QinetiQ Annual Report 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.qinetiq.com<br />

<strong>QinetiQ</strong><br />

<strong>QinetiQ</strong> Group<br />

Group<br />

plc<br />

plc<br />

<strong>Annual</strong><br />

<strong>Annual</strong><br />

<strong>Report</strong><br />

<strong>Report</strong><br />

and<br />

and<br />

Accounts<br />

Accounts<br />

<strong>2017</strong><br />

<strong>2017</strong><br />

Financial statements<br />

Financial statements<br />

125<br />

125<br />

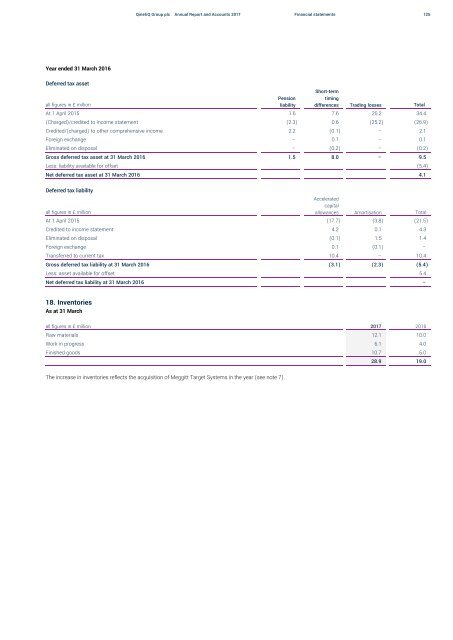

Year ended 31 March 2016<br />

Deferred tax asset<br />

all figures in £ million<br />

Pension<br />

liability<br />

Short-term<br />

timing<br />

differences Trading losses Total<br />

At 1 April 2015 1.6 7.6 25.2 34.4<br />

(Charged)/credited to income statement (2.3) 0.6 (25.2) (26.9)<br />

Credited/(charged) to other comprehensive income 2.2 (0.1) – 2.1<br />

Foreign exchange – 0.1 – 0.1<br />

Eliminated on disposal – (0.2) – (0.2)<br />

Gross deferred tax asset at 31 March 2016 1.5 8.0 – 9.5<br />

Less: liability available for offset (5.4)<br />

Net deferred tax asset at 31 March 2016 4.1<br />

Deferred tax liability<br />

all figures in £ million<br />

Accelerated<br />

capital<br />

allowances Amortisation Total<br />

At 1 April 2015 (17.7) (3.8) (21.5)<br />

Credited to income statement 4.2 0.1 4.3<br />

Eliminated on disposal (0.1) 1.5 1.4<br />

Foreign exchange 0.1 (0.1) –<br />

Transferred to current tax 10.4 – 10.4<br />

Gross deferred tax liability at 31 March 2016 (3.1) (2.3) (5.4)<br />

Less: asset available for offset 5.4<br />

Net deferred tax liability at 31 March 2016 –<br />

18. Inventories<br />

As at 31 March<br />

all figures in £ million <strong>2017</strong> 2016<br />

Raw materials 12.1 10.0<br />

Work in progress 6.1 4.0<br />

Finished goods 10.7 5.0<br />

28.9 19.0<br />

The increase in inventories reflects the acquisition of Meggitt Target Systems in the year (see note 7).