AUTHORISATION

U1hB302Xjd2

U1hB302Xjd2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SECTION I<br />

FUNDAMENTALS OF THE UBI MARKET<br />

In the US, fraudulent auto insurance claims were estimated at $4.8-6.8 billion in<br />

2007 by the Insurance Research Council.<br />

Questionable personal injury protection (PIP) claims involving staged accidents<br />

surged by 52% in 2009 and then 17% in 2010. For 2011, early estimates suggest<br />

an even larger increase.<br />

Licence<br />

Today, 21% of bodily-injury (BI) claims and 18% of PIP claims that were settled had<br />

the appearance of fraud and/or build-up. Build-up generally involves inflating<br />

otherwise legitimate claims.<br />

agreement<br />

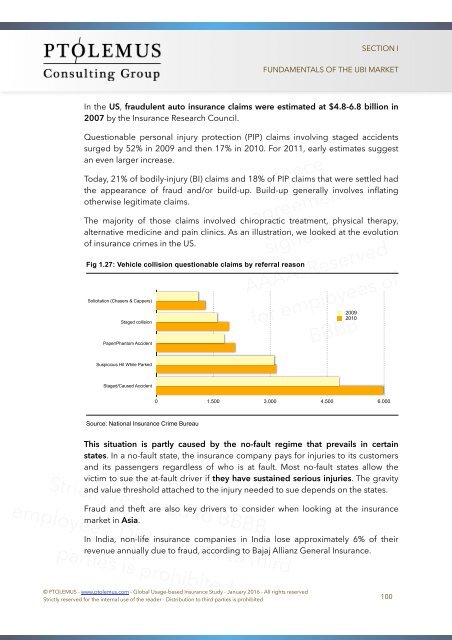

The majority of those claims involved chiropractic treatment, physical therapy,<br />

alternative medicine and pain clinics. As an illustration, we looked at the evolution<br />

of insurance crimes in the US.<br />

Fig 1.27: Vehicle collision questionable claims by referral reason<br />

Solicitation (Chasers & Cappers)<br />

Staged collision<br />

Paper/Phantom Accident<br />

signed by<br />

AAAA. Reserved<br />

for employees of<br />

2009<br />

2010<br />

BBBB<br />

Suspicious Hit While Parked<br />

Staged/Caused Accident<br />

0 1.500 3.000 4.500 6.000<br />

Source: National Insurance Crime Bureau<br />

This situation is partly caused by the no-fault regime that prevails in certain<br />

states. In a no-fault state, the insurance company pays for injuries to its customers<br />

and its passengers regardless of who is at fault. Most no-fault states allow the<br />

victim to sue the at-fault driver if they have sustained serious injuries. The gravity<br />

and value threshold attached to the injury needed to sue depends on the states.<br />

Strictly reserved to BBBB<br />

employees. Distribution to third<br />

Fraud and theft are also key drivers to consider when looking at the insurance<br />

market in Asia.<br />

In India, non-life insurance companies in India lose approximately 6% of their<br />

revenue annually due to fraud, according to Bajaj Allianz General Insurance.<br />

parties is prohibited<br />

© PTOLEMUS - www.ptolemus.com - Global Usage-based Insurance Study - January 2016 - All rights reserved<br />

Strictly reserved for the internal use of the reader - Distribution to third parties is prohibited 100