MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>MATELAN</strong> <strong>Research</strong><br />

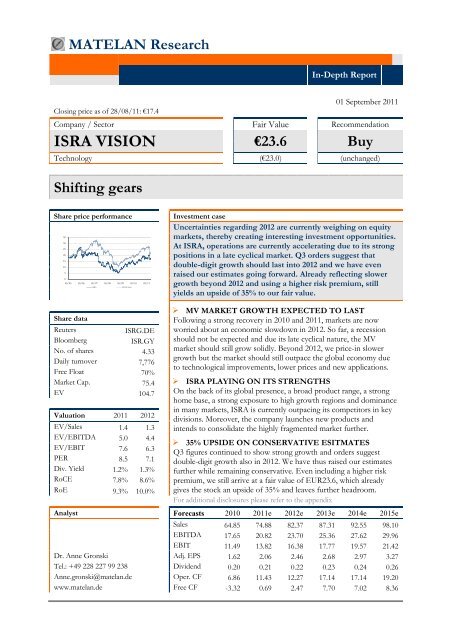

Closing price as of 28/08/11: €17.4<br />

In-Depth Report<br />

01 September 2011<br />

Company / Sector Fair Value Recommendation<br />

<strong>ISRA</strong> <strong>VISION</strong><br />

€23.6<br />

Buy<br />

Technology (€23.0) (unchanged)<br />

Shifting gears<br />

Share price performance Investment case<br />

Uncertainties regarding 2012 are currently weighing on equity<br />

35<br />

markets, thereby creating interesting investment opportunities.<br />

30<br />

25<br />

20<br />

At <strong>ISRA</strong>, operations are currently accelerating due to its strong<br />

positions in a late cyclical market. Q3 orders suggest that<br />

15<br />

10<br />

double-digit growth should last into 2012 and we have even<br />

5<br />

raised our estimates going forward. Already reflecting slower<br />

0<br />

05/05 05/06 05/07<br />

<strong>ISRA</strong><br />

05/08 05/09 05/10<br />

SDAX (Ind.)<br />

05/11 growth beyond 2012 and using a higher risk premium, still<br />

yields an upside of 35% to our fair value.<br />

Share data<br />

Reuters ISRG.DE<br />

Bloomberg ISR.GY<br />

No. of shares 4.33<br />

Daily turnover 7,776<br />

Free Float 70%<br />

Market Cap. 75.4<br />

EV 104.7<br />

Valuation 2011 2012<br />

EV/Sales 1.4 1.3<br />

EV/EBITDA 5.0 4.4<br />

EV/EBIT 7.6 6.3<br />

PER 8.5 7.1<br />

Div. Yield 1.2% 1.3%<br />

RoCE 7.8% 8.6%<br />

RoE 9.3% 10.0%<br />

� MV MARKET GROWTH EXPECTED TO LAST<br />

Following a strong recovery in 2010 and 2011, markets are now<br />

worried about an economic slowdown in 2012. So far, a recession<br />

should not be expected and due its late cyclical nature, the MV<br />

market should still grow solidly. Beyond 2012, we price-in slower<br />

growth but the market should still outpace the global economy due<br />

to technological improvements, lower prices and new applications.<br />

� <strong>ISRA</strong> PLAYING ON ITS STRENGTHS<br />

On the back of its global presence, a broad product range, a strong<br />

home base, a strong exposure to high growth regions and dominance<br />

in many markets, <strong>ISRA</strong> is currently outpacing its competitors in key<br />

divisions. Moreover, the company launches new products and<br />

intends to consolidate the highly fragmented market further.<br />

� 35% UPSIDE ON CONSERVATIVE ESITMATES<br />

Q3 figures continued to show strong growth and orders suggest<br />

double-digit growth also in 2012. We have thus raised our estimates<br />

further while remaining conservative. Even including a higher risk<br />

premium, we still arrive at a fair value of EUR23.6, which already<br />

gives the stock an upside of 35% and leaves further headroom.<br />

For additional disclosures please refer to the appendix<br />

Analyst Forecasts 2010 2011e 2012e 2013e 2014e 2015e<br />

Sales 64.85 74.88 82.37 87.31 92.55 98.10<br />

EBITDA 17.65 20.82 23.70 25.36 27.62 29.96<br />

EBIT 11.49 13.82 16.38 17.77 19.57 21.42<br />

Dr. Anne Gronski Adj. EPS 1.62 2.06 2.46 2.68 2.97 3.27<br />

Tel.: +49 228 227 99 238 Dividend 0.20 0.21 0.22 0.23 0.24 0.26<br />

Anne.gronski@matelan.de Oper. CF 6.86 11.43 12.27 17.14 17.14 19.20<br />

www.matelan.de Free CF -3.32 0.69 2.47 7.70 7.02 8.36

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

TABLE OF CONTENTS<br />

- 2 -<br />

Executive Summary ........................................................................................ 3<br />

Valuation .......................................................................................................... 5<br />

Market Structure & Developments ............................................................ 10<br />

Regional Macroeconomic Trends Stimulate Market .......................... 11<br />

Revival of Traditional Customer Industries ........................................ 13<br />

Discrete Inspection Systems Remain Key Application ..................... 15<br />

Trend Towards Less Complex Products ............................................. 16<br />

Numerous Drivers of Future Growth ................................................. 18<br />

Company Profile and Strategy .................................................................... 20<br />

Strongly Positioned in Key Growth Regions ...................................... 20<br />

Broad Diversification Across Industries .............................................. 21<br />

Differentiating from the Competition .................................................. 22<br />

Strategic Expansion of Activities .......................................................... 25<br />

Capitalizing on Growth Trends ............................................................ 27<br />

Financial Analysis ......................................................................................... 29<br />

Drawing a Conservative Growth Scenario .......................................... 29<br />

Working Capital is the Main Balance Sheet Lever ............................. 31<br />

Back to Positive Free Cash Flows ........................................................ 32<br />

Q3 Sends Positive Signals for 2012 ...................................................... 33<br />

ADDITIONAL DISCLOSURES ........................................................................ 40<br />

DISCLAIMER ................................................................................................... 40<br />

ADDITIONAL INFORMATION ....................................................................... 41<br />

CONTACT DATA ............................................................................................ 41

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

EXECUTIVE SUMMARY<br />

Economic recovery<br />

stimulating the<br />

European machine<br />

vision market - German<br />

companies excellently<br />

positioned<br />

Numerous drivers of<br />

growth: + 20% expected<br />

for 2011<br />

Order intake secures<br />

sound development in<br />

2012<br />

<strong>ISRA</strong> attractively<br />

positioned to benefit<br />

from regional growth<br />

trends while being<br />

broadly diversified<br />

across customer<br />

industries<br />

Broad product range and<br />

global reach give <strong>ISRA</strong><br />

an edge over most<br />

competitors<br />

- 3 -<br />

Following a sharp contraction during the recession year 2009, the European<br />

market for machine vision technology showed a strong comeback in 2010 on<br />

the back of a recovering global economy. This economic recovery was mainly<br />

driven by the Asian markets, in particular China. Within Europe, Germany<br />

experienced the strongest economic growth, while most other nations were<br />

still struggling. This puts German machine vision companies in a favourable<br />

position as they not only have the largest home market, but also an aboveaverage<br />

exposure to China, the strongest growth driver worldwide.<br />

Economic growth, particularly coming from the emerging markets, increasing<br />

automation in the US and the strength of the German economy are clear<br />

growth drivers for the machine vision market going forward. Looking at<br />

customer industries, we see the traditional industries showing a strong<br />

comeback. Automotive and electrical goods showed the highest growth rates<br />

in 2010 and are expected to continue to do so in 2011. The pharma industry<br />

has good prospects and is rather resistant to a potential economic slowdown.<br />

In industries such as glass and metal, the industry background looks<br />

somewhat more heterogeneous but some machine vision companies are still<br />

reporting good order intake from these industries. We should continue to see<br />

discrete inspection systems as the most important application but 3D systems<br />

and new application should increasingly become drivers of growth. In terms<br />

of products, there is currently a trend towards less complex systems, though<br />

vision systems will continue to dominate the market as they become<br />

increasingly powerful at lower prices. On the back of all these growth drivers,<br />

the EMVA assumes a market increase of 20% for the current year.<br />

Markets are currently worried about a potential slowdown of global economic<br />

growth in 2012. However, most indicators are so far not pointing to a<br />

recession. Growth must be expected to slow from the 2011 level but remain<br />

positive. As a consequence of the late cyclical nature of the machine vision<br />

industry, we would expect the economic slowdown to show only with a time<br />

lag. In fact, order intake remains strong and suggests that the trends<br />

described above will continue in 2012 at slightly lower rates.<br />

Within a rather fragmented industry, <strong>ISRA</strong> counts among the leading<br />

companies and is one of the few global players. Though Europe is still the<br />

most important region for the company, overseas sales already account for<br />

half of the business. In fact, China has become the second largest location<br />

after Germany. Moreover, <strong>ISRA</strong> is broadly diversified across most customer<br />

industries. Originating from the automotive industry, metal, paper and glass<br />

now also account for major parts of the company’s sales. We thus feel that<br />

the company should benefit strongly from regional growth trends, while<br />

being in a position to even out the different cycles of the customer industries.<br />

Looking at the competition, only Cognex matches <strong>ISRA</strong>’s broad<br />

diversification across the industries and its global reach. Though dealing with<br />

much larger customers is never easy, <strong>ISRA</strong>’s ability to serve its customers<br />

globally with a broad product range gives the company a clear edge over most<br />

competitors. Moreover, <strong>ISRA</strong> clearly dominates markets such as glass and

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Leveraging strong<br />

market positions and<br />

driving growth with new<br />

product initiatives<br />

Double-digit net profit<br />

growth based on<br />

conservative top-line and<br />

margin assumptions<br />

Further progress in<br />

NWC could unlock<br />

additional value –<br />

positive free cash flows<br />

from coming year<br />

onwards<br />

Q3 follows up on strong<br />

Q2 numbers – doubledigit<br />

growth also<br />

expected for next year<br />

Conservatively calculated<br />

fair value of EUR23.6<br />

CCA and CTA point at<br />

further headroom.<br />

- 4 -<br />

metal with shares of 80% and 65%, respectively. This makes it hard for the<br />

customer to find acceptable alternatives.<br />

<strong>ISRA</strong> is clearly differentiating itself from the competition through is global<br />

presence, its broad product range and technological leadership in many areas.<br />

Moreover, the company is currently undertaking some initiatives to fuel<br />

further growth in the industrial automation segment with new product<br />

launches and we expect the company to continue its successful strategic<br />

expansion in the surface vision segment.<br />

Based on the positive developments that <strong>ISRA</strong> is currently experiencing as a<br />

result of improving market dynamics as well as the company’s strong position<br />

in its relevant markets, our current growth assumption of 8.6% over the<br />

medium-term appears rather conservative and takes into account a potential<br />

economic slowdown. In particular, we have not yet priced-in management’s<br />

target of more than EUR100m in sales in the coming years. We also assume<br />

only a slight margin increase. Still, net profit growth comes to a C<strong>AG</strong>R of<br />

15.2%, which means a doubling over the coming 5 years.<br />

One of the key financial drivers – apart from earnings development – is<br />

working capital. <strong>ISRA</strong> clearly has above-average working capital needs and<br />

improvements on this side could unlock substantial value for the company.<br />

Against the background of its low capital intensity, <strong>ISRA</strong> is still earning its<br />

cost of capital and shows an industry average RoCE, when excluding<br />

goodwill. Despite the financing of numerous acquisitions, <strong>ISRA</strong> still shows a<br />

low gearing. Although the company is likely to further consolidate the<br />

market, we are not pricing-in any acquisitions. This leaves the company in a<br />

position to produce positive free cash flows from the current year onwards.<br />

The third quarter sustained the strong picture presented in the second<br />

quarter, leaving our full year estimates too conservative. We have thus raised<br />

our esitmates without becoming aggressive. Order intake accelerated further<br />

and led to a further increase in the order book. A quarter of our sales forecast<br />

for the coming year is already in the books and we expect this to double by<br />

year-end. Against this background, management has not only reiterated its<br />

guidance for the current year, it also expects double-digit growth in the<br />

coming year, even in view of the current uncertainties regarding the<br />

macroeconomic environment.<br />

We value <strong>ISRA</strong>’s stock on the back of the financials described above. Our<br />

DCF analysis arrives at a fair value of EUR23.6 when sticking to the<br />

conservative approach that we had already used in estimating the company’s<br />

financials and employing an increased market risk premium to reflect current<br />

uncertainties on equity markets. A normalization of the risk perception would<br />

even drive this value to EUR26.5. Our peer group analysis shows that <strong>ISRA</strong><br />

trades at a significant discount to the average multiples of its peers, in<br />

particular on a PE basis. Implicit multiples on the base of our fair value bring<br />

<strong>ISRA</strong>’s PE in line with the average of its closest peers. Applying average<br />

multiples of all peers to <strong>ISRA</strong>’s earnings yields values in the range of<br />

EUR20.8 to EUR30.2. Moreover, <strong>ISRA</strong> trades at PE discounts of 14.8% and<br />

9.8% to the Elexis transaction even based on our valuation before the risk<br />

adjustment. Our conservative DCF valuation thus not only gives the share an<br />

upside of 35%, the comparable company analysis as well as the comparable<br />

transaction analysis supports the view that there is still further headroom in<br />

our valuation.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

VALUATION<br />

DCF and peer group<br />

valuation<br />

Three stage DCF model<br />

Conservative long-term<br />

assumptions for growth,<br />

margins …<br />

… and WACC<br />

calculation<br />

Fair value of EUR23.6<br />

- 5 -<br />

For valuation purposes, we use a detailed DCF model and a peer group<br />

comparison based on the most important valuation multiples. While the DCF<br />

model is our main valuation tool, which allows for an in-depth discussion of<br />

<strong>ISRA</strong>’s most important value drivers, the peer group comparison is used as a<br />

validity check for our results.<br />

Our DCF model calculates <strong>ISRA</strong>’s fair value by discounting the company’s<br />

future free cash flows. In the first phase, we derive the free cash flows from<br />

our detailed financial modelling, which is discussed in the financial section of<br />

this report. The cash flows are then estimated via linearization of all<br />

important value drivers to a normalized value. From the latter, the terminal<br />

value is calculated.<br />

As the terminal value assumptions in particular have a large impact on the<br />

valuation, we have kept them conservative: We have, for example, set the<br />

growth rate of total output to 1.5%, which is merely reflecting inflation. We<br />

thus assume no real growth in <strong>ISRA</strong>’s total output in the terminal value. To<br />

underline this, we have equated the depreciation rate with the rate of<br />

investment, meaning that the company is only replacing its capital invested in<br />

the business and not expanding it. In addition, we have set the EBITDA<br />

margin slightly below its value in the last explicitly estimated period (i.e.<br />

2014/15). Moreover, we have not assumed any further improvements in<br />

<strong>ISRA</strong>’s working capital in the terminal value.<br />

All free cash-flows are discounted with the company’s weighted average cost<br />

of capital. This is based on the current forward rates of German government<br />

bonds as risk-free rates. To determine the cost of debt, we add the credit<br />

spread and adjust the tax shield. On the equity side, we add a market risk<br />

premium, which is weighted with a beta factor. In order to reflect current<br />

uncertainties with regard to the economic development in 2012, which is<br />

documented in the recent sell-off on equity markets, we have raised the<br />

market risk premium for small caps by 1pp to now 7%. The beta factor is<br />

derived fundamentally, taking into account the company’s risk profile as<br />

summarized below. In the case of <strong>ISRA</strong>, we see a higher risk compared to the<br />

market in all risk categories, which results in a final beta factor of 1.2.<br />

Weighting the cost of equity and debt with the market values of the<br />

company’s equity and debt, we come to WACCs between 7.5% and 11.4%<br />

for the years under review.<br />

All assumptions of our valuation are detailed in the table below and result in a<br />

fair value of EUR23.6, which provides the share with an upside of roughly<br />

35% to the current price. It should be highlighted that under the same set of<br />

assumptions our fair value would come to EUR26.5 if we had not raised the<br />

market risk premium. This represents an additional upside if equity markets<br />

start to normalise and <strong>ISRA</strong> delivers on the expected earnings streams.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

DCF model<br />

EURm 01/09/2011 30/09/2011 30/09/2012 30/09/2013 30/09/2014 30/09/2015 30/09/2016 30/09/2017 30/09/2018 30/09/2019 30/09/2020 30/09/2021<br />

Total Output 82.9 91.5 96.1 101.9 108.2 114.0 119.2 123.7 127.5 130.4 132.3<br />

Growth 10.4% 5.0% 6.1% 6.1% 5.3% 4.6% 3.8% 3.0% 2.3% 1.5%<br />

Operating costs -62.1 -67.8 -70.7 -74.3 -86.8 -91.6 -96.1 -100.0 -103.3 -106.0 -107.8<br />

EBITDA 20.8 23.7 25.4 27.6 30.0 31.4 32.7 33.8 34.7 35.4 35.7<br />

Margin 25.1% 25.9% 26.4% 27.1% 27.7% 27.6% 27.5% 27.4% 27.2% 27.1% 27.0%<br />

Depreciation and amortisation -7.0 -7.3 -7.6 -8.1 -8.5 -9.1 -9.7 -10.1 -10.6 -11.0 -11.2<br />

EBIT 13.8 16.4 17.8 19.6 21.4 22.3 23.1 23.7 24.1 24.4 24.5<br />

Margin 16.7% 17.9% 18.5% 19.2% 19.8% 19.6% 19.4% 19.2% 18.9% 18.7% 18.5%<br />

Operating cash-taxes -4.0 -4.8 -5.2 -5.8 -6.4 -6.6 -6.7 -6.8 -6.9 -6.9 -6.9<br />

Other adjustments 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0<br />

NOPLAT 9.8 11.6 12.5 13.8 15.0 15.7 16.3 16.8 17.2 17.5 17.6<br />

Change 18.2% 8.2% 9.9% 9.2% 4.6% 3.9% 3.1% 2.3% 1.5% 0.7%<br />

Depreciation and amortisation 7.0 7.3 7.6 8.1 8.5 9.1 9.7 10.1 10.6 11.0 11.2<br />

Operating cash flow 16.8 18.9 20.1 21.8 23.6 24.8 26.0 27.0 27.8 28.4 28.9<br />

Capital expenditure -10.7 -9.8 -9.4 -10.1 -10.8 -11.1 -11.3 -11.5 -11.5 -11.4 -11.2<br />

Change in working capital -3.1 -5.9 -3.1 -4.0 -4.3 -4.0 -3.6 -3.1 -2.6 -2.0 -1.4<br />

Free cash flow 3.0 3.2 7.5 7.7 8.5 9.7 11.1 12.4 13.7 15.0 16.3<br />

Cost of capital 7.5% 8.1% 8.5% 8.9% 9.2% 9.5% 9.7% 9.9% 10.1% 10.2% 11.4%<br />

Capital employed 104.5 105.8 117.4 125.9 134.4 140.4 145.6 150.1 153.6 156.0<br />

RoCE 9.4% 10.9% 10.7% 10.9% 11.2% 11.2% 11.2% 11.2% 11.2% 11.2%<br />

Spread 1.8% 2.9% 2.2% 2.0% 2.0% 1.7% 1.6% 1.3% 1.1% 1.0%<br />

Present value of operating cash flows 132.8 3.0 2.9 6.5 6.0 6.1 6.4 6.7 6.8 6.9 6.9 74.6<br />

Non operating assets 6.0<br />

Enterprise value 138.8 Risk profile Assumptions for termial value<br />

Debt -33.8 Cyclical exposure 25.0% 1.1 Long term growth rate 1.5%<br />

Pension provisions -1.9 Transparency 35.0% 1.0 EBIT-margin 18.5%<br />

Minorities -0.8 Size/Liquidity 10.0% 1.3 Risk free rate 5.5%<br />

Equity Value 102.3 Leverage 30.0% 1.4 Risk premium 7.0%<br />

Number of shares 4.3 Other 0.0% 1.0 Credit spread 1.5%<br />

Value per share 23.6 Fundamental beta 1.2 Equity ratio 74.1%<br />

Source: <strong>MATELAN</strong> <strong>Research</strong><br />

Consistent value<br />

generation<br />

Model appears to be<br />

rather stable<br />

- 6 -<br />

The model also shows that <strong>ISRA</strong> is consistently producing a higher return on<br />

capital employed compared to its cost of capital, thereby generating value<br />

throughout the model. However, the spread between the ROCE and the cost<br />

of capital is declining over time, which is mainly a result of our conservative<br />

assumption of net working capital development. Here we see a source of<br />

further potential upgrades in our valuation.<br />

Apart from working capital, sustainable levels for growth, EBIT margin,<br />

required capex levels and cost of capital are the most important variables in<br />

our fair value calculation. Against this background, we have performed a<br />

sensitivity analysis for a 1pp change in each of these variables. The following<br />

chart shows that this leads to a change in the fair value of up to 7.6%. This<br />

shows that the model is rather stable and leaves sufficient upside for the<br />

share even if we saw a negative change in one of the variables. It should be<br />

mentioned, that a 1pp change in the NWC-ratio is probably underrepresenting<br />

the leverage here due to the high base value.<br />

Sensitivity analysis<br />

Growth<br />

EBIT margin<br />

Investments<br />

Working Capital<br />

Cost of Capital<br />

Source: <strong>MATELAN</strong> <strong>Research</strong>, in EUR<br />

21.6 22.6 23.6 24.6 25.6<br />

+/- 100bp

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Building a broad peer<br />

group<br />

No peer fully<br />

comparable to <strong>ISRA</strong><br />

Overview of the positioning of the peers<br />

Fields of Business<br />

Comment<br />

Source: <strong>MATELAN</strong> <strong>Research</strong><br />

- 7 -<br />

In addition to the DCF model, we have applied a peer group analysis based<br />

on the most common multiples, EV/Sales, EV/EBITDA, EV/EBIT and PE<br />

for the FY 2011 and 2012, respectively. Among the listed machine vision<br />

companies, Basler and Viscom are probably the closest peers as they are also<br />

listed in Germany and they are also pure machine vision companies. In order<br />

to get a broader perspective of the valuation of machine vision companies,<br />

we do also look at the companies listed abroad (Cognex, Perceptron and<br />

Orbotech) and AVT, which has shifted focus to some extent following the<br />

acquisition of GMI. In addition, we have looked at Elexis, which is also not a<br />

pure machine vision company but offers a broad portfolio of automation<br />

technologies to the steel, printing and plastics industry. Elexis is currently<br />

being taken-over and thus yields decent transaction multiples.<br />

A short overview of the competitors is provided in the table below. It shows<br />

that companies vary greatly in the degree of diversification, ranging from<br />

highly focused small players such as Viscom, AVT and Perceptron to large<br />

players, such as Orbotech and Cognex. It has to be noted that none of the<br />

players are fully comparable to <strong>ISRA</strong> as each one only partly matches <strong>ISRA</strong>’s<br />

industry mix. More information as to what extent they compete with <strong>ISRA</strong><br />

can be found in the section on the competitive landscape.<br />

Basler Viscom Cognex Perceptron Orbotech AVT Elexis<br />

Approx. 80% of sales<br />

come from MV<br />

components,<br />

particularly digital<br />

cameras. Remainder<br />

is achieved with<br />

inspection solutions<br />

for LCD glass.<br />

Profits from strong<br />

demand for<br />

components. Weak<br />

solutions business was<br />

scaled down: Optical<br />

Media Inspection,<br />

Sealing Inspection &<br />

Solar Wafer<br />

Inspection were sold<br />

to a strategic investor<br />

Considering different<br />

reporting years …<br />

… and accounting<br />

standards<br />

Leading supplier of<br />

inspection systems<br />

for the electronics<br />

industry<br />

High dependency on<br />

the electronics<br />

industry as well as on<br />

a few large<br />

customers. Profits<br />

from strong upswing<br />

in demand from the<br />

electronics industry<br />

Worldwide #1 one<br />

in optical inspection<br />

components.<br />

Leading supplier of<br />

optical inspection<br />

solutions to a broad<br />

range of industries.<br />

Profits from high<br />

demand for<br />

components and<br />

compact 'ready to<br />

use' vision systems<br />

Supplier of<br />

measurement and<br />

inspection<br />

applications for<br />

automotive and<br />

manufacturing<br />

companies<br />

Leading supplier of optical<br />

inspection systems for the<br />

production of printed<br />

circuit boards and flat<br />

panel displays<br />

High dependency on Profits from strong<br />

the automobile upswing in demand from<br />

industry. Solutions the electronics industry<br />

base on laser<br />

technology. Profits<br />

from high demand<br />

from the automobile<br />

industry.<br />

Leading supplier of<br />

advanced optical<br />

inspection systems<br />

for the packaging and<br />

label printing<br />

industry. Also a<br />

leading supplier of<br />

pressroom<br />

automation systems.<br />

High dependency on<br />

the printing industry.<br />

Company reports in<br />

USD, while share<br />

trades in Euro,<br />

weakening of the<br />

USD thus has a<br />

negative impact on<br />

valuation.<br />

Supplier of factory<br />

automation<br />

technologies for the<br />

steel, printing and<br />

plastics industry.<br />

Elexis is currently<br />

being taken over by<br />

SMS GmbH which<br />

already holds an<br />

84.4% equity stake in<br />

the company.<br />

For the interpretation of results from the peer group comparison it is<br />

important to keep two points in mind that result from different accounting<br />

practices: <strong>ISRA</strong>, as well as Cognex and Perceptron, have broken fiscal years.<br />

In essence, this should lead to an increase of the premium for the fiscal year<br />

under consideration that comprises more of the previous calendar year. That<br />

means, this would justify multiples for Cognex (FY ends in June) being higher<br />

than for <strong>ISRA</strong> (FY ends in September). <strong>ISRA</strong>’s multiples again should be<br />

higher than Basler’s, where the fiscal year corresponds to the calendar year.<br />

The second bias results from the companies’ different treatment of<br />

development costs: while all companies reporting in accordance with IFRS<br />

are required to activate development costs, those who report in accordance<br />

with US GAAP are not. This effect can skew margins in favour of the<br />

former. As activated development costs are being written down over a certain<br />

period of time, the margin difference is highest with regard to EBITDA and<br />

is somewhat mitigated at lower levels. Two main conclusions arise from this:<br />

firstly, valuation-wise it justifies per se a certain premium for those reporting

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Higher margins justify<br />

premium<br />

Peer group comparison<br />

- 8 -<br />

in accordance with US GAAP, and secondly, the focus of this analysis should<br />

be on EV/EBIT and PE rather than on the EV/EBITDA or EV/Sales<br />

multiples.<br />

Overview of the use of accounting standards<br />

Company<br />

Accounting<br />

principles<br />

Headquarters Listed in<br />

<strong>ISRA</strong> Vision IFRS Germany Germany<br />

Basler IFRS Germany Germany<br />

Viscom IFRS Germany Germany<br />

Cognex US GAAP USA USA<br />

Perceptron US GAAP USA USA<br />

Orbotech US GAAP Israel USA<br />

AVT US GAAP Israel Germany<br />

Elexis<br />

Source: <strong>MATELAN</strong> <strong>Research</strong><br />

IFRS Germany Germany<br />

For better comparability, the margins for <strong>ISRA</strong> are calculated on the basis of<br />

net sales only (in contrast to the remainder of the report where we calculate<br />

margins as a percentage of total output, i.e. including capitalized items). While<br />

growth is roughly in line with the market, we find that <strong>ISRA</strong> has the second<br />

highest margins among the peers, which clearly justifies a premium compared<br />

to the other companies.<br />

Basler Viscom Cognex Perceptron Orbotech AVT Elexis Average <strong>ISRA</strong> <strong>ISRA</strong> (FV)<br />

Currency EUR EUR USD USD USD USD EUR EUR EUR<br />

FY end Dec 31 Dec 31 Dec 31 June 30 Dec 31 Dec 31 Dec 31 Sept 30 Sept 30<br />

Share price 10.8 7.0 35.4 6.0 11.5 4.9 20.4 17.4 23.6<br />

No of share (m) 3.5 9.0 41.5 8.7 35.4 5.3 9.2 4.3 4.3<br />

Market cap 37.7 63.0 1467.5 51.5 406.6 26.1 187.2 75.4 102.3<br />

Net debt 19.5 -23.6 -33.2 -9.8 -56.8 -10.8 -11.0 26.5 26.5<br />

Pension provisions 0.0 0.3 0.0 0.0 27.5 0.0 8.6 1.9 1.9<br />

Minorities 0.0 0.0 0.0 0.0 1.9 0.0 2.9 0.8 0.8<br />

Participations 0.0 -3.2 -249.9 -10.3 0.0 0.0 -2.8 0.0 0.0<br />

Enterprise Value 57.2 36.6 1184.4 31.5 379.2 15.3 184.9 101.9 128.8<br />

Sales 55.1 52.0 323.0 56.5 574.0 43.4 168.5 74.9 74.9<br />

EBITDA 14.4 9.6 98.4 2.7 n.a. 3.5 27.6 20.8 20.8<br />

Margin 26.1% 18.5% 30.5% 4.8% n.a. 8.1% 16.4% 27.8% 27.8%<br />

EBIT 7.4 8.6 84.9 1.6 81.9 2.7 24.1 13.8 13.8<br />

Margin 13.3% 16.6% 26.3% 2.9% 14.3% 6.2% 14.3% 18.5% 18.5%<br />

Adj. Net Profit 4.0 6.9 66.7 1.4 67.6 2.9 14.7 8.9 8.9<br />

EV/Sales 1.0 0.7 3.7 0.6 0.7 0.4 1.1 1.2 1.4 1.7<br />

EV/EBITDA 4.0 3.8 12.0 11.7 n.a. 4.4 6.7 7.6 4.9 6.2<br />

EV/EBIT 7.8 4.2 14.0 19.3 4.6 5.7 7.7 9.0 7.4 9.3<br />

PE 9.5 9.2 22.0 37.1 6.0 9.1 12.8 15.1 8.4 11.5<br />

Sales 56.6 58.0 361.0 62.0 622.0 48.5 179.5 82.4 82.4<br />

Growth 2.7% 11.5% 11.8% 9.7% 8.4% 11.6% 6.5% 10.0% 10.0%<br />

EBITDA 14.2 9.6 114.0 4.4 n.a. 4.8 29.5 23.7 23.7<br />

Margin 25.1% 16.5% 31.6% 7.1% n.a. 9.9% 16.4% 28.8% 28.8%<br />

EBIT 7.0 8.6 101.8 3.4 93.9 3.9 26.0 16.4 16.4<br />

Margin 12.3% 14.9% 24.9% 5.4% 15.1% 8.0% 14.5% 19.9% 19.9%<br />

Adj. Net Profit 3.8 6.5 79.1 2.4 78.4 3.6 16.3 10.7 10.7<br />

EV/Sales 1.0 0.6 3.3 0.5 0.6 0.3 1.0 1.1 1.2 1.6<br />

EV/EBITDA 4.0 3.8 10.4 7.1 n.a. 3.2 6.3 6.3 4.3 5.4<br />

EV/EBIT 8.2 4.2 11.6 9.3 4.0 3.9 7.1 6.9 6.2 7.9<br />

PE 9.9 9.7 18.6 21.5 5.2 7.3 11.5 12.0 7.1 9.6<br />

Source: <strong>MATELAN</strong> <strong>Research</strong>, Bloomberg, company reports (last FY), closing prices and consensus estimates as of 28/08/11<br />

2011e<br />

2012e

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Strong discount on PE<br />

basis<br />

Peer group supports our<br />

DCF valuation<br />

Elexis transaction shows<br />

that our valuation is still<br />

not stretched<br />

Peers point at additional<br />

upside for <strong>ISRA</strong><br />

Risks to our valuation<br />

- 9 -<br />

Based on EV/Sales multiples, <strong>ISRA</strong> trades with a sizable premium compared<br />

to its peers. More importantly, <strong>ISRA</strong> trades at a material discount to its peers,<br />

even the close ones, on almost all earnings multiples.<br />

We also find that the peer group analysis is perfectly consistent with our DCF<br />

calculation. Looking at the multiples that are implied in our DCF valuation,<br />

we find that our DCF calculation brings EV / EBITDA and EV/EBIT<br />

multiples roughly in line with the industry average and PEs even in line with<br />

the close peers.<br />

It must also be highlighted that <strong>ISRA</strong> is currently trading substantially below<br />

the transaction multiples that result from the current offer for Elexis.<br />

Furthermore, even our DCF valuation arrives at multiples that are not yet<br />

aligned with the Elexis offer, in particular on a PE basis. It should be kept in<br />

mind that the Elexis offer took place before the recent sell-off in the equity<br />

markets and is thus unaffected by the increased risk in the global economic<br />

situation. However, even our DCF valuation of <strong>ISRA</strong> before the risk<br />

adjustment would yield PE multiples 14.8% and 9.8% below the respective<br />

Elexis multiples for the years 2011 and 2012.<br />

In addition, we have applied the peer group multiples shown above to <strong>ISRA</strong>’s<br />

earnings in order to arrive at a share price for <strong>ISRA</strong> that is consistent with the<br />

current valuation of the peers. The following table shows a valuation range<br />

for each multiple determined by the second highest and the second lowest<br />

value and taking the average of the resulting values in the years 2011 and<br />

2012. We have left out the highest and lowest multiple in order to eliminate<br />

outliers. We also show the value determined by the average of the peer group.<br />

The chart makes it clear that employing an EV/Sales multiple does not lead<br />

to reasonable results, which can be explained by <strong>ISRA</strong>’s above average<br />

profitability. Looking at average values shows a price range of EUR20.8-30.2<br />

for <strong>ISRA</strong> across the earnings multiples. It should also be remembered that<br />

this methodology does not yet take into account the FY and the margin bias.<br />

Price ranges for <strong>ISRA</strong> based on peer group<br />

50.0<br />

45.0<br />

40.0<br />

35.0<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

EV / Sales EV / EBITDA EV / EBIT PE<br />

Source: <strong>MATELAN</strong> <strong>Research</strong>, in EUR per share<br />

Finally, it must be pointed out, that although the risk of an economic<br />

downturn is already reflected in our DCF (increased risk premium) and our<br />

peer group (reduced prices of peers) valuations, a major recession actually<br />

materialising would lead to further adjustments. This is a remaining risk to<br />

our analysis, though the upside appears to be higher at this point in time.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

MARKET STRUCTURE & DEVELOPMENTS<br />

Key component of<br />

automation processes<br />

and beyond<br />

Combining different<br />

components to an entire<br />

system<br />

Market coming back to<br />

double-digit growth rates<br />

again<br />

- 10 -<br />

Machine vision is an interdisciplinary technology that combines in particular<br />

lighting, optics, electronics, information technology, software and automation<br />

technology in order to improve industrial but also non-industrial processes.<br />

The main objective is to capture pictures within a production process and<br />

analyse them according to previously defined patterns. This encompasses the<br />

guidance of movements for robots or automated vehicles (robot vision),<br />

controlling production processes e.g. for fast moving materials (surface<br />

vision) or check for completeness (quality vision), and allows the machines to<br />

work faster, in a more precise way and without human intervention. Apart<br />

from these industrial applications, fields such as monitoring areas for security<br />

purposes, controlling traffic flows or driver assistance systems are of<br />

increasing importance.<br />

The main components for a standard machine vision system are (1) lighting,<br />

that ensures that the images captured by the cameras are optimal for the<br />

subsequent analysis, (2) cameras that capture the images, (3) cables and<br />

interfaces that bring the information to the computer and (4) the computer,<br />

which does the final processing. In addition to these hardware components, a<br />

software steering the processes is needed. Apart from such modular systems,<br />

vision systems can be more compact, i.e. in the form of cameras that have<br />

integrated processing and illumination.<br />

Machine vision has become a core tool for further improving automation<br />

processes in the industry and other areas of society and daily life. The market<br />

has thus experienced strong growth since its break-through in the early 80s.<br />

New applications in areas such as safety and security, life sciences,<br />

entertainment, criminology, medical engineering are now likely to drive<br />

growth further in the years to come. The following chart show that the<br />

German machine vision market, one of the largest in the world and for which<br />

a fair history has been recorded, has experienced an average growth rate of<br />

8.4% over the past ten years. While the first half of the decade showed<br />

consistently sound double-digit growth rates, growth had slipped to single<br />

digit in the second half. Moreover, it shows that the financial and economic<br />

crisis in 2009 has had a severe impact on the German machine vision<br />

industry, driving down sales by 21%. The year 2010 brought, however, a<br />

tremendous recovery, coming in even ahead of the previous peak year 2008.<br />

Though growth in 2011 will not match the exceptional rate seen in 2010, it is<br />

still expected to continue at a double-digit rate.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Economic recovery has<br />

driven the machine<br />

vision market<br />

Asian markets lead<br />

global economic<br />

recovery, Germany<br />

shines in Europe<br />

- 11 -<br />

Growth of the German machine vision market<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

2000<br />

2001<br />

Source: VDMA, EURm<br />

2002<br />

2003<br />

2004<br />

2005<br />

-10%<br />

-20%<br />

-30%<br />

REGIONAL MACROECONOMIC TRENDS STIMULATE MARKET<br />

The machine vision market tends to follow economic cycles as it is mainly<br />

driven by capital expenditure of the users of this technology. These tend to<br />

expand their capacities in good times but reduce their capital expenditure<br />

when it is getting harder. Looking at the global economy, we find a stronger<br />

than expected recovery in 2010 from the financial and economic crisis a year<br />

earlier. This has had a very positive impact on the European machine vision<br />

landscape, as we had already illustrated for the case of Germany.<br />

GDP growth in key regions<br />

2008 2009 2010 2011E 2012E<br />

Germany 1.0% -4.7% 3.6% 3.5% 1.8%<br />

France -0.2% -2.6% 1.4% 2.2% 1.4%<br />

Italy -1.3% -5.2% 1.2% 0.8% 1.1%<br />

UK -0.1% -4.9% 1.3% 1.1% 1.4%<br />

EU 0.7% -3.9% 1.7% 1.8% 1.5%<br />

USA 0.0% -2.6% 2.9% 1.5% 1.5%<br />

Japan -1.2% -6.3% 4.0% -0.8% 2.7%<br />

Brazil 5.2% -0.7% 7.5% 3.9% 3.5%<br />

Russia 5.2% -7.8% 4.0% 4.4% 3.5%<br />

India 4.9% 9.1% 8.8% 8.0% 8.0%<br />

China 9.6% 9.2% 10.3% 9.0% 8.0%<br />

World 2.7% -0.7% 4.9% 3.7% 3.5%<br />

Source: WestLB as of 28/08/2011<br />

The global economic recovery in 2010 has been driven predominantly by<br />

Asian and other emerging countries, in particular China and India. China<br />

grew by 10.3% mainly on the back of domestic economic activity, with strong<br />

investments in the construction and real estate market. India grew at a rate of<br />

8.8%, mainly driven by private consumption. Due to the higher base, the year<br />

2011 should see as slower but still solid growth in global GDP and the<br />

emerging markets are expected to continue underpinning global growth, with<br />

China and India still showing high single digit growth rates. Within Europe,<br />

Germany follows-up on its leading role, in particular on the base of its strong<br />

exports. France is gaining speed in 2011 after a rather moderate development<br />

2006<br />

2007<br />

2008<br />

2009<br />

Total Sales Growth (r.s.)<br />

2010<br />

2011E<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

2012 should still see<br />

solid growth, despite<br />

weaker situation in some<br />

countries<br />

European machine<br />

vision market increased<br />

by 34.8% in 2010<br />

Germany most<br />

important market<br />

- 12 -<br />

in 2010. Italy remains weak, mainly as a result of sluggish private and public<br />

consumption. In Spain, the restrictive fiscal policy along with the lasting crisis<br />

in the real estate and banking sectors weigh on the recovery. The UK is also<br />

losing ground, in particular because of fiscal measures such as the VAT<br />

increase in order to reduce the national budget deficit. The US has recovered<br />

by 2.7% in 2010 on the back of a number of governmental stimulus packages.<br />

Due the current debt crisis, the country is expected to show weaker rates in<br />

2011 and 2012. With a 4% GDP growth, Japan has seen a strong recovery in<br />

2010, the current year will, however, be burdened by the tragic events in<br />

Fukushima.<br />

For 2012, a variety of indicators point at a major slowdown in economic<br />

growth and equity markets have already reacted quite heavily on such<br />

prospects. In fact, economic forecasts for a number of countries have been<br />

lowered. Still, India and China should not fall materially short of 2011, Italy<br />

and the UK should finally see some acceleration and the US is not going<br />

down further from the 2011 level. Against this background, we should still<br />

see solid single-digit global GDP growth, which is even ahead of the 2008<br />

level. Within Europe, Germany is expected to defend its leading role.<br />

Sales distribution and growth rates by region<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Germany<br />

France<br />

Italy<br />

UK & Ireland<br />

Other Europe<br />

2009 2010 Growth (r.s.)<br />

Source: EMVA, sales of surveyed companies in EURm<br />

Americas<br />

160%<br />

140%<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

Based on the sound economic recovery the European machine vision market<br />

has recovered much faster from the crisis in 2009 than most of the<br />

companies had anticipated. While the industry expected at the beginning of<br />

2010 to raise sales by 10%, a level of 35% was finally achieved, according to a<br />

survey of 225 European machine vision companies undertaken by the<br />

EMVA. It should be highlighted that roughly half of the companies included<br />

in that report are based in Germany and that these companies account for<br />

61% of the reported sales. Germany is thus playing an exceptional role in that<br />

survey.<br />

Looking at the results of the EMVA survey shows that not only 61% of the<br />

sales of European machine vision companies were generated by machine<br />

vision companies located in Germany, 32% of sales are also generated from<br />

German customers. Germany is thus the largest market for European<br />

machine vision companies. With a share of 8% the Italian market has<br />

replaced France as the second most important European machine vision<br />

market. In total, 72% of sales of the European companies are generated<br />

within Europe. Just over 13% go to each, the Americas and Asia.<br />

China<br />

Japan<br />

South Korea<br />

Other Asia<br />

Other World

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

China driving growth<br />

Economic development<br />

should fuel growth in<br />

the machine vision<br />

industry further. German<br />

companies excellently<br />

positioned<br />

Automotive and<br />

Electrical show strongest<br />

growth rates in 2010<br />

- 13 -<br />

In terms of growth, Asia (+62%) is even outpacing North America (which<br />

already grew at a remarkable rate of 46%) mainly driven by China (+151%),<br />

which reinforced its position as the most important Asian market for<br />

European machine vision companies. Though much smaller markets, Taiwan<br />

(132%) and South Korea (62%) also showed unmatched growth rates. It is<br />

also noteworthy that these extraordinarily high growth rates are mainly a<br />

result of the excellent links of German companies to these countries.<br />

Excluding the German companies from the survey, shows much more<br />

balanced growth among the Asian countries. With 28%, Europe grew underproportionately,<br />

with the important German and French markets being up<br />

“just” 24.8% and 19.7%, respectively.<br />

Though at a lower rate than previously anticipated, the global economy is<br />

expected to grow further in the coming years, predominantly driven by a<br />

number of Asian countries. This should stimulate the development of the<br />

machine vision industry further. Against this background, German machine<br />

vision companies appear to enjoy a rather favourable position within the<br />

European landscape as they can tap the largest home market, benefit from<br />

the above average economic development of Germany compared to the<br />

other European countries and have excellent relations to the highest growth<br />

regions.<br />

REVIVAL OF TRADITIONAL CUSTOMER INDUSTRIES<br />

Looking at customer industries, we find that demand from the traditional<br />

industrial customers sharply increased in 2010 as a result of the economic<br />

upswing and accounted for 90% of total sales. Here the largest customer<br />

sector, the automotive industry, saw the strongest increase (61%). Packaging,<br />

the second most important customer group, grew roughly in line with the<br />

market and thus maintained its market share. On the base of an 82% jump in<br />

sales, the electrical/electronic industry has become the third largest customer<br />

group for European machine vision companies. Also the medical and<br />

pharmaceutical customers showed a strong upswing in their ordering activity.<br />

In contrast, we still saw negative growth rates in food, semiconductors and<br />

other manufacturing. Though the non-manufacturing customers show a<br />

lower percentage of total sales in 2010 they have not declined in absolute<br />

numbers and continue to represent an important and further growing part of<br />

the market.<br />

Market shares and growth rates by customer industry<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Source: EMVA<br />

Automotive<br />

Packaging<br />

Electrical<br />

Pharma<br />

Glass<br />

Paper<br />

Metal<br />

Rubber/Plastic<br />

Semiconductors<br />

Medical<br />

Printing<br />

Food<br />

Other Manuf.<br />

2009 2010 Growth (r.s.)<br />

Non Manuf.<br />

120%<br />

80%<br />

40%<br />

0%<br />

-40%<br />

-80%

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Automotive still on the<br />

expansion trail<br />

Glass market to show<br />

more moderate growth<br />

Metal benefiting from<br />

relocation of capacities<br />

Paper and pulp still off<br />

peak levels<br />

Pharma shows high<br />

growth from BRIC<br />

countries and new<br />

regulatory requirements<br />

Semiconductors growing<br />

at solid rate again<br />

- 14 -<br />

Going forward we see the automotive industry taking the dynamic<br />

development, which was predominantly driven by the four BRIC countries as<br />

well as the US market, into 2011 and (to a slightly lesser extent) 2012, though<br />

some European markets have cooled down somewhat. Investment spending<br />

appears to continue, mainly in order to serve upcoming demand in Asia, in<br />

particular China.<br />

In the flat glass industry, China accounts for approximately 50% of global flat<br />

glass production, followed by Europe (16% in 2009) and the US (8% in<br />

2009). In 2010, sales showed declines in some instances in building products,<br />

automotive as well as speciality glass. In 2011, the building sector now shows<br />

a return to modest growth, the solar business is expected to continue growing<br />

as are the automotive (see above) and display businesses. In fact, the glass<br />

market is expected to grow on average by 6% through 2014. However, 2012<br />

might be slightly below that rate and the industry might not come back to<br />

pre-crisis production levels before 2013. We would thus expect to see<br />

investments in machine vision systems rather as a result of productivity<br />

measures than further capacity expansions.<br />

The metal industry showed double-digit growth rates in all steel producing<br />

countries in 2010. Aluminium production increased mainly as a result of new<br />

smelters started and restarted, in particular in China but also Qatar and the<br />

UAE. Copper production remained roughly stable. Going forward,<br />

production might fall back again, leading to a lower utilisation of capacities.<br />

Still, there is a trend to relocate capacities to higher growth regions, which<br />

should be favourable for machine vision companies.<br />

The production of paper and pulp has recovered to some extent from the<br />

dramatic decline in 2009 but is still 8-10% short of the pre-crisis levels. The<br />

year 2011 is expected to show further progress in a mid-single digit rate. The<br />

industry should thus see its pre-crisis levels by 2012/13. Going forward, we<br />

would thus expect investment activity to accelerate moderately.<br />

The world pharmaceutical market was worth an estimated EUR597bn in<br />

2010, with North America accounting for a 42% share, well ahead of Europe<br />

(29%) and Japan (11%). Rapid growth is experienced in particular in<br />

emerging economies such as Brazil, China and India. China and Brazil<br />

showed growth rates of more than 20% compared with an average rate of<br />

1.8% in the five major European markets and 3.3% for the US market.<br />

Increasing regulatory requirements in many countries that aim at securing<br />

drug safety despite increasingly globalized supply chains should additionally<br />

fuel investment spending in track and tracing solutions. The European<br />

Parliament, for example, has adopted a directive against falsified medicine in<br />

February 2011, which must be implemented into national law until 2013.<br />

In the semiconductor industry, all major product categories showed doubledigit<br />

growth rates in 2010. With a 31.8% increase compared to the crisis year<br />

2009, the industry recorded a record number of global chip sales last year.<br />

With 54% of sales the Asia/Pacific region is the largest market for<br />

semiconductors. For 2011, a moderate single digit growth is expected, though<br />

the year has started with double-digit growth. Silicon wafers showed a slightly<br />

lower growth (45%) compared to chips in 2010 so that solid demand (at a<br />

more modest post-recovery rate) is expected for 2011. The global electric and<br />

electronic industry followed the recovery of the semiconductor and silicon<br />

wafer industry in 2010 and has compensated the losses during the global<br />

crisis within a year. For 2011, the world market is expected to grow by 7%,<br />

with the most dynamic development in the emerging markets. 2012 should<br />

come in slightly below this rate.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Automotive, electrical<br />

and pharma could<br />

become main drivers of<br />

future growth, German<br />

companies show strong<br />

positioning in these<br />

industries<br />

Inspections systems for<br />

discrete items still the<br />

most important<br />

application<br />

Different products used<br />

for different fields of<br />

application<br />

Symbol reading and<br />

discrete inspection show<br />

highest growth rates in<br />

2010<br />

- 15 -<br />

On the back of current market developments at the major customers we<br />

would expect further growth for the European machine vision industry to be<br />

fuelled in particular from the important segments, automotive and electrical,<br />

but also pharma and medical. Looking at the German machine vision<br />

companies, we find them over-proportionately strong positioned in particular<br />

in the automotive but also the pharma industries, which should give them an<br />

edge over their European competitors. It should also be noted that some<br />

machine vision companies are able to generate high growth in industries that<br />

are growing more moderately as a result of for example their market<br />

positioning or their product offering.<br />

DISCRETE INSPECTION SYSTEMS REMAIN KEY APPLICATION<br />

The applications of machine vision technology are as multifaceted as the<br />

customer industries that use them. The most important applications can be<br />

found in inspection, i.e. the inspection of discrete items and the inspection of<br />

continuous materials, such as paper, plastic films or sheet metal, also known<br />

as “web inspection”. Discrete systems accounted for 46.5% of all vision<br />

applications in 2010. Together, both applications came to 59.5%. Metrology<br />

is the second most important field of application. Here 3D metrology alone<br />

accounts for 13% out of a total of 16%.<br />

Separating the two product categories of vision systems, we find that the<br />

distribution of applications varies significantly. Inspection systems are clearly<br />

the most important application for more sophisticated application-specific<br />

and configurable systems. Compact systems, such as smart cameras and<br />

vision sensors, are more often used in metrology as well as in character<br />

recognition, part recognition and symbol reading.<br />

In terms of growth, we find the highest rate (49%) in symbol reading, i.e. bar<br />

codes & dot-matrix codes. Growth here is particularly driven by the<br />

industries’ increased efforts to make their supply and value added chains<br />

consistently traceable. Given that regulations across the globe increasingly<br />

require this, we expect their growth to remain above average. Discrete<br />

inspection systems and 2D metrology also grew over-proportionately in 2010.<br />

The strong development of others, might point at strong innovation, though<br />

areas widely related to inspection or measuring tasks might be included in<br />

here.<br />

Market shares and growth rates by applications<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Source: EMVA<br />

Inspection<br />

(discrete)<br />

Inspection<br />

(continuous)<br />

Metrology<br />

Symbol<br />

reading<br />

Guidance<br />

Character<br />

recognition<br />

Part<br />

recognition<br />

2009 2010 Growth (r.s.)<br />

Other<br />

200%<br />

150%<br />

100%<br />

50%<br />

0%<br />

-50%<br />

-100%

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Discrete inspection<br />

systems, 3D systems and<br />

new applications to drive<br />

future growth<br />

Systems vs. components<br />

Vision systems still the<br />

most important product<br />

category …<br />

… but cameras and<br />

compact systems show<br />

the highest growth rates<br />

Sales growth mainly<br />

driven by higher<br />

volumes<br />

Falling prices help<br />

fuelling further growth<br />

- 16 -<br />

On the back of over-proportionate growth expectations coming from the<br />

automotive and pharma industries, we would expect discrete inspection<br />

systems to continue growing above average in the coming years. Moreover,<br />

3D systems should gain pace again, and we would expect the number of new<br />

application types to increase further. Interestingly, the German companies are<br />

less well positioned in discrete inspection systems compared to the European<br />

average, despite their strong links to the automotive and pharma industries.<br />

They are, however, stronger in continuous processes.<br />

TREND TOWARDS LESS COMPLEX PRODUCTS<br />

Machine vision technology can be separated in two main categories, i.e. vision<br />

systems and vision components. Vision systems cover the above mentioned<br />

application-specific visions systems and configurable vision systems, as well<br />

as smart cameras/compact systems and vision sensors. Vision components<br />

include cameras, frame grabbers, lighting equipment, optics, vision software,<br />

interfaces and cables, as well as other vision accessories.<br />

The following chart shows that vision systems are still the most important<br />

product category, accounting for 42.7% of sales in 2010. Including compact<br />

systems, the share of systems comes to 50.7%. The sale of components<br />

accounts for the remaining half of the market, with cameras being by far the<br />

most important component (30.7%).<br />

Cameras and compact systems showed the highest growth rates, with 61%<br />

and 49%, respectively. With components (+50.5%) clearly outpacing systems<br />

(+23.7%) there appears to be a trend towards lower value products. This is<br />

also reflected in the systems segment, where compact systems grew more<br />

than twice as fast compared to their more complex counterparts in 2010.<br />

Sales and growth rates by product type<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Vision<br />

systems<br />

Compact<br />

systems<br />

Cameras<br />

Frame<br />

Grabbers<br />

2009 2010 Growth<br />

Source: EMVA, sales of surveyed companies in EURm<br />

Lighting<br />

The following chart makes it clear that the sales trends described above<br />

mainly follow the unit developments as price changes accounted for just 4-6<br />

percentage points. In fact, averages prices were down between 4.0% and<br />

5.5% for vision systems, compact systems and cameras, while price for frame<br />

grabbers and Optics increased by 6.3% and 4.1%, respectively.<br />

The graph also illustrates the huge pricing difference between vision systems<br />

and the other product, which fall into a range of EUR130 to EUR1300<br />

compared EUR23000 for an average vision system. As a general trend, we see<br />

Optics<br />

Vision<br />

Software<br />

Interfaces<br />

and cables<br />

Other<br />

Asseccories<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Future growth at<br />

compact systems and<br />

components driven by<br />

new application and<br />

greater ease of use<br />

Increasing share of endusers<br />

- 17 -<br />

key products becoming less expensive, while performance is further<br />

increasing. This is an additional driver of volume growth.<br />

Average prices of major products<br />

40.000<br />

35.000<br />

30.000<br />

25.000<br />

20.000<br />

15.000<br />

10.000<br />

5.000<br />

0<br />

2009<br />

Source: EMVA, in EUR<br />

2010 Growth<br />

Though complex vision systems will remain an indispensible part of the<br />

machine vision industry and the strong development of the automotive<br />

industry will continue to support growth here, we see a trend towards<br />

compact systems and single components, in particular cameras. This is in our<br />

view driven by an increasing use in new field of application such as traffic<br />

control or security as well as in increasing ease of use of machine vision<br />

technology, allowing the customers to use the tools by themselves.<br />

Market shares by customer type<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Source: EMVA<br />

Vision<br />

systems<br />

OEM<br />

Compact<br />

systems<br />

End-users<br />

Cameras<br />

Integrators<br />

Frame<br />

Grabbers<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

-2%<br />

-4%<br />

-6%<br />

-8%<br />

The latter trend can be observed in the development of market shares of the<br />

different customer types. In 2010 end-users became again the strongest<br />

customer type, accounting for 55% of sales. This back-shift to end-users<br />

could also be observed in Germany, where end-users now accounted for 47%<br />

of sales, and was even more pronounced in the other European countries.<br />

The decline in OEM equipment is to a large extent a reflection of the<br />

introduction of a new category, integrators.<br />

Distributors<br />

2009 2010<br />

Optics<br />

Others

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Positive impetus from<br />

traditional industries and<br />

new applications<br />

Emerging countries on<br />

the move, America to<br />

increase level of<br />

automation, Germany<br />

with strong economic<br />

development<br />

Products becoming<br />

more powerful at lower<br />

prices<br />

European machine<br />

vision market expected<br />

to show 20% growth in<br />

2011<br />

- 18 -<br />

NUMEROUS DRIVERS OF FUTURE GROWTH<br />

In total, the remarkable upswing in the automotive industry with a sharp rise<br />

of demand in Asian countries, together with industries resilient to economic<br />

fluctuations such as the pharma industry should ensure that the traditional<br />

customer industries will remain the backbone of vision technology companies<br />

in Europe. Moreover, turnover in the non-manufacturing sectors, such as life<br />

science, security, medical equipment, entertainment and traffic, should gather<br />

speed again.<br />

Above all, Chinese manufacturers are increasingly automating their<br />

production as demands for quality are rising in not only their export but also<br />

the domestic markets. Car manufacturers in China are considerably<br />

expanding their capacities. Other industries follow suit. Other Asian markets<br />

such as South Korea, Thailand and Malaysia offer potential for increases in<br />

turnover. The level of automation is rather low in growth regions such as<br />

Brazil. Also the American market still has a low level of automation and<br />

needs to improve productivity. In Europe, growth should be driven by the<br />

Central and Eastern European countries. Though Germany ranks second in<br />

terms of automation after Japan, the positive economic situation of the<br />

country should drive growth here.<br />

These developments are supported by the fact that products are getting<br />

cheaper, more standardized, easier to use and more powerful. The latter<br />

involves a continuous improvement of all vision systems components.<br />

Computer-related developments that have particularly increased the<br />

performance and applicability of machine vision systems are faster processors<br />

and bus speeds, as well as the miniaturization of chips. Camera-related<br />

developments include a trend toward increasing resolutions and the<br />

introduction of faster sensor frame rates. Connection-related developments<br />

have led to faster, digital interfaces, which are able to manage the higher<br />

bandwidth signals generated by faster sensor frame rates and greater<br />

resolution. Software-related developments are new or improved algorithms<br />

and easier to use interfaces. The latter has particularly increased the<br />

acceptance of machine vision systems on the factory floor. The impact of the<br />

technological progress is two-fold: first, the efficiency of vision systems is<br />

increasing continuously; making their use even more profitable for end users<br />

and second, new fields of application are opening up.<br />

Against this background, the EMVA expects the machine vision industry to<br />

grow by 20% in 2011. In contrast to 2010, Europe is expected to show the<br />

highest growth rate with 22%. The Americas should come to 19% and Asia,<br />

mainly driven by China to 18%. The German industry association expects an<br />

increase of 11% for its members, however, in view of recent trading this<br />

appears to be more than conservative. The year 2012 should then show a<br />

more normalised rate. As a result of the late cyclical nature of the industry,<br />

some slowdown of economic growth expected for 2012 should rather be felt<br />

in subsequent years.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Further consolidation<br />

likely to be an additional<br />

source of growth<br />

- 19 -<br />

Outlook for the MV market by region<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

-10%<br />

-20%<br />

-30%<br />

Source: EMVA<br />

Europe<br />

An additional source of growth is the hugely fragmented market structure.<br />

The following chart shows that almost half of the surveyed companies have<br />

only between 1 and 10 employees. Only 4% of the companies have more<br />

than 100 employees. This leaves ample room for further consolidation, which<br />

should take place for three reasons: (1) end users of machine vision tend to<br />

be global manufacturers which prefer companies that can service them in<br />

different countries, (2) price pressure in the industry is particularly hard for<br />

smaller companies with less bargaining power and (3) the substitution of less<br />

complicated machine vision application-specific vision systems by ‘off the<br />

shelf’ solutions should particularly hit smaller providers with a limited<br />

number of products on offer. Larger players should thus profit from the<br />

continued consolidation of the market.<br />

European machine vision companies by size<br />

18%<br />

Source: EMVA, no of employees<br />

America<br />

Asia<br />

Other<br />

2009 2010 2011E<br />

20%<br />

9%<br />

4%<br />

49%<br />

1-10 11-20 21-50 51-100 101-500<br />

Total

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

COMPANY PROFILE AND STRATEGY<br />

Global player with …<br />

… strong positions in<br />

key growth regions<br />

- 20 -<br />

STRONGLY POSITIONED IN KEY GROWTH REGIONS<br />

<strong>ISRA</strong> Vision is one of the leading providers for machine vision systems. The<br />

company was founded in 1985 and has its headquarters in Darmstadt,<br />

Germany. In total, the company has more than 20 subsidiaries, of which 11<br />

are located in Europe (Germany 7, UK 2, Finland 1 and Italy 1), 7 in Asia<br />

(including two in China and one in India), 2 in North America and 1 in South<br />

America (Brazil). The latest addition is the glass centre in Tianjin, China.<br />

<strong>ISRA</strong> plans to open another subsidiary in Moscow soon. The company<br />

employs nearly 440 people. With approximately 40 employees, China has<br />

turned into <strong>ISRA</strong>’s second largest location after Germany.<br />

<strong>ISRA</strong>’s international structures are reflected in its composition of sales.<br />

Though Europe is still the most important market for the company with a<br />

sales share of 42%, Asia’s importance has increased significantly over the<br />

recent years, now accounting for approx. 38% of total sales. Overseas sales in<br />

total already account for more than half of the business. This is a significantly<br />

higher exposure to key growth regions compared to the market average<br />

(North America 12% and Asia 16%). Though the European market is<br />

expected to show a slightly higher growth rate in 2011, we would expect the<br />

overseas share to increase further over the medium term. It should also be<br />

noted that last year half of the European sales came from Germany, and half<br />

of the Asia/ROW sales came from China, which both currently offer the<br />

most interesting prospects in their respective regions.<br />

Revenue composition by regions<br />

38%<br />

Source: <strong>MATELAN</strong>, FY2010/11e<br />

20%<br />

42%<br />

Europe America Asia / ROW

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Global presence gives<br />

competitive advantage<br />

Expansion increased<br />

importance of surface<br />

vision<br />

Metal, glass and plastics<br />

have become <strong>ISRA</strong>’s<br />

most important<br />

segments<br />

- 21 -<br />

Basically there are four advantages arising from <strong>ISRA</strong>’s above average size<br />

and its higher degree of internationalisation compared to most machine<br />

vision companies. Firstly, development costs as percentage of total sales are<br />

lower, which facilitates investment in R&D. Secondly, services can be offered<br />

across the globe which is important as most manufacturer operate globally.<br />

Then, production re-allocation trends – such as the move of the solar<br />

industry to Asia can be followed and finally, the negotiation power towards<br />

suppliers is better, though <strong>ISRA</strong>’s size compared to its end customers is still<br />

small (which shows in still rather high receivables outstanding).<br />

BROAD DIVERSIFICATION ACROSS INDUSTRIES<br />

Within its organization, <strong>ISRA</strong> distinguishes between two segments: industrial<br />

automation and surface vision. The company’s structure is illustrated in the<br />

graph below. The first segment – industrial automation - encompasses <strong>ISRA</strong>’s<br />

robot guidance and quality vision applications. Having refrained from<br />

offering applications for the logistics and food industries where margins tend<br />

to be lower, the segment is now focused on the automotive industry, which<br />

used to be <strong>ISRA</strong>’s dominant activity before the company started the<br />

systematic expansion of its second segment, surface vision, over the past ten<br />

years. With a sales share of approximately 85%, surface vision today is clearly<br />

the most important segment. It encompasses seven industries for which<br />

<strong>ISRA</strong> is offering surface inspection systems at various points in their<br />

production processes.<br />

Company structure<br />

Indust.<br />

Autom.<br />

Automotive<br />

Glass<br />

Source: <strong>ISRA</strong> <strong>VISION</strong><br />

Solar<br />

Plastics<br />

Surface<br />

Vision<br />

With a sales share of about 21% each, we expect the glass and the metal<br />

industry to be <strong>ISRA</strong>’s most important customer groups followed by the<br />

plastics industry, the automotive industry, the paper industry, the solar<br />

industry and the print industry. The solar segment is <strong>ISRA</strong>’s most recently<br />

formed business segment. It includes <strong>ISRA</strong>’s inspection applications for thinfilm<br />