ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

ACCT 505 Managerial Accounting Entire Course

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

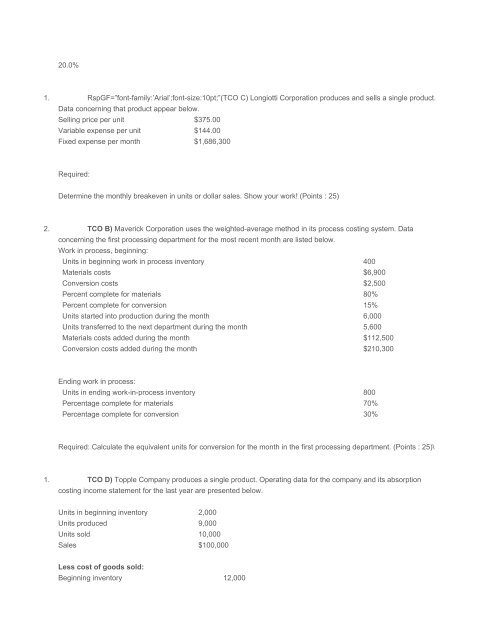

20.0%<br />

1. RspGF=”font-family:’Arial’;font-size:10pt;”(TCO C) Longiotti Corporation produces and sells a single product.<br />

Data concerning that product appear below.<br />

Selling price per unit $375.00<br />

Variable expense per unit $144.00<br />

Fixed expense per month $1,686,300<br />

Required:<br />

Determine the monthly breakeven in units or dollar sales. Show your work! (Points : 25)<br />

2. TCO B) Maverick Corporation uses the weighted-average method in its process costing system. Data<br />

concerning the first processing department for the most recent month are listed below.<br />

Work in process, beginning:<br />

Units in beginning work in process inventory 400<br />

Materials costs $6,900<br />

Conversion costs $2,500<br />

Percent complete for materials 80%<br />

Percent complete for conversion 15%<br />

Units started into production during the month 6,000<br />

Units transferred to the next department during the month 5,600<br />

Materials costs added during the month $112,500<br />

Conversion costs added during the month $210,300<br />

Ending work in process:<br />

Units in ending work-in-process inventory 800<br />

Percentage complete for materials 70%<br />

Percentage complete for conversion 30%<br />

Required: Calculate the equivalent units for conversion for the month in the first processing department. (Points : 25)\<br />

1. TCO D) Topple Company produces a single product. Operating data for the company and its absorption<br />

costing income statement for the last year are presented below.<br />

Units in beginning inventory 2,000<br />

Units produced 9,000<br />

Units sold 10,000<br />

Sales $100,000<br />

Less cost of goods sold:<br />

Beginning inventory 12,000