MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

2012 should still see<br />

solid growth, despite<br />

weaker situation in some<br />

countries<br />

European machine<br />

vision market increased<br />

by 34.8% in 2010<br />

Germany most<br />

important market<br />

- 12 -<br />

in 2010. Italy remains weak, mainly as a result of sluggish private and public<br />

consumption. In Spain, the restrictive fiscal policy along with the lasting crisis<br />

in the real estate and banking sectors weigh on the recovery. The UK is also<br />

losing ground, in particular because of fiscal measures such as the VAT<br />

increase in order to reduce the national budget deficit. The US has recovered<br />

by 2.7% in 2010 on the back of a number of governmental stimulus packages.<br />

Due the current debt crisis, the country is expected to show weaker rates in<br />

2011 and 2012. With a 4% GDP growth, Japan has seen a strong recovery in<br />

2010, the current year will, however, be burdened by the tragic events in<br />

Fukushima.<br />

For 2012, a variety of indicators point at a major slowdown in economic<br />

growth and equity markets have already reacted quite heavily on such<br />

prospects. In fact, economic forecasts for a number of countries have been<br />

lowered. Still, India and China should not fall materially short of 2011, Italy<br />

and the UK should finally see some acceleration and the US is not going<br />

down further from the 2011 level. Against this background, we should still<br />

see solid single-digit global GDP growth, which is even ahead of the 2008<br />

level. Within Europe, Germany is expected to defend its leading role.<br />

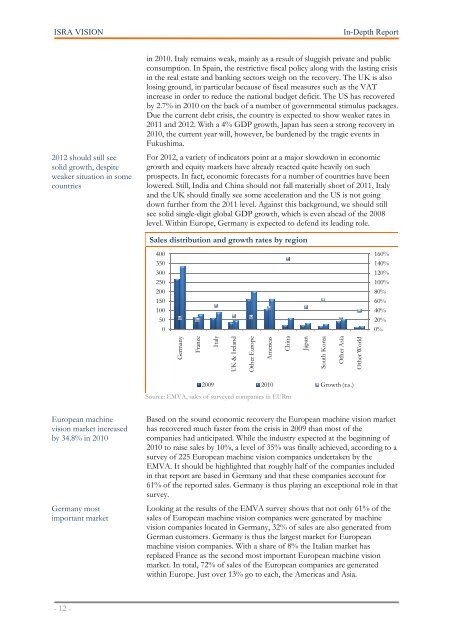

Sales distribution and growth rates by region<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Germany<br />

France<br />

Italy<br />

UK & Ireland<br />

Other Europe<br />

2009 2010 Growth (r.s.)<br />

Source: EMVA, sales of surveyed companies in EURm<br />

Americas<br />

160%<br />

140%<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

Based on the sound economic recovery the European machine vision market<br />

has recovered much faster from the crisis in 2009 than most of the<br />

companies had anticipated. While the industry expected at the beginning of<br />

2010 to raise sales by 10%, a level of 35% was finally achieved, according to a<br />

survey of 225 European machine vision companies undertaken by the<br />

EMVA. It should be highlighted that roughly half of the companies included<br />

in that report are based in Germany and that these companies account for<br />

61% of the reported sales. Germany is thus playing an exceptional role in that<br />

survey.<br />

Looking at the results of the EMVA survey shows that not only 61% of the<br />

sales of European machine vision companies were generated by machine<br />

vision companies located in Germany, 32% of sales are also generated from<br />

German customers. Germany is thus the largest market for European<br />

machine vision companies. With a share of 8% the Italian market has<br />

replaced France as the second most important European machine vision<br />

market. In total, 72% of sales of the European companies are generated<br />

within Europe. Just over 13% go to each, the Americas and Asia.<br />

China<br />

Japan<br />

South Korea<br />

Other Asia<br />

Other World