Template for HA Research Notes - ISRA VISION AG

Template for HA Research Notes - ISRA VISION AG

Template for HA Research Notes - ISRA VISION AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ISRA</strong> Vision<br />

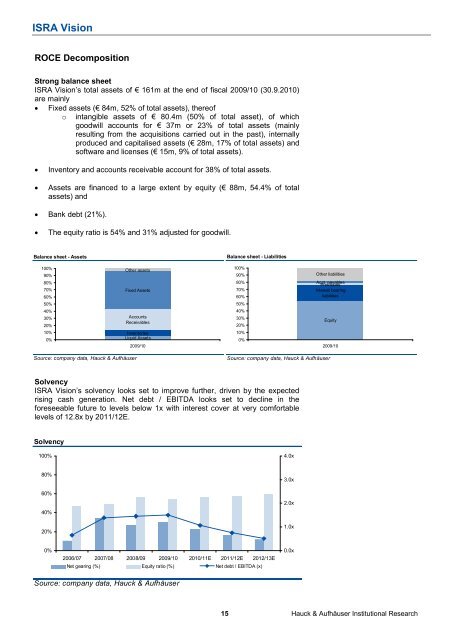

ROCE Decomposition<br />

Strong balance sheet<br />

<strong>ISRA</strong> Vision’s total assets of € 161m at the end of fiscal 2009/10 (30.9.2010)<br />

are mainly<br />

• Fixed assets (€ 84m, 52% of total assets), thereof<br />

o intangible assets of € 80.4m (50% of total asset), of which<br />

goodwill accounts <strong>for</strong> € 37m or 23% of total assets (mainly<br />

resulting from the acquisitions carried out in the past), internally<br />

produced and capitalised assets (€ 28m, 17% of total assets) and<br />

software and licenses (€ 15m, 9% of total assets).<br />

• Inventory and accounts receivable account <strong>for</strong> 38% of total assets.<br />

• Assets are financed to a large extent by equity (€ 88m, 54.4% of total<br />

assets) and<br />

• Bank debt (21%).<br />

• The equity ratio is 54% and 31% adjusted <strong>for</strong> goodwill.<br />

Balance sheet - Assets<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Source: company data, Hauck & Aufhäuser<br />

Other assets<br />

Fixed Assets<br />

Accounts<br />

Receivables<br />

Inventories<br />

Liquid Assets<br />

2009/10<br />

Balance sheet - Liabilities<br />

Source: company data, Hauck & Aufhäuser<br />

Solvency<br />

<strong>ISRA</strong> Vision’s solvency looks set to improve further, driven by the expected<br />

rising cash generation. Net debt / EBITDA looks set to decline in the<br />

<strong>for</strong>eseeable future to levels below 1x with interest cover at very com<strong>for</strong>table<br />

levels of 12.8x by 2011/12E.<br />

Solvency<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

100%<br />

2006/07 2007/08 2008/09 2009/10 2010/11E 2011/12E 2012/13E<br />

Net gearing (%) Equity ratio (%) Net debt / EBITDA (x)<br />

Source: company data, Hauck & Aufhäuser<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

4.0x<br />

3.0x<br />

2.0x<br />

1.0x<br />

0.0x<br />

Other liabilities<br />

Acct. payables<br />

Provisions<br />

Interest bearing<br />

liabilities<br />

Equity<br />

2009/10<br />

15 Hauck & Aufhäuser Institutional <strong>Research</strong>