ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

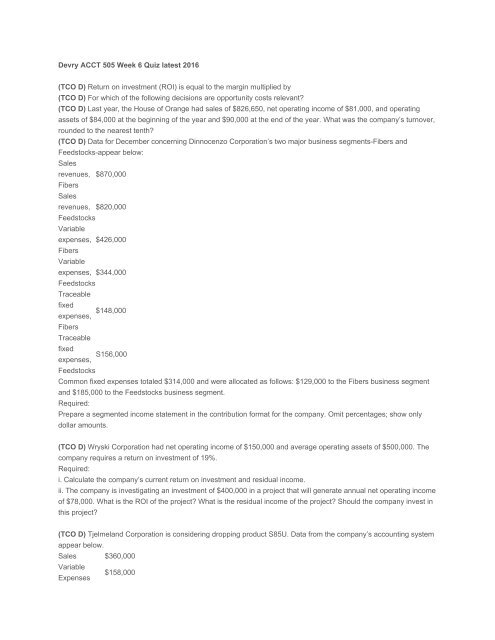

Devry <strong>ACCT</strong> <strong>505</strong> Week 6 Quiz latest 2016<br />

(TCO D) Return on investment (ROI) is equal to the margin multiplied by<br />

(TCO D) For which of the following decisions are opportunity costs relevant?<br />

(TCO D) Last year, the House of Orange had sales of $826,650, net operating income of $81,000, and operating<br />

assets of $84,000 at the beginning of the year and $90,000 at the end of the year. What was the company’s turnover,<br />

rounded to the nearest tenth?<br />

(TCO D) Data for December concerning Dinnocenzo Corporation’s two major business segments-Fibers and<br />

Feedstocks-appear below:<br />

Sales<br />

revenues, $870,000<br />

Fibers<br />

Sales<br />

revenues, $820,000<br />

Feedstocks<br />

Variable<br />

expenses, $426,000<br />

Fibers<br />

Variable<br />

expenses, $344,000<br />

Feedstocks<br />

Traceable<br />

fixed<br />

$148,000<br />

expenses,<br />

Fibers<br />

Traceable<br />

fixed<br />

S156,000<br />

expenses,<br />

Feedstocks<br />

Common fixed expenses totaled $314,000 and were allocated as follows: $129,000 to the Fibers business segment<br />

and $185,000 to the Feedstocks business segment.<br />

Required:<br />

Prepare a segmented income statement in the contribution format for the company. Omit percentages; show only<br />

dollar amounts.<br />

(TCO D) Wryski Corporation had net operating income of $150,000 and average operating assets of $500,000. The<br />

company requires a return on investment of 19%.<br />

Required:<br />

i. Calculate the company’s current return on investment and residual income.<br />

ii. The company is investigating an investment of $400,000 in a project that will generate annual net operating income<br />

of $78,000. What is the ROI of the project? What is the residual income of the project? Should the company invest in<br />

this project?<br />

(TCO D) Tjelmeland Corporation is considering dropping product S85U. Data from the company’s accounting system<br />

appear below.<br />

Sales $360,000<br />

Variable<br />

$158,000<br />

Expenses