ASQ6_EN-website

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COUNTRY PROFILE: SOUTH KOREA<br />

STATUS QUO<br />

Though a relatively small business aviation market, South Korea is actively<br />

seeking to make a name for itself among the bigger markets in the Asia-<br />

Pacific region.<br />

At year end 2016, there were 22 business jets based in South Korea, up<br />

from 19 in 2015. Long range jets and corporate airliners each hold 27%<br />

of the fleet, suggesting most use is over longer distances. However, the<br />

shorter-range Cessna models are still the most popular, with 36% of the<br />

market share in the country. Overall, the fleet is young, with the majority<br />

manufactured in the past decade.<br />

Korean Air is the largest operator in the country by far (50% of the fleet), with<br />

11 aircraft including two BBJs, two Global Express XRS’, six Cessnas and<br />

one G650. Samsung Group previously held the largest fleet in the country,<br />

but sold their entire fleet to Korean Air. Samsung is now exclusively using<br />

charter services provided by Korean Air.<br />

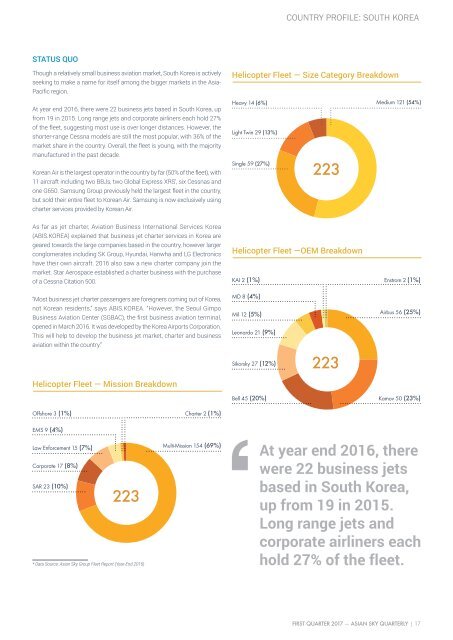

Helicopter Fleet — Size Category Breakdown<br />

Light Twin 29 (13%)<br />

Single 59 (27%)<br />

54+27+13+6+G<br />

Heavy 14 (6%) Medium 121 (54%)<br />

223<br />

As far as jet charter, Aviation Business International Services Korea<br />

(ABIS.KOREA) explained that business jet charter services in Korea are<br />

geared towards the large companies based in the country, however larger<br />

conglomerates including SK Group, Hyundai, Hanwha and LG Electronics<br />

Helicopter Fleet —OEM Breakdown<br />

have their own aircraft. 2016 also saw a new charter company join the<br />

market. Star Aerospace established a charter business with the purchase<br />

of a Cessna Citation 500.<br />

KAI 2 (1%)<br />

Enstrom 2 (1%)<br />

“Most business jet charter passengers are foreigners coming out of Korea,<br />

MD 8 (4%)<br />

25+23+20+12+9+5+4+1+1+G<br />

not Korean residents,” says ABIS.KOREA. “However, the Seoul Gimpo<br />

Mil 12 (5%)<br />

Airbus 56 (25%)<br />

Business Aviation Center (SGBAC), the first business aviation terminal,<br />

opened in March 2016. It was developed by the Korea Airports Corporation.<br />

Leonardo 21 (9%)<br />

This will help to develop the business jet market, charter and business<br />

aviation within the country.”<br />

Sikorsky 27 (12%)<br />

223<br />

Helicopter Fleet — Mission Breakdown<br />

Bell 45 (20%)<br />

Kamov 50 (23%)<br />

Law Enforcement 15 (7%)<br />

Multi-Mission 154 (69%)<br />

Offshore 3 (1%)<br />

Charter 2 (1%)<br />

EMS 9 (4%)<br />

Corporate 17 (8%)<br />

SAR 23 (10%)<br />

69+10+8+7+4+1+1+G<br />

223<br />

* Data Source: Asian Sky Group Fleet Report (Year-End 2016)<br />

At year end 2016, there<br />

were 22 business jets<br />

based in South Korea,<br />

up from 19 in 2015.<br />

Long range jets and<br />

corporate airliners each<br />

hold 27% of the fleet.<br />

FIRST QUARTER 2017 — ASIAN SKY QUARTERLY | 17