MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Building a broad peer<br />

group<br />

No peer fully<br />

comparable to <strong>ISRA</strong><br />

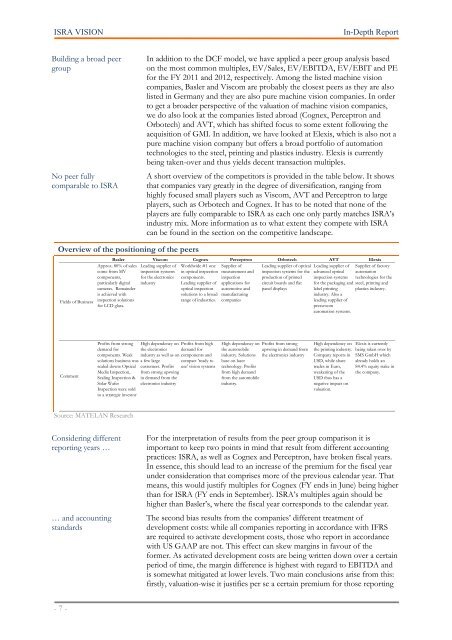

Overview of the positioning of the peers<br />

Fields of Business<br />

Comment<br />

Source: <strong>MATELAN</strong> <strong>Research</strong><br />

- 7 -<br />

In addition to the DCF model, we have applied a peer group analysis based<br />

on the most common multiples, EV/Sales, EV/EBITDA, EV/EBIT and PE<br />

for the FY 2011 and 2012, respectively. Among the listed machine vision<br />

companies, Basler and Viscom are probably the closest peers as they are also<br />

listed in Germany and they are also pure machine vision companies. In order<br />

to get a broader perspective of the valuation of machine vision companies,<br />

we do also look at the companies listed abroad (Cognex, Perceptron and<br />

Orbotech) and AVT, which has shifted focus to some extent following the<br />

acquisition of GMI. In addition, we have looked at Elexis, which is also not a<br />

pure machine vision company but offers a broad portfolio of automation<br />

technologies to the steel, printing and plastics industry. Elexis is currently<br />

being taken-over and thus yields decent transaction multiples.<br />

A short overview of the competitors is provided in the table below. It shows<br />

that companies vary greatly in the degree of diversification, ranging from<br />

highly focused small players such as Viscom, AVT and Perceptron to large<br />

players, such as Orbotech and Cognex. It has to be noted that none of the<br />

players are fully comparable to <strong>ISRA</strong> as each one only partly matches <strong>ISRA</strong>’s<br />

industry mix. More information as to what extent they compete with <strong>ISRA</strong><br />

can be found in the section on the competitive landscape.<br />

Basler Viscom Cognex Perceptron Orbotech AVT Elexis<br />

Approx. 80% of sales<br />

come from MV<br />

components,<br />

particularly digital<br />

cameras. Remainder<br />

is achieved with<br />

inspection solutions<br />

for LCD glass.<br />

Profits from strong<br />

demand for<br />

components. Weak<br />

solutions business was<br />

scaled down: Optical<br />

Media Inspection,<br />

Sealing Inspection &<br />

Solar Wafer<br />

Inspection were sold<br />

to a strategic investor<br />

Considering different<br />

reporting years …<br />

… and accounting<br />

standards<br />

Leading supplier of<br />

inspection systems<br />

for the electronics<br />

industry<br />

High dependency on<br />

the electronics<br />

industry as well as on<br />

a few large<br />

customers. Profits<br />

from strong upswing<br />

in demand from the<br />

electronics industry<br />

Worldwide #1 one<br />

in optical inspection<br />

components.<br />

Leading supplier of<br />

optical inspection<br />

solutions to a broad<br />

range of industries.<br />

Profits from high<br />

demand for<br />

components and<br />

compact 'ready to<br />

use' vision systems<br />

Supplier of<br />

measurement and<br />

inspection<br />

applications for<br />

automotive and<br />

manufacturing<br />

companies<br />

Leading supplier of optical<br />

inspection systems for the<br />

production of printed<br />

circuit boards and flat<br />

panel displays<br />

High dependency on Profits from strong<br />

the automobile upswing in demand from<br />

industry. Solutions the electronics industry<br />

base on laser<br />

technology. Profits<br />

from high demand<br />

from the automobile<br />

industry.<br />

Leading supplier of<br />

advanced optical<br />

inspection systems<br />

for the packaging and<br />

label printing<br />

industry. Also a<br />

leading supplier of<br />

pressroom<br />

automation systems.<br />

High dependency on<br />

the printing industry.<br />

Company reports in<br />

USD, while share<br />

trades in Euro,<br />

weakening of the<br />

USD thus has a<br />

negative impact on<br />

valuation.<br />

Supplier of factory<br />

automation<br />

technologies for the<br />

steel, printing and<br />

plastics industry.<br />

Elexis is currently<br />

being taken over by<br />

SMS GmbH which<br />

already holds an<br />

84.4% equity stake in<br />

the company.<br />

For the interpretation of results from the peer group comparison it is<br />

important to keep two points in mind that result from different accounting<br />

practices: <strong>ISRA</strong>, as well as Cognex and Perceptron, have broken fiscal years.<br />

In essence, this should lead to an increase of the premium for the fiscal year<br />

under consideration that comprises more of the previous calendar year. That<br />

means, this would justify multiples for Cognex (FY ends in June) being higher<br />

than for <strong>ISRA</strong> (FY ends in September). <strong>ISRA</strong>’s multiples again should be<br />

higher than Basler’s, where the fiscal year corresponds to the calendar year.<br />

The second bias results from the companies’ different treatment of<br />

development costs: while all companies reporting in accordance with IFRS<br />

are required to activate development costs, those who report in accordance<br />

with US GAAP are not. This effect can skew margins in favour of the<br />

former. As activated development costs are being written down over a certain<br />

period of time, the margin difference is highest with regard to EBITDA and<br />

is somewhat mitigated at lower levels. Two main conclusions arise from this:<br />

firstly, valuation-wise it justifies per se a certain premium for those reporting