MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Strong discount on PE<br />

basis<br />

Peer group supports our<br />

DCF valuation<br />

Elexis transaction shows<br />

that our valuation is still<br />

not stretched<br />

Peers point at additional<br />

upside for <strong>ISRA</strong><br />

Risks to our valuation<br />

- 9 -<br />

Based on EV/Sales multiples, <strong>ISRA</strong> trades with a sizable premium compared<br />

to its peers. More importantly, <strong>ISRA</strong> trades at a material discount to its peers,<br />

even the close ones, on almost all earnings multiples.<br />

We also find that the peer group analysis is perfectly consistent with our DCF<br />

calculation. Looking at the multiples that are implied in our DCF valuation,<br />

we find that our DCF calculation brings EV / EBITDA and EV/EBIT<br />

multiples roughly in line with the industry average and PEs even in line with<br />

the close peers.<br />

It must also be highlighted that <strong>ISRA</strong> is currently trading substantially below<br />

the transaction multiples that result from the current offer for Elexis.<br />

Furthermore, even our DCF valuation arrives at multiples that are not yet<br />

aligned with the Elexis offer, in particular on a PE basis. It should be kept in<br />

mind that the Elexis offer took place before the recent sell-off in the equity<br />

markets and is thus unaffected by the increased risk in the global economic<br />

situation. However, even our DCF valuation of <strong>ISRA</strong> before the risk<br />

adjustment would yield PE multiples 14.8% and 9.8% below the respective<br />

Elexis multiples for the years 2011 and 2012.<br />

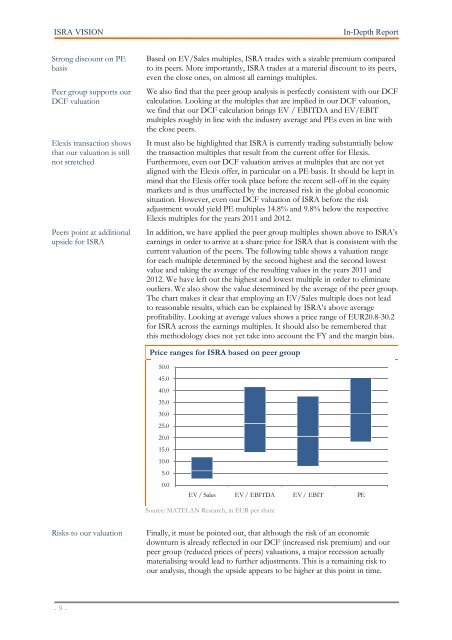

In addition, we have applied the peer group multiples shown above to <strong>ISRA</strong>’s<br />

earnings in order to arrive at a share price for <strong>ISRA</strong> that is consistent with the<br />

current valuation of the peers. The following table shows a valuation range<br />

for each multiple determined by the second highest and the second lowest<br />

value and taking the average of the resulting values in the years 2011 and<br />

2012. We have left out the highest and lowest multiple in order to eliminate<br />

outliers. We also show the value determined by the average of the peer group.<br />

The chart makes it clear that employing an EV/Sales multiple does not lead<br />

to reasonable results, which can be explained by <strong>ISRA</strong>’s above average<br />

profitability. Looking at average values shows a price range of EUR20.8-30.2<br />

for <strong>ISRA</strong> across the earnings multiples. It should also be remembered that<br />

this methodology does not yet take into account the FY and the margin bias.<br />

Price ranges for <strong>ISRA</strong> based on peer group<br />

50.0<br />

45.0<br />

40.0<br />

35.0<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

EV / Sales EV / EBITDA EV / EBIT PE<br />

Source: <strong>MATELAN</strong> <strong>Research</strong>, in EUR per share<br />

Finally, it must be pointed out, that although the risk of an economic<br />

downturn is already reflected in our DCF (increased risk premium) and our<br />

peer group (reduced prices of peers) valuations, a major recession actually<br />

materialising would lead to further adjustments. This is a remaining risk to<br />

our analysis, though the upside appears to be higher at this point in time.