Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

Annual report and financial statement 2009 - United Utilities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

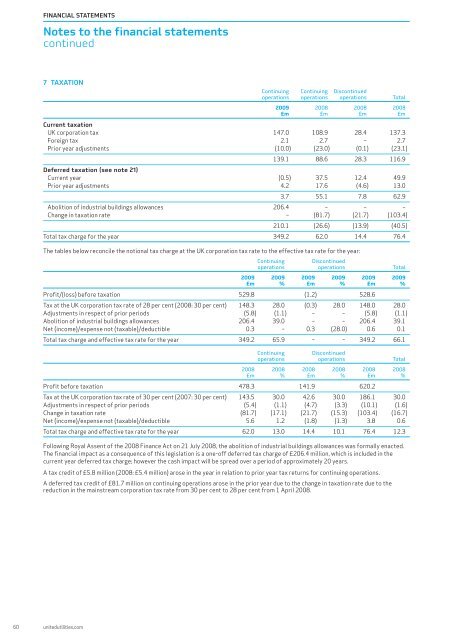

FINANCIAL STATEMENTSNotes to the <strong>financial</strong> <strong>statement</strong>scontinued7 TAXATIONContinuing Continuing Discontinuedoperations operations operations Total<strong>2009</strong> 2008 2008 2008£m £m £m £mCurrent taxationUK corporation tax 147.0 108.9 28.4 137.3Foreign tax 2.1 2.7 – 2.7Prior year adjustments (10.0) (23.0) (0.1) (23.1)139.1 88.6 28.3 116.9Deferred taxation (see note 21)Current year (0.5) 37.5 12.4 49.9Prior year adjustments 4.2 17.6 (4.6) 13.03.7 55.1 7.8 62.9Abolition of industrial buildings allowances 206.4 – – –Change in taxation rate – (81.7) (21.7) (103.4)210.1 (26.6) (13.9) (40.5)Total tax charge for the year 349.2 62.0 14.4 76.4The tables below reconcile the notional tax charge at the UK corporation tax rate to the effective tax rate for the year:ContinuingDiscontinuedoperations operations Total<strong>2009</strong> <strong>2009</strong> <strong>2009</strong> <strong>2009</strong> <strong>2009</strong> <strong>2009</strong>£m % £m % £m %Profit/(loss) before taxation 529.8 (1.2) 528.6Tax at the UK corporation tax rate of 28 per cent (2008: 30 per cent) 148.3 28.0 (0.3) 28.0 148.0 28.0Adjustments in respect of prior periods (5.8) (1.1) – – (5.8) (1.1)Abolition of industrial buildings allowances 206.4 39.0 – – 206.4 39.1Net (income)/expense not (taxable)/deductible 0.3 – 0.3 (28.0) 0.6 0.1Total tax charge <strong>and</strong> effective tax rate for the year 349.2 65.9 – – 349.2 66.1ContinuingDiscontinuedoperations operations Total2008 2008 2008 2008 2008 2008£m % £m % £m %Profit before taxation 478.3 141.9 620.2Tax at the UK corporation tax rate of 30 per cent (2007: 30 per cent) 143.5 30.0 42.6 30.0 186.1 30.0Adjustments in respect of prior periods (5.4) (1.1) (4.7) (3.3) (10.1) (1.6)Change in taxation rate (81.7) (17.1) (21.7) (15.3) (103.4) (16.7)Net (income)/expense not (taxable)/deductible 5.6 1.2 (1.8) (1.3) 3.8 0.6Total tax charge <strong>and</strong> effective tax rate for the year 62.0 13.0 14.4 10.1 76.4 12.3Following Royal Assent of the 2008 Finance Act on 21 July 2008, the abolition of industrial buildings allowances was formally enacted.The <strong>financial</strong> impact as a consequence of this legislation is a one-off deferred tax charge of £206.4 million, which is included in thecurrent year deferred tax charge; however the cash impact will be spread over a period of approximately 20 years.A tax credit of £5.8 million (2008: £5.4 million) arose in the year in relation to prior year tax returns for continuing operations.A deferred tax credit of £81.7 million on continuing operations arose in the prior year due to the change in taxation rate due to thereduction in the mainstream corporation tax rate from 30 per cent to 28 per cent from 1 April 2008.60 unitedutilities.com