ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

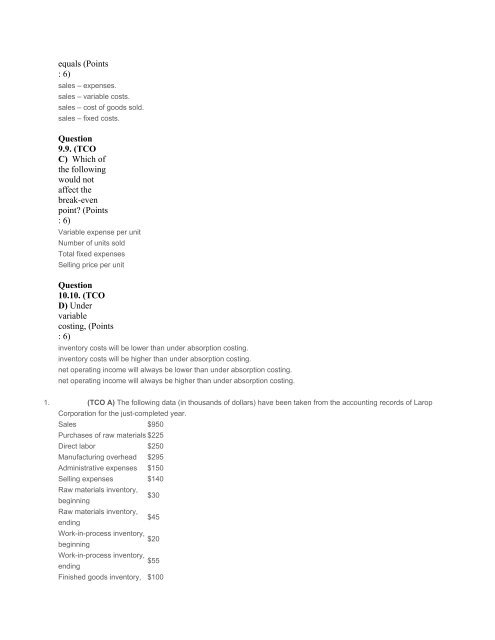

equals (Points<br />

: 6)<br />

sales – expenses.<br />

sales – variable costs.<br />

sales – cost of goods sold.<br />

sales – fixed costs.<br />

Question<br />

9.9. (TCO<br />

C) Which of<br />

the following<br />

would not<br />

affect the<br />

break-even<br />

point? (Points<br />

: 6)<br />

Variable expense per unit<br />

Number of units sold<br />

Total fixed expenses<br />

Selling price per unit<br />

Question<br />

10.10. (TCO<br />

D) Under<br />

variable<br />

costing, (Points<br />

: 6)<br />

inventory costs will be lower than under absorption costing.<br />

inventory costs will be higher than under absorption costing.<br />

net operating income will always be lower than under absorption costing.<br />

net operating income will always be higher than under absorption costing.<br />

1. (TCO A) The following data (in thousands of dollars) have been taken from the accounting records of Larop<br />

Corporation for the just-completed year.<br />

Sales $950<br />

Purchases of raw materials $225<br />

Direct labor $250<br />

Manufacturing overhead $295<br />

Administrative expenses $150<br />

Selling expenses $140<br />

Raw materials inventory,<br />

beginning<br />

$30<br />

Raw materials inventory,<br />

ending<br />

$45<br />

Work-in-process inventory,<br />

$20<br />

beginning<br />

Work-in-process inventory,<br />

$55<br />

ending<br />

Finished goods inventory, $100