MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Earning cost of capital<br />

despite working capital<br />

needs and high goodwill<br />

Balance sheet still shows<br />

low gearing<br />

<strong>ISRA</strong> uses options to<br />

invest in the business<br />

Free cash flow assumed<br />

from current year<br />

onwards<br />

- 32 -<br />

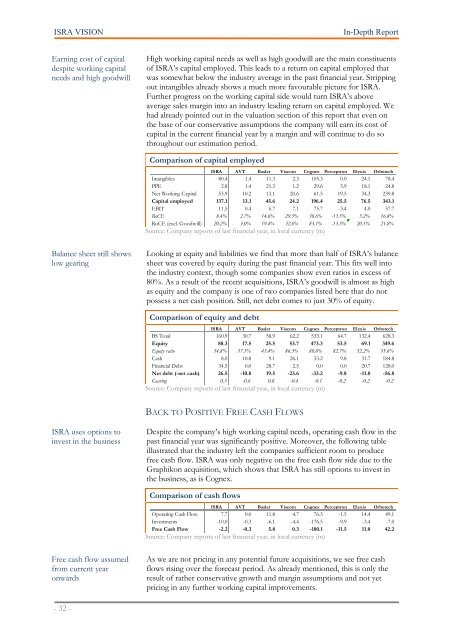

High working capital needs as well as high goodwill are the main constituents<br />

of <strong>ISRA</strong>’s capital employed. This leads to a return on capital employed that<br />

was somewhat below the industry average in the past financial year. Stripping<br />

out intangibles already shows a much more favourable picture for <strong>ISRA</strong>.<br />

Further progress on the working capital side would turn <strong>ISRA</strong>’s above<br />

average sales margin into an industry leading return on capital employed. We<br />

had already pointed out in the valuation section of this report that even on<br />

the base of our conservative assumptions the company will earn its cost of<br />

capital in the current financial year by a margin and will continue to do so<br />

throughout our estimation period.<br />

Comparison of capital employed<br />

<strong>ISRA</strong> AVT Basler Viscom Cognex Perceptron Elexis Orbotech<br />

Intangibles 80.4 1.4 11.3 2.3 105.3 0.0 24.1 78.4<br />

PPE 2.8 1.4 21.3 1.2 29.6 5.9 18.1 24.8<br />

Net Working Capital 53.9 10.2 13.1 20.6 61.5 19.5 34.3 239.8<br />

Capital employed 137.1 13.1 45.6 24.2 196.4 25.5 76.5 343.1<br />

EBIT 11.5 0.4 6.7 7.1 75.7 -3.4 4.0 57.7<br />

RoCE 8.4% 2.7% 14.6% 29.5% 38.6% -13.5% 5.2% 16.8%<br />

RoCE (excl. Goodwill) 20.2% 3.0% 19.4% 32.6% 83.1% -13.5% 20.1% 21.8%<br />

Source: Company reports of last financial year, in local currency (m)<br />

Looking at equity and liabilities we find that more than half of <strong>ISRA</strong>’s balance<br />

sheet was covered by equity during the past financial year. This fits well into<br />

the industry context, though some companies show even ratios in excess of<br />

80%. As a result of the recent acquisitions, <strong>ISRA</strong>’s goodwill is almost as high<br />

as equity and the company is one of two companies listed here that do not<br />

possess a net cash position. Still, net debt comes to just 30% of equity.<br />

Comparison of equity and debt<br />

<strong>ISRA</strong> AVT Basler Viscom Cognex Perceptron Elexis Orbotech<br />

BS Total 160.9 30.7 58.9 62.2 533.1 64.7 132.4 628.3<br />

Equity 88.3 17.5 25.5 53.7 473.3 53.5 69.1 349.6<br />

Equity ratio 54.8% 57.1% 43.4% 86.3% 88.8% 82.7% 52.2% 55.6%<br />

Cash 8.0 10.8 9.1 26.1 33.2 9.8 31.7 184.8<br />

Financial Debt 34.5 0.0 28.7 2.5 0.0 0.0 20.7 128.0<br />

Net debt (-net cash) 26.5 -10.8 19.5 -23.6 -33.2 -9.8 -11.0 -56.8<br />

Gearing 0.3 -0.6 0.8 -0.4 -0.1 -0.2 -0.2 -0.2<br />

Source: Company reports of last financial year, in local currency (m)<br />

BACK TO POSITIVE FREE CASH FLOWS<br />

Despite the company’s high working capital needs, operating cash flow in the<br />

past financial year was significantly positive. Moreover, the following table<br />

illustrated that the industry left the companies sufficient room to produce<br />

free cash flow. <strong>ISRA</strong> was only negative on the free cash flow side due to the<br />

Graphikon acquisition, which shows that <strong>ISRA</strong> has still options to invest in<br />

the business, as is Cognex.<br />

Comparison of cash flows<br />

<strong>ISRA</strong> AVT Basler Viscom Cognex Perceptron Elexis Orbotech<br />

Operating Cash Flow 7.7 0.0 11.8 4.7 76.3 -1.5 14.4 49.1<br />

Investments -10.0 -0.3 -6.1 -4.4 -176.5 -9.9 -3.4 -7.0<br />

Free Cash Flow -2.2 -0.3 5.8 0.3 -100.1 -11.5 11.0 42.2<br />

Source: Company reports of last financial year, in local currency (m)<br />

As we are not pricing in any potential future acquisitions, we see free cash<br />

flows rising over the forecast period. As already mentioned, this is only the<br />

result of rather conservative growth and margin assumptions and not yet<br />

pricing in any further working capital improvements.