ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

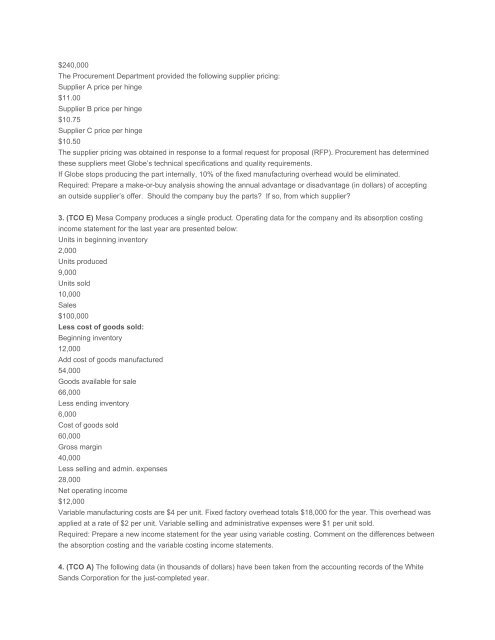

$240,000<br />

The Procurement Department provided the following supplier pricing:<br />

Supplier A price per hinge<br />

$11.00<br />

Supplier B price per hinge<br />

$10.75<br />

Supplier C price per hinge<br />

$10.50<br />

The supplier pricing was obtained in response to a formal request for proposal (RFP). Procurement has determined<br />

these suppliers meet Globe’s technical specifications and quality requirements.<br />

If Globe stops producing the part internally, 10% of the fixed manufacturing overhead would be eliminated.<br />

Required: Prepare a make-or-buy analysis showing the annual advantage or disadvantage (in dollars) of accepting<br />

an outside supplier’s offer. Should the company buy the parts? If so, from which supplier?<br />

3. (TCO E) Mesa Company produces a single product. Operating data for the company and its absorption costing<br />

income statement for the last year are presented below:<br />

Units in beginning inventory<br />

2,000<br />

Units produced<br />

9,000<br />

Units sold<br />

10,000<br />

Sales<br />

$100,000<br />

Less cost of goods sold:<br />

Beginning inventory<br />

12,000<br />

Add cost of goods manufactured<br />

54,000<br />

Goods available for sale<br />

66,000<br />

Less ending inventory<br />

6,000<br />

Cost of goods sold<br />

60,000<br />

Gross margin<br />

40,000<br />

Less selling and admin. expenses<br />

28,000<br />

Net operating income<br />

$12,000<br />

Variable manufacturing costs are $4 per unit. Fixed factory overhead totals $18,000 for the year. This overhead was<br />

applied at a rate of $2 per unit. Variable selling and administrative expenses were $1 per unit sold.<br />

Required: Prepare a new income statement for the year using variable costing. Comment on the differences between<br />

the absorption costing and the variable costing income statements.<br />

4. (TCO A) The following data (in thousands of dollars) have been taken from the accounting records of the White<br />

Sands Corporation for the just-completed year.