MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

FINANCIAL ANALYSIS<br />

Conservative growth …<br />

… and margin<br />

assumptions<br />

- 29 -<br />

DRAWING A CONSERVATIVE GROWTH SCENARIO<br />

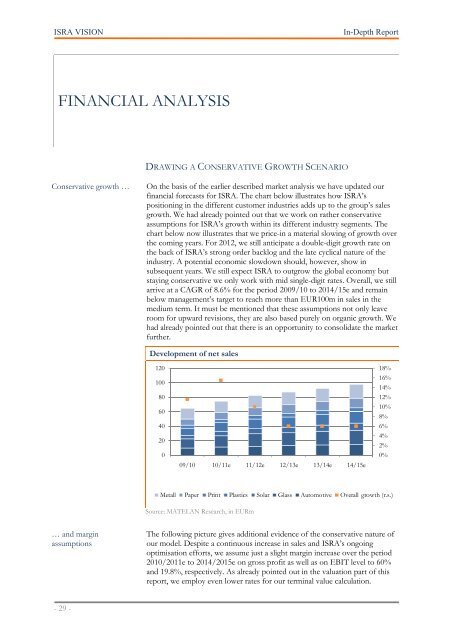

On the basis of the earlier described market analysis we have updated our<br />

financial forecasts for <strong>ISRA</strong>. The chart below illustrates how <strong>ISRA</strong>’s<br />

positioning in the different customer industries adds up to the group’s sales<br />

growth. We had already pointed out that we work on rather conservative<br />

assumptions for <strong>ISRA</strong>’s growth within its different industry segments. The<br />

chart below now illustrates that we price-in a material slowing of growth over<br />

the coming years. For 2012, we still anticipate a double-digit growth rate on<br />

the back of <strong>ISRA</strong>’s strong order backlog and the late cyclical nature of the<br />

industry. A potential economic slowdown should, however, show in<br />

subsequent years. We still expect <strong>ISRA</strong> to outgrow the global economy but<br />

staying conservative we only work with mid single-digit rates. Overall, we still<br />

arrive at a C<strong>AG</strong>R of 8.6% for the period 2009/10 to 2014/15e and remain<br />

below management’s target to reach more than EUR100m in sales in the<br />

medium term. It must be mentioned that these assumptions not only leave<br />

room for upward revisions, they are also based purely on organic growth. We<br />

had already pointed out that there is an opportunity to consolidate the market<br />

further.<br />

Development of net sales<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

09/10 10/11e 11/12e 12/13e 13/14e 14/15e<br />

Source: <strong>MATELAN</strong> <strong>Research</strong>, in EURm<br />

18%<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Metall Paper Print Plastics Solar Glass Automotive Overall growth (r.s.)<br />

The following picture gives additional evidence of the conservative nature of<br />

our model. Despite a continuous increase in sales and <strong>ISRA</strong>’s ongoing<br />

optimisation efforts, we assume just a slight margin increase over the period<br />

2010/2011e to 2014/2015e on gross profit as well as on EBIT level to 60%<br />

and 19.8%, respectively. As already pointed out in the valuation part of this<br />

report, we employ even lower rates for our terminal value calculation.