Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

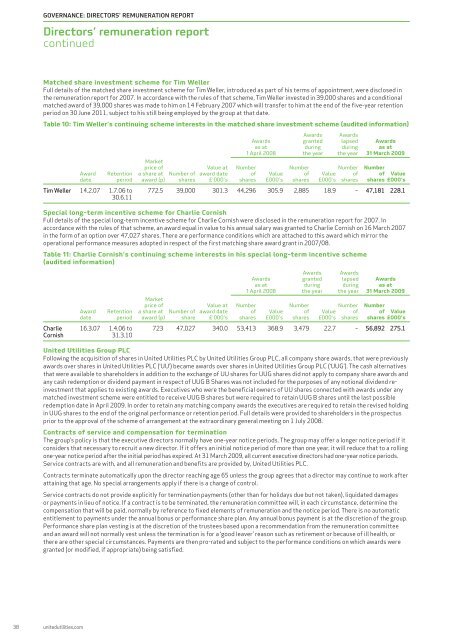

GOVERNANCE: DIRECTORS’ REMUNERATION REPORTDirectors’ remuneration <strong>report</strong>continuedMatched share investment scheme for Tim WellerFull details of the matched share investment scheme for Tim Weller, introduced as part of his terms of appointment, were disclosed inthe remuneration <strong>report</strong> for 2007. In accordance with the rules of that scheme, Tim Weller invested in 39,000 shares <strong>and</strong> a conditionalmatched award of 39,000 shares was made to him on 14 February 2007 which will transfer to him at the end of the five-year retentionperiod on 30 June 2011, subject to his still being employed by the group at that date.Table 10: Tim Weller’s continuing scheme interests in the matched share investment scheme (audited information)Awards AwardsAwards granted lapsed Awardsas at during during as at1 April 2008 the year the year 31 March <strong>2009</strong>Marketprice of Value at Number Number Number NumberAward Retention a share at Number of award date of Value of Value of of Valuedate period award (p) shares £’000’s shares £000’s shares £000’s shares shares £000’sTim Weller 14.2.07 1.7.06 to 772.5 39,000 301.3 44,296 305.9 2,885 18.9 – 47,181 228.130.6.11Special long-term incentive scheme for Charlie CornishFull details of the special long-term incentive scheme for Charlie Cornish were disclosed in the remuneration <strong>report</strong> for 2007. Inaccordance with the rules of that scheme, an award equal in value to his annual salary was granted to Charlie Cornish on 16 March 2007in the form of an option over 47,027 shares. There are performance conditions which are attached to this award which mirror theoperational performance measures adopted in respect of the first matching share award grant in 2007/08.Table 11: Charlie Cornish’s continuing scheme interests in his special long-term incentive scheme(audited information)Awards AwardsAwards granted lapsed Awardsas at during during as at1 April 2008 the year the year 31 March <strong>2009</strong>Marketprice of Value at Number Number Number NumberAward Retention a share at Number of award date of Value of Value of of Valuedate period award (p) share £’000’s shares £000’s shares £000’s shares shares £000’sCharlie 16.3.07 1.4.06 to 723 47,027 340.0 53,413 368.9 3,479 22.7 – 56,892 275.1Cornish 31.3.10<strong>United</strong> <strong>Utilities</strong> Group PLCFollowing the acquisition of shares in <strong>United</strong> <strong>Utilities</strong> PLC by <strong>United</strong> <strong>Utilities</strong> Group PLC, all company share awards, that were previouslyawards over shares in <strong>United</strong> <strong>Utilities</strong> PLC (‘UU’) became awards over shares in <strong>United</strong> <strong>Utilities</strong> Group PLC (‘UUG’). The cash alternativesthat were available to shareholders in addition to the exchange of UU shares for UUG shares did not apply to company share awards <strong>and</strong>any cash redemption or dividend payment in respect of UUG B Shares was not included for the purposes of any notional dividend reinvestmentthat applies to existing awards. Executives who were the beneficial owners of UU shares connected with awards under anymatched investment scheme were entitled to receive UUG B shares but were required to retain UUG B shares until the last possibleredemption date in April <strong>2009</strong>. In order to retain any matching company awards the executives are required to retain the revised holdingin UUG shares to the end of the original performance or retention period. Full details were provided to shareholders in the prospectusprior to the approval of the scheme of arrangement at the extraordinary general meeting on 1 July 2008.Contracts of service <strong>and</strong> compensation for terminationThe group’s policy is that the executive directors normally have one-year notice periods. The group may offer a longer notice period if itconsiders that necessary to recruit a new director. If it offers an initial notice period of more than one year, it will reduce that to a rollingone-year notice period after the initial period has expired. At 31 March <strong>2009</strong>, all current executive directors had one-year notice periods.Service contracts are with, <strong>and</strong> all remuneration <strong>and</strong> benefits are provided by, <strong>United</strong> <strong>Utilities</strong> PLC.Contracts terminate automatically upon the director reaching age 65 unless the group agrees that a director may continue to work afterattaining that age. No special arrangements apply if there is a change of control.Service contracts do not provide explicitly for termination payments (other than for holidays due but not taken), liquidated damagesor payments in lieu of notice. If a contract is to be terminated, the remuneration committee will, in each circumstance, determine thecompensation that will be paid, normally by reference to fixed elements of remuneration <strong>and</strong> the notice period. There is no automaticentitlement to payments under the annual bonus or performance share plan. Any annual bonus payment is at the discretion of the group.Performance share plan vesting is at the discretion of the trustees based upon a recommendation from the remuneration committee<strong>and</strong> an award will not normally vest unless the termination is for a ‘good leaver’ reason such as retirement or because of ill health, orthere are other special circumstances. Payments are then pro-rated <strong>and</strong> subject to the performance conditions on which awards weregranted (or modified, if appropriate) being satisfied.38 unitedutilities.com