ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

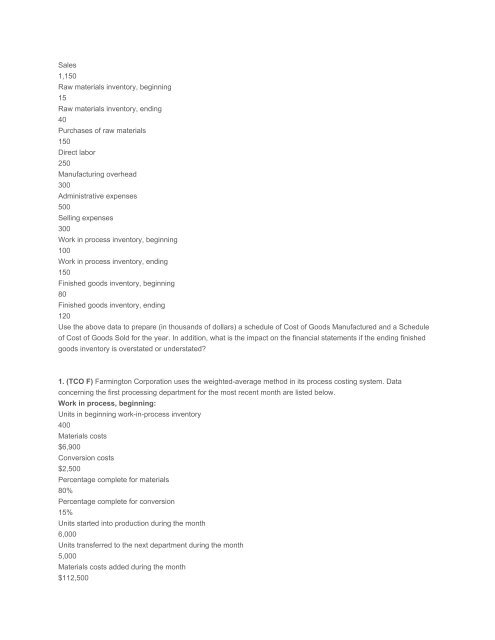

Sales<br />

1,150<br />

Raw materials inventory, beginning<br />

15<br />

Raw materials inventory, ending<br />

40<br />

Purchases of raw materials<br />

150<br />

Direct labor<br />

250<br />

Manufacturing overhead<br />

300<br />

Administrative expenses<br />

500<br />

Selling expenses<br />

300<br />

Work in process inventory, beginning<br />

100<br />

Work in process inventory, ending<br />

150<br />

Finished goods inventory, beginning<br />

80<br />

Finished goods inventory, ending<br />

120<br />

Use the above data to prepare (in thousands of dollars) a schedule of Cost of Goods Manufactured and a Schedule<br />

of Cost of Goods Sold for the year. In addition, what is the impact on the financial statements if the ending finished<br />

goods inventory is overstated or understated?<br />

1. (TCO F) Farmington Corporation uses the weighted-average method in its process costing system. Data<br />

concerning the first processing department for the most recent month are listed below.<br />

Work in process, beginning:<br />

Units in beginning work-in-process inventory<br />

400<br />

Materials costs<br />

$6,900<br />

Conversion costs<br />

$2,500<br />

Percentage complete for materials<br />

80%<br />

Percentage complete for conversion<br />

15%<br />

Units started into production during the month<br />

6,000<br />

Units transferred to the next department during the month<br />

5,000<br />

Materials costs added during the month<br />

$112,500