ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

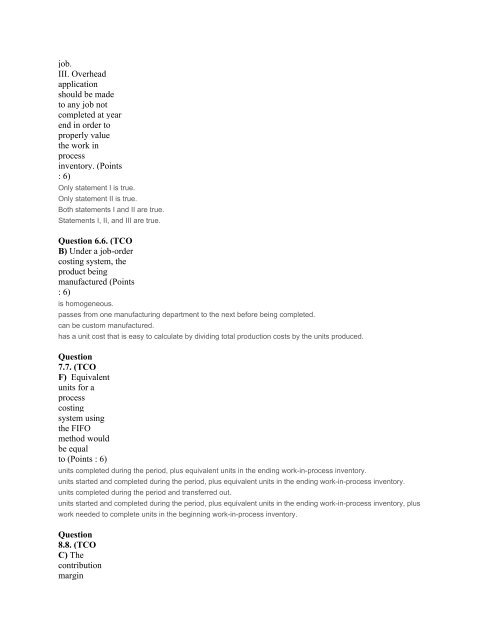

job.<br />

III. Overhead<br />

application<br />

should be made<br />

to any job not<br />

completed at year<br />

end in order to<br />

properly value<br />

the work in<br />

process<br />

inventory. (Points<br />

: 6)<br />

Only statement I is true.<br />

Only statement II is true.<br />

Both statements I and II are true.<br />

Statements I, II, and III are true.<br />

Question 6.6. (TCO<br />

B) Under a job-order<br />

costing system, the<br />

product being<br />

manufactured (Points<br />

: 6)<br />

is homogeneous.<br />

passes from one manufacturing department to the next before being completed.<br />

can be custom manufactured.<br />

has a unit cost that is easy to calculate by dividing total production costs by the units produced.<br />

Question<br />

7.7. (TCO<br />

F) Equivalent<br />

units for a<br />

process<br />

costing<br />

system using<br />

the FIFO<br />

method would<br />

be equal<br />

to (Points : 6)<br />

units completed during the period, plus equivalent units in the ending work-in-process inventory.<br />

units started and completed during the period, plus equivalent units in the ending work-in-process inventory.<br />

units completed during the period and transferred out.<br />

units started and completed during the period, plus equivalent units in the ending work-in-process inventory, plus<br />

work needed to complete units in the beginning work-in-process inventory.<br />

Question<br />

8.8. (TCO<br />

C) The<br />

contribution<br />

margin