QinetiQ Annual Report 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.qinetiq.com<br />

<strong>QinetiQ</strong><br />

<strong>QinetiQ</strong> Group<br />

Group<br />

plc<br />

plc<br />

<strong>Annual</strong><br />

<strong>Annual</strong><br />

<strong>Report</strong><br />

<strong>Report</strong><br />

and<br />

and<br />

Accounts<br />

Accounts<br />

<strong>2017</strong><br />

<strong>2017</strong><br />

Financial statements<br />

Financial statements 113<br />

113<br />

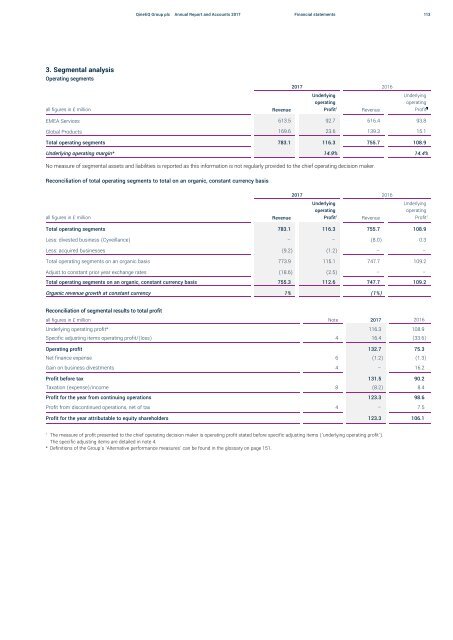

3. Segmental analysis<br />

Operating segments<br />

all figures in £ million<br />

Revenue<br />

<strong>2017</strong> 2016<br />

Underlying<br />

operating<br />

Profit 1<br />

Revenue<br />

Underlying<br />

operating<br />

Profit 1<br />

EMEA Services 613.5 92.7 616.4 93.8<br />

Global Products 169.6 23.6 139.3 15.1<br />

Total operating segments 783.1 116.3 755.7 108.9<br />

Underlying operating margin* 14.9% 14.4%<br />

No measure of segmental assets and liabilities is reported as this information is not regularly provided to the chief operating decision maker.<br />

Reconciliation of total operating segments to total on an organic, constant currency basis<br />

all figures in £ million<br />

Revenue<br />

<strong>2017</strong> 2016<br />

Underlying<br />

operating<br />

Profit 1<br />

Revenue<br />

Underlying<br />

operating<br />

Profit 1<br />

Total operating segments 783.1 116.3 755.7 108.9<br />

Less: divested business (Cyveillance) – – (8.0) 0.3<br />

Less: acquired businesses (9.2) (1.2) – –<br />

Total operating segments on an organic basis 773.9 115.1 747.7 109.2<br />

Adjust to constant prior year exchange rates (18.6) (2.5) – –<br />

Total operating segments on an organic, constant currency basis 755.3 112.6 747.7 109.2<br />

Organic revenue growth at constant currency 1% (1%)<br />

Reconciliation of segmental results to total profit<br />

all figures in £ million Note <strong>2017</strong> 2016<br />

Underlying operating profit* 116.3 108.9<br />

Specific adjusting items operating profit/(loss) 4 16.4 (33.6)<br />

Operating profit 132.7 75.3<br />

Net finance expense 6 (1.2) (1.3)<br />

Gain on business divestments 4 – 16.2<br />

Profit before tax 131.5 90.2<br />

Taxation (expense)/income 8 (8.2) 8.4<br />

Profit for the year from continuing operations 123.3 98.6<br />

Profit from discontinued operations, net of tax 4 – 7.5<br />

Profit for the year attributable to equity shareholders 123.3 106.1<br />

1<br />

The measure of profit presented to the chief operating decision maker is operating profit stated before specific adjusting items (‘underlying operating profit’).<br />

The specific adjusting items are detailed in note 4.<br />

* Definitions of the Group’s ‘Alternative performance measures’ can be found in the glossary on page 151.