ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

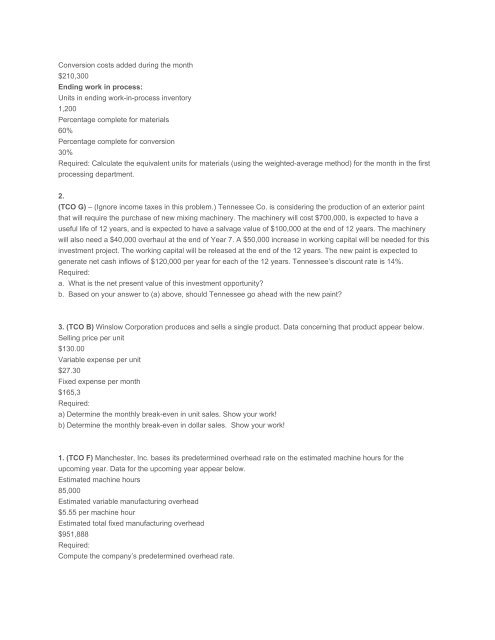

Conversion costs added during the month<br />

$210,300<br />

Ending work in process:<br />

Units in ending work-in-process inventory<br />

1,200<br />

Percentage complete for materials<br />

60%<br />

Percentage complete for conversion<br />

30%<br />

Required: Calculate the equivalent units for materials (using the weighted-average method) for the month in the first<br />

processing department.<br />

2.<br />

(TCO G) – (Ignore income taxes in this problem.) Tennessee Co. is considering the production of an exterior paint<br />

that will require the purchase of new mixing machinery. The machinery will cost $700,000, is expected to have a<br />

useful life of 12 years, and is expected to have a salvage value of $100,000 at the end of 12 years. The machinery<br />

will also need a $40,000 overhaul at the end of Year 7. A $50,000 increase in working capital will be needed for this<br />

investment project. The working capital will be released at the end of the 12 years. The new paint is expected to<br />

generate net cash inflows of $120,000 per year for each of the 12 years. Tennessee’s discount rate is 14%.<br />

Required:<br />

a. What is the net present value of this investment opportunity?<br />

b. Based on your answer to (a) above, should Tennessee go ahead with the new paint?<br />

3. (TCO B) Winslow Corporation produces and sells a single product. Data concerning that product appear below.<br />

Selling price per unit<br />

$130.00<br />

Variable expense per unit<br />

$27.30<br />

Fixed expense per month<br />

$165,3<br />

Required:<br />

a) Determine the monthly break-even in unit sales. Show your work!<br />

b) Determine the monthly break-even in dollar sales. Show your work!<br />

1. (TCO F) Manchester, Inc. bases its predetermined overhead rate on the estimated machine hours for the<br />

upcoming year. Data for the upcoming year appear below.<br />

Estimated machine hours<br />

85,000<br />

Estimated variable manufacturing overhead<br />

$5.55 per machine hour<br />

Estimated total fixed manufacturing overhead<br />

$951,888<br />

Required:<br />

Compute the company’s predetermined overhead rate.