2017complete3

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

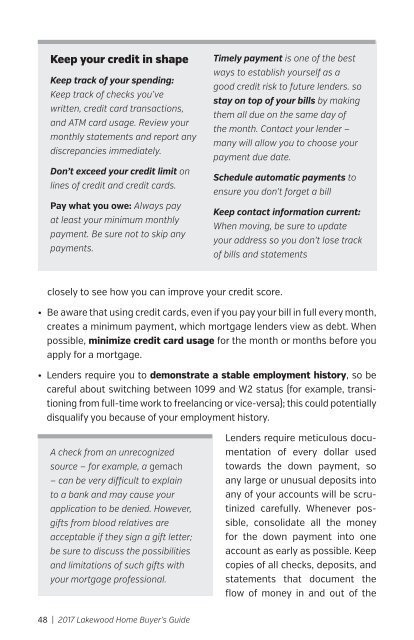

Keep your credit in shape<br />

Keep track of your spending:<br />

Keep track of checks you’ve<br />

written, credit card transactions,<br />

and ATM card usage. Review your<br />

monthly statements and report any<br />

discrepancies immediately.<br />

Don’t exceed your credit limit on<br />

lines of credit and credit cards.<br />

Pay what you owe: Always pay<br />

at least your minimum monthly<br />

payment. Be sure not to skip any<br />

payments.<br />

Timely payment is one of the best<br />

ways to establish yourself as a<br />

good credit risk to future lenders. so<br />

stay on top of your bills by making<br />

them all due on the same day of<br />

the month. Contact your lender —<br />

many will allow you to choose your<br />

payment due date.<br />

Schedule automatic payments to<br />

ensure you don’t forget a bill<br />

Keep contact information current:<br />

When moving, be sure to update<br />

your address so you don’t lose track<br />

of bills and statements<br />

closely to see how you can improve your credit score.<br />

• Be aware that using credit cards, even if you pay your bill in full every month,<br />

creates a minimum payment, which mortgage lenders view as debt. When<br />

possible, minimize credit card usage for the month or months before you<br />

apply for a mortgage.<br />

• Lenders require you to demonstrate a stable employment history, so be<br />

careful about switching between 1099 and W2 status (for example, transitioning<br />

from full-time work to freelancing or vice-versa); this could potentially<br />

disqualify you because of your employment history.<br />

A check from an unrecognized<br />

source — for example, a gemach<br />

— can be very difficult to explain<br />

to a bank and may cause your<br />

application to be denied. However,<br />

gifts from blood relatives are<br />

acceptable if they sign a gift letter;<br />

be sure to discuss the possibilities<br />

and limitations of such gifts with<br />

your mortgage professional.<br />

Lenders require meticulous documentation<br />

of every dollar used<br />

towards the down payment, so<br />

any large or unusual deposits into<br />

any of your accounts will be scrutinized<br />

carefully. Whenever possible,<br />

consolidate all the money<br />

for the down payment into one<br />

account as early as possible. Keep<br />

copies of all checks, deposits, and<br />

statements that document the<br />

flow of money in and out of the<br />

48 | 2017 Lakewood Home Buyer’s Guide