MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Low capital intensity<br />

High net working capital<br />

needs<br />

Driving NWC further<br />

down could unlock<br />

additional value<br />

- 31 -<br />

WORKING CAPITAL IS THE MAIN BALANCE SHEET LEVER<br />

The anticipated balance sheet development is geared in essence to past ratios.<br />

Tangible assets only grow moderately as <strong>ISRA</strong>, being a software company,<br />

needs little equipment to pursue the business. The growth of intangible assets<br />

is linked to capitalized development, which usually accounts for 12% of net<br />

sales and grows accordingly (ex depreciation).<br />

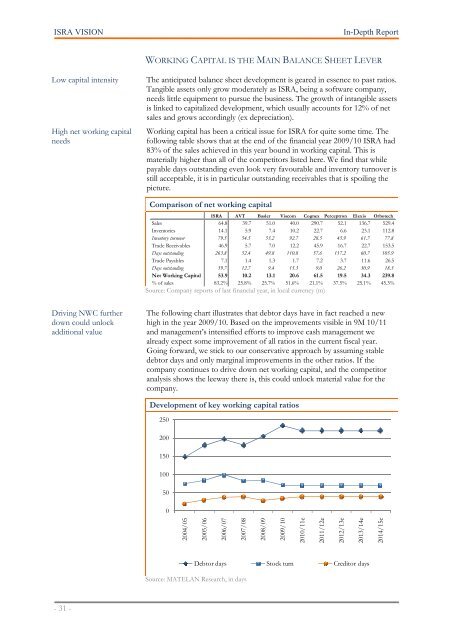

Working capital has been a critical issue for <strong>ISRA</strong> for quite some time. The<br />

following table shows that at the end of the financial year 2009/10 <strong>ISRA</strong> had<br />

83% of the sales achieved in this year bound in working capital. This is<br />

materially higher than all of the competitors listed here. We find that while<br />

payable days outstanding even look very favourable and inventory turnover is<br />

still acceptable, it is in particular outstanding receivables that is spoiling the<br />

picture.<br />

Comparison of net working capital<br />

<strong>ISRA</strong> AVT Basler Viscom Cognex Perceptron Elexis Orbotech<br />

Sales 64.8 39.7 51.0 40.0 290.7 52.1 136.7 529.4<br />

Inventories 14.1 5.9 7.4 10.2 22.7 6.6 23.1 112.8<br />

Inventory turnover 79.5 54.5 53.2 92.7 28.5 45.9 61.7 77.8<br />

Trade Receivables 46.9 5.7 7.0 12.2 45.9 16.7 22.7 153.5<br />

Days outstanding 263.8 52.4 49.8 110.8 57.6 117.2 60.7 105.9<br />

Trade Payables 7.1 1.4 1.3 1.7 7.2 3.7 11.6 26.5<br />

Days outstanding 39.7 12.7 9.4 15.3 9.0 26.2 30.9 18.3<br />

Net Working Capital 53.9 10.2 13.1 20.6 61.5 19.5 34.3 239.8<br />

% of sales 83.2% 25.8% 25.7% 51.6% 21.1% 37.5% 25.1% 45.3%<br />

Source: Company reports of last financial year, in local currency (m)<br />

The following chart illustrates that debtor days have in fact reached a new<br />

high in the year 2009/10. Based on the improvements visible in 9M 10/11<br />

and management’s intensified efforts to improve cash management we<br />

already expect some improvement of all ratios in the current fiscal year.<br />

Going forward, we stick to our conservative approach by assuming stable<br />

debtor days and only marginal improvements in the other ratios. If the<br />

company continues to drive down net working capital, and the competitor<br />

analysis shows the leeway there is, this could unlock material value for the<br />

company.<br />

Development of key working capital ratios<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2004/05<br />

2005/06<br />

2006/07<br />

2007/08<br />

Source: <strong>MATELAN</strong> <strong>Research</strong>, in days<br />

2008/09<br />

2009/10<br />

2010/11e<br />

2011/12e<br />

2012/13e<br />

2013/14e<br />

Debtor days Stock turn Creditor days<br />

2014/15e