MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

MATELAN Research - ISRA VISION AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ISRA</strong> <strong>VISION</strong> In-Depth Report<br />

Discrete inspection<br />

systems, 3D systems and<br />

new applications to drive<br />

future growth<br />

Systems vs. components<br />

Vision systems still the<br />

most important product<br />

category …<br />

… but cameras and<br />

compact systems show<br />

the highest growth rates<br />

Sales growth mainly<br />

driven by higher<br />

volumes<br />

Falling prices help<br />

fuelling further growth<br />

- 16 -<br />

On the back of over-proportionate growth expectations coming from the<br />

automotive and pharma industries, we would expect discrete inspection<br />

systems to continue growing above average in the coming years. Moreover,<br />

3D systems should gain pace again, and we would expect the number of new<br />

application types to increase further. Interestingly, the German companies are<br />

less well positioned in discrete inspection systems compared to the European<br />

average, despite their strong links to the automotive and pharma industries.<br />

They are, however, stronger in continuous processes.<br />

TREND TOWARDS LESS COMPLEX PRODUCTS<br />

Machine vision technology can be separated in two main categories, i.e. vision<br />

systems and vision components. Vision systems cover the above mentioned<br />

application-specific visions systems and configurable vision systems, as well<br />

as smart cameras/compact systems and vision sensors. Vision components<br />

include cameras, frame grabbers, lighting equipment, optics, vision software,<br />

interfaces and cables, as well as other vision accessories.<br />

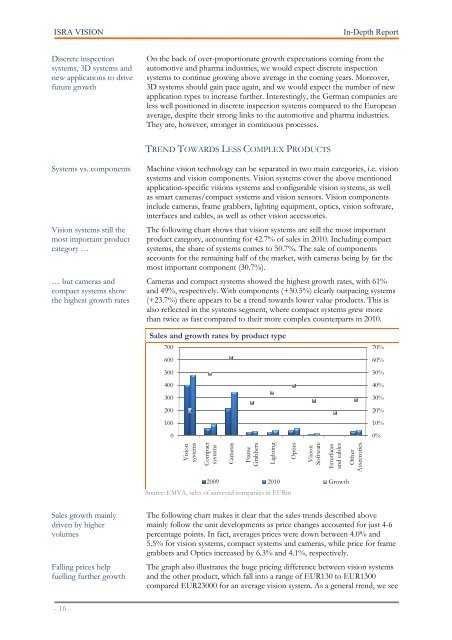

The following chart shows that vision systems are still the most important<br />

product category, accounting for 42.7% of sales in 2010. Including compact<br />

systems, the share of systems comes to 50.7%. The sale of components<br />

accounts for the remaining half of the market, with cameras being by far the<br />

most important component (30.7%).<br />

Cameras and compact systems showed the highest growth rates, with 61%<br />

and 49%, respectively. With components (+50.5%) clearly outpacing systems<br />

(+23.7%) there appears to be a trend towards lower value products. This is<br />

also reflected in the systems segment, where compact systems grew more<br />

than twice as fast compared to their more complex counterparts in 2010.<br />

Sales and growth rates by product type<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Vision<br />

systems<br />

Compact<br />

systems<br />

Cameras<br />

Frame<br />

Grabbers<br />

2009 2010 Growth<br />

Source: EMVA, sales of surveyed companies in EURm<br />

Lighting<br />

The following chart makes it clear that the sales trends described above<br />

mainly follow the unit developments as price changes accounted for just 4-6<br />

percentage points. In fact, averages prices were down between 4.0% and<br />

5.5% for vision systems, compact systems and cameras, while price for frame<br />

grabbers and Optics increased by 6.3% and 4.1%, respectively.<br />

The graph also illustrates the huge pricing difference between vision systems<br />

and the other product, which fall into a range of EUR130 to EUR1300<br />

compared EUR23000 for an average vision system. As a general trend, we see<br />

Optics<br />

Vision<br />

Software<br />

Interfaces<br />

and cables<br />

Other<br />

Asseccories<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%