- Page 2 and 3:

Privatization in MalaysiaRegulation

- Page 4 and 5:

Privatization in MalaysiaRegulation

- Page 6:

Dedicated to my parents, Tan Siew S

- Page 9 and 10:

viiiContentsProblems 123Conclusion

- Page 11 and 12:

xTables6.02 Asia Pacific airlines:

- Page 14 and 15:

AbbreviationsAFTAAFTKAPTKARPASEANAS

- Page 16 and 17:

LoSLPPJLRTLTALTATLTDLTLMARAMASMBOMC

- Page 18 and 19:

1 IntroductionWhy privatize?The deb

- Page 20 and 21:

Introduction: why privatize? 3neces

- Page 22 and 23:

Introduction: why privatize? 5count

- Page 24 and 25:

2 Privatization, rents andrent-seek

- Page 26 and 27:

Privatization, rents and rent-seeki

- Page 28 and 29:

Privatization, rents and rent-seeki

- Page 30 and 31:

Privatization, rents and rent-seeki

- Page 32 and 33:

Privatization, rents and rent-seeki

- Page 34 and 35:

Privatization, rents and rent-seeki

- Page 36 and 37:

Privatization, rents and rent-seeki

- Page 38 and 39:

Privatization, rents and rent-seeki

- Page 40 and 41:

Privatization, rents and rent-seeki

- Page 42 and 43:

Privatization, rents and rent-seeki

- Page 44 and 45:

Privatization, rents and rent-seeki

- Page 46 and 47:

Privatization, rents and rent-seeki

- Page 48 and 49:

Privatization, rents and rent-seeki

- Page 50 and 51:

What is needed to make privatizatio

- Page 52 and 53:

Privatization, rents and rent-seeki

- Page 54 and 55:

Privatization, rents and rent-seeki

- Page 56 and 57:

3 Institutional and politicalfailur

- Page 58 and 59:

Institutional and political failure

- Page 60 and 61:

Institutional and political failure

- Page 62 and 63:

Institutional and political failure

- Page 64 and 65:

Institutional and political failure

- Page 66 and 67:

Institutional and political failure

- Page 68 and 69:

Institutional and political failure

- Page 70 and 71:

Institutional and political failure

- Page 72 and 73:

Institutional and political failure

- Page 74 and 75:

Institutional and political failure

- Page 76 and 77:

Institutional and political failure

- Page 78 and 79:

Institutional and political failure

- Page 80 and 81:

Institutional and political failure

- Page 82 and 83:

Institutional and political failure

- Page 84 and 85:

Institutional and political failure

- Page 86 and 87:

Institutional and political failure

- Page 88 and 89:

Institutional and political failure

- Page 90 and 91:

Institutional and political failure

- Page 92 and 93:

Institutional and political failure

- Page 94 and 95:

Institutional and political failure

- Page 96 and 97:

Malaysia’s national sewerage syst

- Page 98 and 99:

Malaysia’s national sewerage syst

- Page 100 and 101:

Malaysia’s national sewerage syst

- Page 102 and 103:

Table 4.01 IWK: Performance summary

- Page 104 and 105:

Malaysia’s national sewerage syst

- Page 106 and 107:

Malaysia’s national sewerage syst

- Page 108 and 109:

Malaysia’s national sewerage syst

- Page 110 and 111:

Malaysia’s national sewerage syst

- Page 112 and 113: Malaysia’s national sewerage syst

- Page 114 and 115: Malaysia’s national sewerage syst

- Page 116 and 117: Malaysia’s national sewerage syst

- Page 118 and 119: Table 4.09 IWK: Tariff revisions, 1

- Page 120 and 121: Malaysia’s national sewerage syst

- Page 122 and 123: Malaysia’s national sewerage syst

- Page 124 and 125: Kuala Lumpur Light Rail Transit 107

- Page 126 and 127: Kuala Lumpur Light Rail Transit 109

- Page 128 and 129: Kuala Lumpur Light Rail Transit 111

- Page 130 and 131: Kuala Lumpur Light Rail Transit 113

- Page 132 and 133: Table 5.01 Kuala Lumpur LRT: Financ

- Page 134 and 135: Kuala Lumpur Light Rail Transit 117

- Page 136 and 137: Table 5.03 Regional urban rail syst

- Page 138 and 139: Kuala Lumpur Light Rail Transit 121

- Page 140 and 141: Kuala Lumpur Light Rail Transit 123

- Page 142 and 143: Kuala Lumpur Light Rail Transit 125

- Page 144 and 145: Kuala Lumpur Light Rail Transit 127

- Page 146 and 147: Kuala Lumpur Light Rail Transit 129

- Page 148 and 149: Kuala Lumpur Light Rail Transit 131

- Page 150 and 151: 6 Perverse incentivesMalaysia Airli

- Page 152 and 153: Malaysia Airlines 135Both types of

- Page 154 and 155: Malaysia Airlines 137The industry i

- Page 156 and 157: BackgroundMalaysia Airlines 139The

- Page 158 and 159: Malaysia Airlines 141improvements i

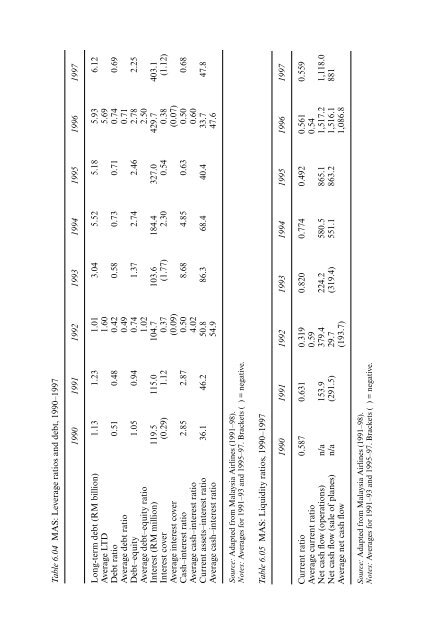

- Page 160 and 161: Malaysia Airlines 143Table 6.03 Reg

- Page 164 and 165: Malaysia Airlines 147debt as early

- Page 166 and 167: Malaysia Airlines 149with the Maldi

- Page 168 and 169: Malaysia Airlines 151its fleet to a

- Page 170 and 171: Malaysia Airlines 15312 November 20

- Page 172 and 173: Malaysia Airlines 155state not inte

- Page 174 and 175: Malaysia Airlines 157overall indust

- Page 176 and 177: Proton 159was technology acquisitio

- Page 178 and 179: Proton 161(when Proton’s domestic

- Page 180 and 181: Proton 163Late-comer and specific c

- Page 182 and 183: Proton 165Motor Company (MMC), in M

- Page 184 and 185: PerformanceProton 167Although Proto

- Page 186 and 187: Table 7.03 Proton: Profitability, 1

- Page 188 and 189: Proton 171be able to develop its ow

- Page 190 and 191: Proton 173Table 7.08 Proton: Export

- Page 192 and 193: Table 7.09 Proton: Impact of reduct

- Page 194 and 195: Proton 1778 May 2004). Overall, Pro

- Page 196 and 197: Proton 179DRB-HICOM for RM297 milli

- Page 198 and 199: Proton 181to go about it’ and Pro

- Page 200 and 201: Proton 183competitiveness needed to

- Page 202 and 203: Proton 185Although Proton was finan

- Page 204 and 205: Proton 187Proton’s poor performan

- Page 206 and 207: Summary and conclusion 189necessita

- Page 208 and 209: Summary and conclusion 191appropria

- Page 210 and 211: Summary and conclusion 193cost per

- Page 212 and 213:

Summary and conclusion 195that it i

- Page 214 and 215:

Notes 197directed primarily at the

- Page 216 and 217:

Notes 1996 IWK was incorporated as

- Page 218 and 219:

Notes 20111 This comprised EPF (20

- Page 220 and 221:

Notes 203million new ordinary share

- Page 222 and 223:

Notes 20515 Proton’s market share

- Page 224 and 225:

References 207Aziz Zariza Ahmad (19

- Page 226 and 227:

References 209Chee P.L. and Fong C.

- Page 228 and 229:

References 211Felker, G. (1993) ‘

- Page 230 and 231:

References 213—— (2002) World A

- Page 232 and 233:

References 215Mustapa Mohamed on Ec

- Page 234 and 235:

References 217Lum W.K. (1994) ‘Pr

- Page 236 and 237:

References 219Payson, W. and Steckl

- Page 238 and 239:

References 221—— (2002) (SMRT)

- Page 240:

Newspapers, magazines, websites and

- Page 243 and 244:

226 IndexBumiputra National Economi

- Page 245 and 246:

228 IndexEmployees Provident Fund s

- Page 247 and 248:

230 Index99-100, 104; industrial ta

- Page 249 and 250:

232 Index41, 50, 65, 71-2, 77, 191;

- Page 251:

234 Indextechnology: acquisition an