ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

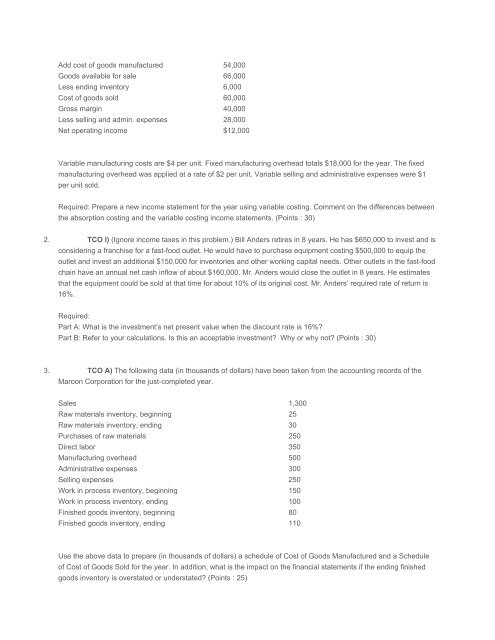

Add cost of goods manufactured 54,000<br />

Goods available for sale 66,000<br />

Less ending inventory 6,000<br />

Cost of goods sold 60,000<br />

Gross margin 40,000<br />

Less selling and admin. expenses 28,000<br />

Net operating income $12,000<br />

Variable manufacturing costs are $4 per unit. Fixed manufacturing overhead totals $18,000 for the year. The fixed<br />

manufacturing overhead was applied at a rate of $2 per unit. Variable selling and administrative expenses were $1<br />

per unit sold.<br />

Required: Prepare a new income statement for the year using variable costing. Comment on the differences between<br />

the absorption costing and the variable costing income statements. (Points : 30)<br />

2. TCO I) (Ignore income taxes in this problem.) Bill Anders retires in 8 years. He has $650,000 to invest and is<br />

considering a franchise for a fast-food outlet. He would have to purchase equipment costing $500,000 to equip the<br />

outlet and invest an additional $150,000 for inventories and other working capital needs. Other outlets in the fast-food<br />

chain have an annual net cash inflow of about $160,000. Mr. Anders would close the outlet in 8 years. He estimates<br />

that the equipment could be sold at that time for about 10% of its original cost. Mr. Anders’ required rate of return is<br />

16%.<br />

Required:<br />

Part A: What is the investment’s net present value when the discount rate is 16%?<br />

Part B: Refer to your calculations. Is this an acceptable investment? Why or why not? (Points : 30)<br />

3. TCO A) The following data (in thousands of dollars) have been taken from the accounting records of the<br />

Maroon Corporation for the just-completed year.<br />

Sales 1,300<br />

Raw materials inventory, beginning 25<br />

Raw materials inventory, ending 30<br />

Purchases of raw materials 250<br />

Direct labor 350<br />

Manufacturing overhead 500<br />

Administrative expenses 300<br />

Selling expenses 250<br />

Work in process inventory, beginning 150<br />

Work in process inventory, ending 100<br />

Finished goods inventory, beginning 80<br />

Finished goods inventory, ending 110<br />

Use the above data to prepare (in thousands of dollars) a schedule of Cost of Goods Manufactured and a Schedule<br />

of Cost of Goods Sold for the year. In addition, what is the impact on the financial statements if the ending finished<br />

goods inventory is overstated or understated? (Points : 25)