strong> 1998Construction 1,887 998Property management 653 580Other real estate operations –43 –122Sale of properties 703 1,266Writedowns/reversals of writedowns –5 –14Share of income in associated companies 657 684Items affecting comparability 3,287 1,033Industrial operations 319 193Other operations –557 –242Total 6,901 4,376Note 11Personnel expensesWages, salaries and other remuneration by geographic area and divided between Board membersetc. and other employees<strong>1999</strong> 1998Board members,Board members,Presidents and Other Presidents and OtherExecutive Vice Presidents employees Total Exec. VPs employees TotalParent CompanySweden 17 31 48 14 69 83(of which, bonuses) 0 1 1SubsidiariesSweden 42 4,229 4,271 30 4,000 4,030(of which, bonuses) 9 9 6 6Other Nordic countries 24 2,013 2,037 28 1,368 1,396(of which, bonuses) 1 1 1 1Other European countries 27 926 953 29 966 995(of which, bonuses) 2 2 4 4North America 7 3,112 3,119 6 2,401 2,407(of which, bonuses) 1 1 2 2Other countries 1 1,016 1,017 2 353 355(of which, bonuses) 0 0Total 118 11,327 11,445 109 9,157 9,266(of which, bonuses) 13 0 13 14 0 14The amount related to Board members, Presidents and Executive Vice Presidents includescompensation to former Board members, Presidents and Executive VicePresidents during the financial year.Wages, salaries, other remuneration and social welfare contributions<strong>1999</strong> 1998Wages, Social Wages, salaries, Socialsalaries, other welfare salaries, other welfareremuneration contributions remuneration contributionsParent Company 48 100 83 120(of which, non-statutory pensions) 76 79Subsidiaries 11,397 3,503 9,183 2,940(of which, non-statutory pensions) 938 786Total 11,445 3,603 9,266 3,060(of which, non-statutory pensions) 1,014 865Of the Parent Company’s non-statutory pension expenses, SEK 5.3 M (37.0) were relatedto the category “Board members, Presidents and Executive Vice Presidents.”This amount includes payments to former Board members, Presidents andExecutive Vice Presidents. The Company’s outstanding non-statutory pension commitmentsto these persons amounted to SEK 62.8 M (25.4). Of the Group’s nonstatutorypension expenses, SEK 19.3 M (43.0) were related to the category “Boardmembers, Presidents and Executive Vice Presidents.” This amount includes paymentsto former Board members, Presidents and Executive Vice Presidents. The expensefor a provision to the employee profit-sharing foundation amounted to SEK119 M (26).Terms of employment and remuneration to the Chairman of the Board,President, Executive Vice Presidents and other members of Group Management.A. Chairman of the BoardDuring <strong>1999</strong> the Chairman of the Board, Bo Rydin, received a director’s fee of SEK750,000. The Board approved this amount as part of the total amount of directors’fees adopted by the <strong>Annual</strong> Meeting of Shareholders.B. The Company’s President and Chief Executive OfficerDuring <strong>1999</strong>, Claes Björk received a salary, fees and other remuneration fromGroup companies in the amount of SEK 5,866,000, plus a bonus of SEK 9,125,500.Mr. Björk has also received a bonus of SEK 19,483,206 from the bonus program describedbelow, which was withdrawn as a pension benefit vested by means of a liabilityin the financial statements of <strong>Skanska</strong> AB. Mr. Björk is not covered by aSwedish pension plan, but is instead covered by <strong>Skanska</strong> USA’s general pensionplan, where after 30 years’ employment he will receive a lump sum with a currentvalue (<strong>1999</strong>) of about SEK 5,782,000. In addition to this general pension plan, thereis a special pension obligation amounting to about USD 1,200,000. In case of terminationof his employment contract by the Company, Mr. Björk is entitled to hissalary and other employment benefits for 24 months.C. Executive Vice Presidents and other members of Group ManagementMembers of Group Management are normally entitled to annual pension premiumpayments, mainly according to the applicable ITP occupational pension plan. Thisplan guarantees a pension entitlement based on final salary. The pension entitlementis 10 percent of final salary for portions of salary up to SEK 273,000, 65 percentof final salary for portions of salary between SEK 273,000 and SEK 728,000and 32.5 percent of final salary for portions of salary between SEK 728,000 and SEK1,092,000. Members of Group Management also have an agreement with theCompany entitling them to a pension from the age of 60. This pension benefit appliesbetween the ages of 60 and 65 and amounts to 70 percent of salary. From age65, a pension is payable according to an ITP plan, with pension entitlements accordingto the above-mentioned amounts. After that, a pension is payable according tothe above-mentioned ITP plan. In case of termination by the Company, notice periodsrange from six months to twelve months, with entitlement to salaries and benefitsthat vary from 18 to 24 months. When benefits are paid after the notice period,other income must normally be subtracted from the amount payable.D. Long-term bonus, 1995-<strong>1999</strong>For the Group Management and about 240 other senior executives in the Group,the long-term bonus program based mainly on the price level of Series B <strong>Skanska</strong>and Drott shares over the five-year period 1995-<strong>1999</strong> has been ended. This bonuswas calculated by multiplying 10 percent of 1-2 months’ salary by the difference betweenthe average market price of a Series B share during June-November <strong>1999</strong>,SEK 385.24 (plus dividends approved during the years 1995-<strong>1999</strong>, including the dividendportion when redeeming shares, SEK 132.74) and SEK 185.Those entitled to this bonus in Sweden were able to receive it either in the form of acash payment early in 2000 or by receiving a pension benefit. This pension benefitwas vested by means of a liability in the financial statements of the respectiveGroup companies and after that, funds (pension capital) were transferred to a jointpension fund established by <strong>Skanska</strong> AB.