ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

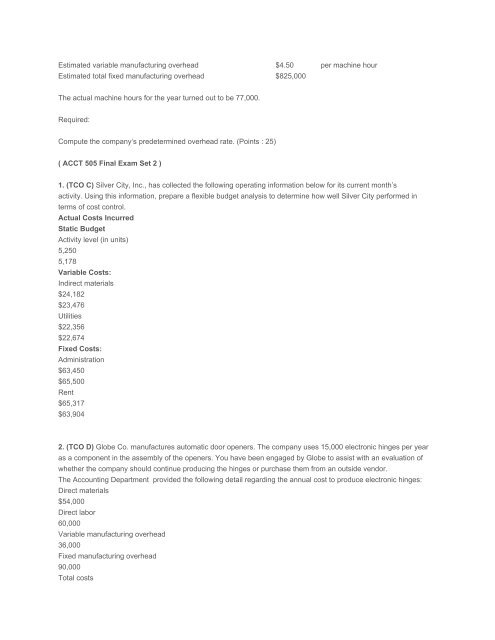

Estimated variable manufacturing overhead $4.50 per machine hour<br />

Estimated total fixed manufacturing overhead $825,000<br />

The actual machine hours for the year turned out to be 77,000.<br />

Required:<br />

Compute the company’s predetermined overhead rate. (Points : 25)<br />

( <strong>ACCT</strong> <strong>505</strong> Final Exam Set 2 )<br />

1. (TCO C) Silver City, Inc., has collected the following operating information below for its current month’s<br />

activity. Using this information, prepare a flexible budget analysis to determine how well Silver City performed in<br />

terms of cost control.<br />

Actual Costs Incurred<br />

Static Budget<br />

Activity level (in units)<br />

5,250<br />

5,178<br />

Variable Costs:<br />

Indirect materials<br />

$24,182<br />

$23,476<br />

Utilities<br />

$22,356<br />

$22,674<br />

Fixed Costs:<br />

Administration<br />

$63,450<br />

$65,500<br />

Rent<br />

$65,317<br />

$63,904<br />

2. (TCO D) Globe Co. manufactures automatic door openers. The company uses 15,000 electronic hinges per year<br />

as a component in the assembly of the openers. You have been engaged by Globe to assist with an evaluation of<br />

whether the company should continue producing the hinges or purchase them from an outside vendor.<br />

The <strong>Accounting</strong> Department provided the following detail regarding the annual cost to produce electronic hinges:<br />

Direct materials<br />

$54,000<br />

Direct labor<br />

60,000<br />

Variable manufacturing overhead<br />

36,000<br />

Fixed manufacturing overhead<br />

90,000<br />

Total costs