Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

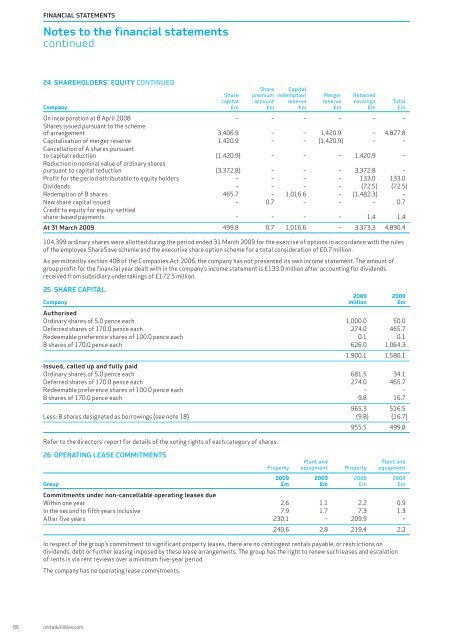

FINANCIAL STATEMENTSNotes to the <strong>financial</strong> <strong>statement</strong>scontinued24 SHAREHOLDERS’ EQUITY CONTINUEDShare CapitalShare premium redemption Merger Retainedcapital account reserve reserve earnings TotalCompany £m £m £m £m £m £mOn incorporation at 8 April 2008 – – – – – –Shares issued pursuant to the schemeof arrangement 3,406.9 – – 1,420.9 – 4,827.8Capitalisation of merger reserve 1,420.9 – – (1,420.9) – –Cancellation of A shares pursuantto capital reduction (1,420.9) – – – 1,420.9 –Reduction in nominal value of ordinary sharespursuant to capital reduction (3,372.8) – – – 3,372.8 –Profit for the period attributable to equity holders – – – – 133.0 133.0Dividends – – – – (72.5) (72.5)Redemption of B shares 465.7 – 1,016.6 – (1,482.3) –New share capital issued – 0.7 – – – 0.7Credit to equity for equity-settledshare-based payments – – – – 1.4 1.4At 31 March <strong>2009</strong> 499.8 0.7 1,016.6 – 3,373.3 4,890.4104,399 ordinary shares were allotted during the period ended 31 March <strong>2009</strong> for the exercise of options in accordance with the rulesof the employee ShareSave scheme <strong>and</strong> the executive share option scheme for a total consideration of £0.7 million.As permitted by section 408 of the Companies Act 2006, the company has not presented its own income <strong>statement</strong>. The amount ofgroup profit for the <strong>financial</strong> year dealt with in the company’s income <strong>statement</strong> is £133.0 million after accounting for dividendsreceived from subsidiary undertakings of £172.5 million.25 SHARE CAPITAL<strong>2009</strong> <strong>2009</strong>Company million £mAuthorisedOrdinary shares of 5.0 pence each 1,000.0 50.0Deferred shares of 170.0 pence each 274.0 465.7Redeemable preference shares of 100.0 pence each 0.1 0.1B shares of 170.0 pence each 626.0 1,064.31,900.1 1,580.1Issued, called up <strong>and</strong> fully paidOrdinary shares of 5.0 pence each 681.5 34.1Deferred shares of 170.0 pence each 274.0 465.7Redeemable preference shares of 100.0 pence each – –B shares of 170.0 pence each 9.8 16.7965.3 516.5Less: B shares designated as borrowings (see note 18) (9.8) (16.7)955.5 499.8Refer to the directors’ <strong>report</strong> for details of the voting rights of each category of shares.26 OPERATING LEASE COMMITMENTSPlant <strong>and</strong>Plant <strong>and</strong>Property equipment Property equipment<strong>2009</strong> <strong>2009</strong> 2008 2008Group £m £m £m £mCommitments under non-cancellable operating leases dueWithin one year 2.6 1.1 2.2 0.9In the second to fifth years inclusive 7.9 1.7 7.3 1.3After five years 230.1 – 209.9 –240.6 2.8 219.4 2.2In respect of the group’s commitment to significant property leases, there are no contingent rentals payable, or restrictions ondividends, debt or further leasing imposed by these lease arrangements. The group has the right to renew such leases <strong>and</strong> escalationof rents is via rent reviews over a minimum five-year period.The company has no operating lease commitments.86 unitedutilities.com