Template for HA Research Notes - ISRA VISION AG

Template for HA Research Notes - ISRA VISION AG

Template for HA Research Notes - ISRA VISION AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ISRA</strong> Vision<br />

o In the metals industry, <strong>for</strong> example, Andritz Metals Division, a<br />

leading global suppliers of rolling mills and strip processing lines,<br />

believes that <strong>ISRA</strong> Vision (Parsytec) and Cognex are market<br />

leaders in visual surface inspection technology.<br />

o SMS Siemag, a major global supplier of metals production and<br />

processing equipment, values the ability of a supplier to deliver<br />

customised quality inspection systems, flexibility and a positive<br />

track record of delivering in time.<br />

o In the paper industry, <strong>ISRA</strong> Vision boasts a world unique and<br />

most complete portfolio of inspection systems at several stages of<br />

the production process, including wire & trim, pick-up, open draw,<br />

press-to-dryer, pre-dryer, dryer, size press and calendar and<br />

reeler.<br />

o In the glass industry, <strong>ISRA</strong> Vision claims a unique positioning<br />

due to its all-in-one camera design and unique high-speed LED<br />

technology combining several optical channels.<br />

o In the solar industry, supported by <strong>ISRA</strong> Vision’s recent<br />

acquisition of Graphikon in 2010, the company is able to offer fully<br />

automated inspection combined with 100% defect recognition.<br />

• <strong>ISRA</strong> Vision’s track record of generating profitable growth over the last<br />

decade at double-digit sales growth rates and always generating 2-digit<br />

EBIT margins as well as a sound balance sheet (54% equity ratio, 30%<br />

net gearing) matter to customers as it signals financial health and stability.<br />

In summary, these strengths have resulted in a global #1 market position in<br />

visual surface inspection technology mainly <strong>for</strong> continuous industrial<br />

manufacturing processes <strong>for</strong> metal, glass and plastics/nonwovens and a<br />

European #1 position in 3D vision systems, mainly supplied to the automotive<br />

industry. The company claims a top 3 position in the solar glass and a top 3-4<br />

position in the paper industry.<br />

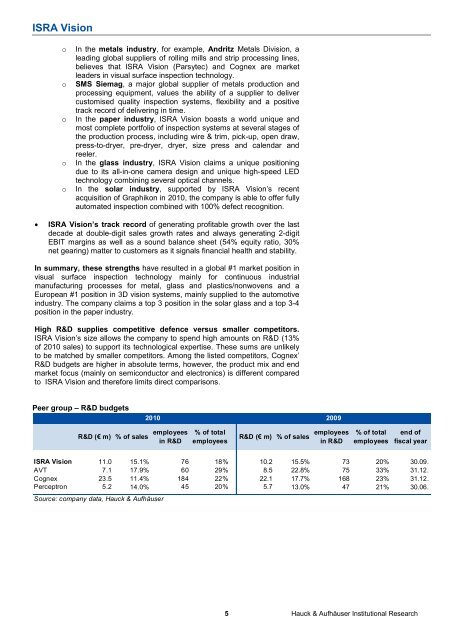

High R&D supplies competitive defence versus smaller competitors.<br />

<strong>ISRA</strong> Vision’s size allows the company to spend high amounts on R&D (13%<br />

of 2010 sales) to support its technological expertise. These sums are unlikely<br />

to be matched by smaller competitors. Among the listed competitors, Cognex’<br />

R&D budgets are higher in absolute terms, however, the product mix and end<br />

market focus (mainly on semiconductor and electronics) is different compared<br />

to <strong>ISRA</strong> Vision and there<strong>for</strong>e limits direct comparisons.<br />

Peer group – R&D budgets<br />

R&D (€ m) % of sales employees<br />

in R&D<br />

% of total<br />

employees<br />

R&D (€ m) % of sales employees<br />

in R&D<br />

% of total<br />

employees<br />

end of<br />

fiscal year<br />

<strong>ISRA</strong> Vision 11.0 15.1% 76 18% 10.2 15.5% 73 20% 30.09.<br />

AVT 7.1 17.9% 60 29% 8.5 22.8% 75 33% 31.12.<br />

Cognex 23.5 11.4% 184 22% 22.1 17.7% 168 23% 31.12.<br />

Perceptron 5.2 14.0% 45 20% 5.7 13.0% 47 21% 30.06.<br />

Source: company data, Hauck & Aufhäuser<br />

2010 2009<br />

5 Hauck & Aufhäuser Institutional <strong>Research</strong>