QinetiQ Annual Report 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

128<br />

128<br />

Financial<br />

Financial statements<br />

statements <strong>QinetiQ</strong><br />

<strong>QinetiQ</strong> Group<br />

Group<br />

plc<br />

plc<br />

<strong>Annual</strong><br />

<strong>Annual</strong><br />

<strong>Report</strong><br />

<strong>Report</strong><br />

and<br />

and<br />

Accounts<br />

Accounts<br />

<strong>2017</strong><br />

<strong>2017</strong><br />

www.qinetiq.com<br />

Notes to the financial statements continued<br />

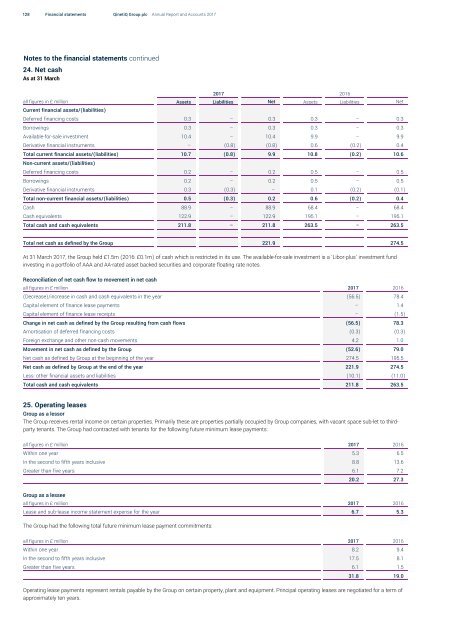

24. Net cash<br />

As at 31 March<br />

<strong>2017</strong> 2016<br />

all figures in £ million Assets Liabilities Net Assets Liabilities Net<br />

Current financial assets/(liabilities)<br />

Deferred financing costs 0.3 – 0.3 0.3 – 0.3<br />

Borrowings 0.3 – 0.3 0.3 – 0.3<br />

Available-for-sale investment 10.4 – 10.4 9.9 – 9.9<br />

Derivative financial instruments – (0.8) (0.8) 0.6 (0.2) 0.4<br />

Total current financial assets/(liabilities) 10.7 (0.8) 9.9 10.8 (0.2) 10.6<br />

Non-current assets/(liabilities)<br />

Deferred financing costs 0.2 – 0.2 0.5 – 0.5<br />

Borrowings 0.2 – 0.2 0.5 – 0.5<br />

Derivative financial instruments 0.3 (0.3) – 0.1 (0.2) (0.1)<br />

Total non-current financial assets/(liabilities) 0.5 (0.3) 0.2 0.6 (0.2) 0.4<br />

Cash 88.9 – 88.9 68.4 – 68.4<br />

Cash equivalents 122.9 – 122.9 195.1 – 195.1<br />

Total cash and cash equivalents 211.8 – 211.8 263.5 – 263.5<br />

Total net cash as defined by the Group 221.9 274.5<br />

At 31 March <strong>2017</strong>, the Group held £1.5m (2016: £0.1m) of cash which is restricted in its use. The available-for-sale investment is a ‘Libor-plus’ investment fund<br />

investing in a portfolio of AAA and AA-rated asset backed securities and corporate floating rate notes.<br />

Reconciliation of net cash flow to movement in net cash<br />

all figures in £ million <strong>2017</strong> 2016<br />

(Decrease)/increase in cash and cash equivalents in the year (56.5) 78.4<br />

Capital element of finance lease payments – 1.4<br />

Capital element of finance lease receipts – (1.5)<br />

Change in net cash as defined by the Group resulting from cash flows (56.5) 78.3<br />

Amortisation of deferred financing costs (0.3) (0.3)<br />

Foreign exchange and other non-cash movements 4.2 1.0<br />

Movement in net cash as defined by the Group (52.6) 79.0<br />

Net cash as defined by Group at the beginning of the year 274.5 195.5<br />

Net cash as defined by Group at the end of the year 221.9 274.5<br />

Less: other financial assets and liabilities (10.1) (11.0)<br />

Total cash and cash equivalents 211.8 263.5<br />

25. Operating leases<br />

Group as a lessor<br />

The Group receives rental income on certain properties. Primarily these are properties partially occupied by Group companies, with vacant space sub-let to thirdparty<br />

tenants. The Group had contracted with tenants for the following future minimum lease payments:<br />

all figures in £ million <strong>2017</strong> 2016<br />

Within one year 5.3 6.5<br />

In the second to fifth years inclusive 8.8 13.6<br />

Greater than five years 6.1 7.2<br />

20.2 27.3<br />

Group as a lessee<br />

all figures in £ million <strong>2017</strong> 2016<br />

Lease and sub-lease income statement expense for the year 6.7 5.3<br />

The Group had the following total future minimum lease payment commitments:<br />

all figures in £ million <strong>2017</strong> 2016<br />

Within one year 8.2 9.4<br />

In the second to fifth years inclusive 17.5 8.1<br />

Greater than five years 6.1 1.5<br />

31.8 19.0<br />

Operating lease payments represent rentals payable by the Group on certain property, plant and equipment. Principal operating leases are negotiated for a term of<br />

approximately ten years.