Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

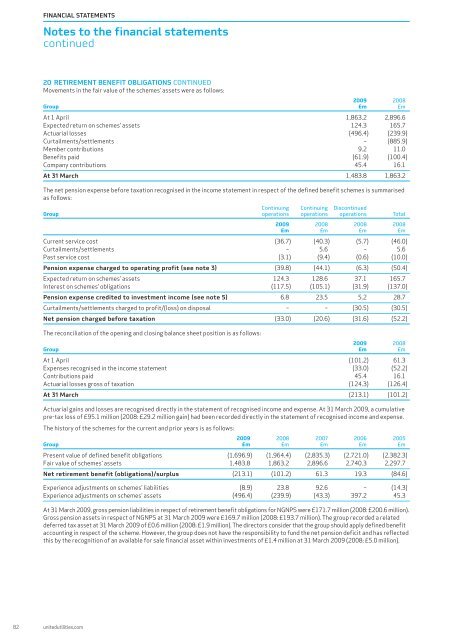

FINANCIAL STATEMENTSNotes to the <strong>financial</strong> <strong>statement</strong>scontinued20 RETIREMENT BENEFIT OBLIGATIONS CONTINUEDMovements in the fair value of the schemes’ assets were as follows:<strong>2009</strong> 2008Group £m £mAt 1 April 1,863.2 2,896.6Expected return on schemes’ assets 124.3 165.7Actuarial losses (496.4) (239.9)Curtailments/settlements – (885.9)Member contributions 9.2 11.0Benefits paid (61.9) (100.4)Company contributions 45.4 16.1At 31 March 1,483.8 1,863.2The net pension expense before taxation recognised in the income <strong>statement</strong> in respect of the defined benefit schemes is summarisedas follows:Continuing Continuing DiscontinuedGroup operations operations operations Total<strong>2009</strong> 2008 2008 2008£m £m £m £mCurrent service cost (36.7) (40.3) (5.7) (46.0)Curtailments/settlements – 5.6 – 5.6Past service cost (3.1) (9.4) (0.6) (10.0)Pension expense charged to operating profit (see note 3) (39.8) (44.1) (6.3) (50.4)Expected return on schemes’ assets 124.3 128.6 37.1 165.7Interest on schemes’ obligations (117.5) (105.1) (31.9) (137.0)Pension expense credited to investment income (see note 5) 6.8 23.5 5.2 28.7Curtailments/settlements charged to profit/(loss) on disposal – – (30.5) (30.5)Net pension charged before taxation (33.0) (20.6) (31.6) (52.2)The reconciliation of the opening <strong>and</strong> closing balance sheet position is as follows:<strong>2009</strong> 2008Group £m £mAt 1 April (101.2) 61.3Expenses recognised in the income <strong>statement</strong> (33.0) (52.2)Contributions paid 45.4 16.1Actuarial losses gross of taxation (124.3) (126.4)At 31 March (213.1) (101.2)Actuarial gains <strong>and</strong> losses are recognised directly in the <strong>statement</strong> of recognised income <strong>and</strong> expense. At 31 March <strong>2009</strong>, a cumulativepre-tax loss of £95.1 million (2008: £29.2 million gain) had been recorded directly in the <strong>statement</strong> of recognised income <strong>and</strong> expense.The history of the schemes for the current <strong>and</strong> prior years is as follows:<strong>2009</strong> 2008 2007 2006 2005Group £m £m £m £m £mPresent value of defined benefit obligations (1,696.9) (1,964.4) (2,835.3) (2,721.0) (2,382.3)Fair value of schemes’ assets 1,483.8 1,863.2 2,896.6 2,740.3 2,297.7Net retirement benefit (obligations)/surplus (213.1) (101.2) 61.3 19.3 (84.6)Experience adjustments on schemes’ liabilities (8.9) 23.8 92.6 – (14.3)Experience adjustments on schemes’ assets (496.4) (239.9) (43.3) 397.2 45.3At 31 March <strong>2009</strong>, gross pension liabilities in respect of retirement benefit obligations for NGNPS were £171.7 million (2008: £200.6 million).Gross pension assets in respect of NGNPS at 31 March <strong>2009</strong> were £169.7 million (2008: £193.7 million). The group recorded a relateddeferred tax asset at 31 March <strong>2009</strong> of £0.6 million (2008: £1.9 million). The directors consider that the group should apply defined benefitaccounting in respect of the scheme. However, the group does not have the responsibility to fund the net pension deficit <strong>and</strong> has reflectedthis by the recognition of an available for sale <strong>financial</strong> asset within investments of £1.4 million at 31 March <strong>2009</strong> (2008: £5.0 million).82 unitedutilities.com