Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

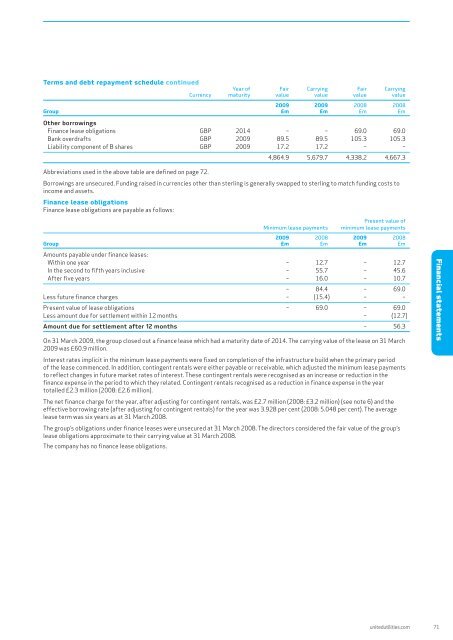

Terms <strong>and</strong> debt repayment schedule continuedYear of Fair Carrying Fair CarryingCurrency maturity value value value value<strong>2009</strong> <strong>2009</strong> 2008 2008Group £m £m £m £mOther borrowingsFinance lease obligations GBP 2014 – – 69.0 69.0Bank overdrafts GBP <strong>2009</strong> 89.5 89.5 105.3 105.3Liability component of B shares GBP <strong>2009</strong> 17.2 17.2 – –Abbreviations used in the above table are defined on page 72.4,864.9 5,679.7 4,338.2 4,667.3Borrowings are unsecured. Funding raised in currencies other than sterling is generally swapped to sterling to match funding costs toincome <strong>and</strong> assets.Finance lease obligationsFinance lease obligations are payable as follows:Minimum lease paymentsPresent value ofminimum lease payments<strong>2009</strong> 2008 <strong>2009</strong> 2008Group £m £m £m £mAmounts payable under finance leases:Within one year – 12.7 – 12.7In the second to fifth years inclusive – 55.7 – 45.6After five years – 16.0 – 10.7– 84.4 – 69.0Less future finance charges – (15.4) – –Present value of lease obligations – 69.0 – 69.0Less amount due for settlement within 12 months – (12.7)Amount due for settlement after 12 months – 56.3On 31 March <strong>2009</strong>, the group closed out a finance lease which had a maturity date of 2014. The carrying value of the lease on 31 March<strong>2009</strong> was £60.9 million.Interest rates implicit in the minimum lease payments were fixed on completion of the infrastructure build when the primary periodof the lease commenced. In addition, contingent rentals were either payable or receivable, which adjusted the minimum lease paymentsto reflect changes in future market rates of interest. These contingent rentals were recognised as an increase or reduction in thefinance expense in the period to which they related. Contingent rentals recognised as a reduction in finance expense in the yeartotalled £2.3 million (2008: £2.6 million).The net finance charge for the year, after adjusting for contingent rentals, was £2.7 million (2008: £3.2 million) (see note 6) <strong>and</strong> theeffective borrowing rate (after adjusting for contingent rentals) for the year was 3.928 per cent (2008: 5.048 per cent). The averagelease term was six years as at 31 March 2008.The group’s obligations under finance leases were unsecured at 31 March 2008. The directors considered the fair value of the group’slease obligations approximate to their carrying value at 31 March 2008.The company has no finance lease obligations.Financial <strong>statement</strong>sunitedutilities.com 71