Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

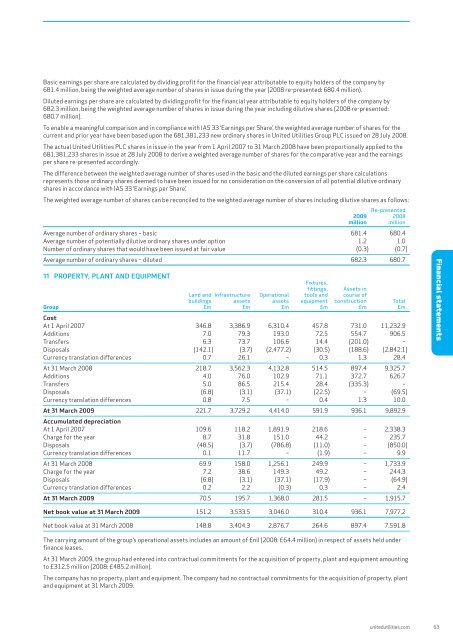

Basic earnings per share are calculated by dividing profit for the <strong>financial</strong> year attributable to equity holders of the company by681.4 million, being the weighted average number of shares in issue during the year (2008 re-presented: 680.4 million).Diluted earnings per share are calculated by dividing profit for the <strong>financial</strong> year attributable to equity holders of the company by682.3 million, being the weighted average number of shares in issue during the year including dilutive shares (2008 re-presented:680.7 million).To enable a meaningful comparison <strong>and</strong> in compliance with IAS 33 ‘Earnings per Share’, the weighted average number of shares for thecurrent <strong>and</strong> prior year have been based upon the 681,381,233 new ordinary shares in <strong>United</strong> <strong>Utilities</strong> Group PLC issued on 28 July 2008.The actual <strong>United</strong> <strong>Utilities</strong> PLC shares in issue in the year from 1 April 2007 to 31 March 2008 have been proportionally applied to the681,381,233 shares in issue at 28 July 2008 to derive a weighted average number of shares for the comparative year <strong>and</strong> the earningsper share re-presented accordingly.The difference between the weighted average number of shares used in the basic <strong>and</strong> the diluted earnings per share calculationsrepresents those ordinary shares deemed to have been issued for no consideration on the conversion of all potential dilutive ordinaryshares in accordance with IAS 33 ‘Earnings per Share’.The weighted average number of shares can be reconciled to the weighted average number of shares including dilutive shares as follows:Re-presented<strong>2009</strong> 2008million millionAverage number of ordinary shares – basic 681.4 680.4Average number of potentially dilutive ordinary shares under option 1.2 1.0Number of ordinary shares that would have been issued at fair value (0.3) (0.7)Average number of ordinary shares – diluted 682.3 680.711 PROPERTY, PLANT AND EQUIPMENTFixtures,fittings, Assets inL<strong>and</strong> <strong>and</strong> Infrastructure Operational tools <strong>and</strong> course ofbuildings assets assets equipment construction TotalGroup £m £m £m £m £m £mCostAt 1 April 2007 346.8 3,386.9 6,310.4 457.8 731.0 11,232.9Additions 7.0 79.3 193.0 72.5 554.7 906.5Transfers 6.3 73.7 106.6 14.4 (201.0) –Disposals (142.1) (3.7) (2,477.2) (30.5) (188.6) (2,842.1)Currency translation differences 0.7 26.1 – 0.3 1.3 28.4At 31 March 2008 218.7 3,562.3 4,132.8 514.5 897.4 9,325.7Additions 4.0 76.0 102.9 71.1 372.7 626.7Transfers 5.0 86.5 215.4 28.4 (335.3) –Disposals (6.8) (3.1) (37.1) (22.5) – (69.5)Currency translation differences 0.8 7.5 – 0.4 1.3 10.0At 31 March <strong>2009</strong> 221.7 3,729.2 4,414.0 591.9 936.1 9,892.9Accumulated depreciationAt 1 April 2007 109.6 118.2 1,891.9 218.6 – 2,338.3Charge for the year 8.7 31.8 151.0 44.2 – 235.7Disposals (48.5) (3.7) (786.8) (11.0) – (850.0)Currency translation differences 0.1 11.7 – (1.9) – 9.9At 31 March 2008 69.9 158.0 1,256.1 249.9 – 1,733.9Charge for the year 7.2 38.6 149.3 49.2 – 244.3Disposals (6.8) (3.1) (37.1) (17.9) – (64.9)Currency translation differences 0.2 2.2 (0.3) 0.3 – 2.4At 31 March <strong>2009</strong> 70.5 195.7 1,368.0 281.5 – 1,915.7Financial <strong>statement</strong>sNet book value at 31 March <strong>2009</strong> 151.2 3,533.5 3,046.0 310.4 936.1 7,977.2Net book value at 31 March 2008 148.8 3,404.3 2,876.7 264.6 897.4 7,591.8The carrying amount of the group’s operational assets includes an amount of £nil (2008: £64.4 million) in respect of assets held underfinance leases.At 31 March <strong>2009</strong>, the group had entered into contractual commitments for the acquisition of property, plant <strong>and</strong> equipment amountingto £312.5 million (2008: £485.2 million).The company has no property, plant <strong>and</strong> equipment. The company had no contractual commitments for the acquisition of property, plant<strong>and</strong> equipment at 31 March <strong>2009</strong>.unitedutilities.com 63