QinetiQ Annual Report 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>QinetiQ</strong> Group plc <strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2017</strong><br />

Additional information<br />

151<br />

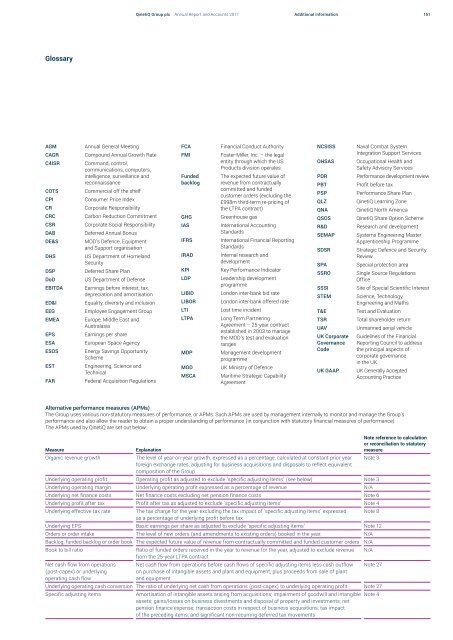

Glossary<br />

AGM<br />

CAGR<br />

C4ISR<br />

COTS<br />

CPI<br />

CR<br />

CRC<br />

CSR<br />

DAB<br />

DE&S<br />

DHS<br />

DSP<br />

DoD<br />

EBITDA<br />

ED&I<br />

EEG<br />

EMEA<br />

EPS<br />

ESA<br />

ESOS<br />

EST<br />

FAR<br />

<strong>Annual</strong> General Meeting<br />

Compound <strong>Annual</strong> Growth Rate<br />

Command, control,<br />

communications, computers,<br />

intelligence, surveillance and<br />

reconnaissance<br />

Commercial off the shelf<br />

Consumer Price Index<br />

Corporate Responsibility<br />

Carbon Reduction Commitment<br />

Corporate Social Responsibility<br />

Deferred <strong>Annual</strong> Bonus<br />

MOD’s Defence, Equipment<br />

and Support organisation<br />

US Department of Homeland<br />

Security<br />

Deferred Share Plan<br />

US Department of Defense<br />

Earnings before interest, tax,<br />

depreciation and amortisation<br />

Equality, diversity and inclusion<br />

Employee Engagement Group<br />

Europe, Middle East and<br />

Australasia<br />

Earnings per share<br />

European Space Agency<br />

Energy Savings Opportunity<br />

Scheme<br />

Engineering, Science and<br />

Technical<br />

Federal Acquisition Regulations<br />

FCA<br />

FMI<br />

Funded<br />

backlog<br />

GHG<br />

IAS<br />

IFRS<br />

IRAD<br />

KPI<br />

LDP<br />

LIBID<br />

LIBOR<br />

LTI<br />

LTPA<br />

MDP<br />

MOD<br />

MSCA<br />

Financial Conduct Authority<br />

Foster-Miller, Inc. – the legal<br />

entity through which the US<br />

Products division operates<br />

The expected future value of<br />

revenue from contractually<br />

committed and funded<br />

customer orders (excluding the<br />

£998m third-term re-pricing of<br />

the LTPA contract)<br />

Greenhouse gas<br />

International Accounting<br />

Standards<br />

International Financial <strong>Report</strong>ing<br />

Standards<br />

Internal research and<br />

development<br />

Key Performance Indicator<br />

Leadership development<br />

programme<br />

London inter-bank bid rate<br />

London inter-bank offered rate<br />

Lost time incident<br />

Long Term Partnering<br />

Agreement – 25-year contract<br />

established in 2003 to manage<br />

the MOD’s test and evaluation<br />

ranges<br />

Management development<br />

programme<br />

UK Ministry of Defence<br />

Maritime Strategic Capability<br />

Agreement<br />

NCSISS<br />

OHSAS<br />

PDR<br />

PBT<br />

PSP<br />

QLZ<br />

QNA<br />

QSOS<br />

R&D<br />

SEMAP<br />

SDSR<br />

SPA<br />

SSRO<br />

SSSI<br />

STEM<br />

T&E<br />

TSR<br />

UAV<br />

UK Corporate<br />

Governance<br />

Code<br />

UK GAAP<br />

Naval Combat System<br />

Integration Support Services<br />

Occupational Health and<br />

Safety Advisory Services<br />

Performance development review<br />

Profit before tax<br />

Performance Share Plan<br />

<strong>QinetiQ</strong> Learning Zone<br />

<strong>QinetiQ</strong> North America<br />

<strong>QinetiQ</strong> Share Option Scheme<br />

Research and development<br />

Systems Engineering Master<br />

Apprenticeship Programme<br />

Strategic Defence and Security<br />

Review<br />

Special protection area<br />

Single Source Regulations<br />

Office<br />

Site of Special Scientific Interest<br />

Science, Technology,<br />

Engineering and Maths<br />

Test and Evaluation<br />

Total shareholder return<br />

Unmanned aerial vehicle<br />

Guidelines of the Financial<br />

<strong>Report</strong>ing Council to address<br />

the principal aspects of<br />

corporate governance<br />

in the UK<br />

UK Generally Accepted<br />

Accounting Practice<br />

Alternative performance measures (APMs)<br />

The Group uses various non-statutory measures of performance, or APMs. Such APMs are used by management internally to monitor and manage the Group’s<br />

performance and also allow the reader to obtain a proper understanding of performance (in conjunction with statutory financial measures of performance).<br />

The APMs used by <strong>QinetiQ</strong> are set out below:<br />

Measure<br />

Explanation<br />

Note reference to calculation<br />

or reconciliation to statutory<br />

measure<br />

Organic revenue growth<br />

The level of year-on-year growth, expressed as a percentage, calculated at constant prior year Note 3<br />

foreign exchange rates, adjusting for business acquisitions and disposals to reflect equivalent<br />

composition of the Group<br />

Underlying operating profit Operating profit as adjusted to exclude ‘specific adjusting items’ (see below) Note 3<br />

Underlying operating margin Underlying operating profit expressed as a percentage of revenue N/A<br />

Underlying net finance costs Net finance costs excluding net pension finance costs Note 6<br />

Underlying profit after tax Profit after tax as adjusted to exclude ‘specific adjusting items’ Note 4<br />

Underlying effective tax rate The tax charge for the year excluding the tax impact of ‘specific adjusting items’ expressed Note 8<br />

as a percentage of underlying profit before tax<br />

Underlying EPS Basic earnings per share as adjusted to exclude ‘specific adjusting items’ Note 12<br />

Orders or order intake The level of new orders (and amendments to existing orders) booked in the year. N/A<br />

Backlog, funded backlog or order book The expected future value of revenue from contractually committed and funded customer orders N/A<br />

Book to bill ratio<br />

Ratio of funded orders received in the year to revenue for the year, adjusted to exclude revenue<br />

from the 25-year LTPA contract<br />

N/A<br />

Net cash flow from operations<br />

(post-capex) or underlying<br />

operating cash flow<br />

Net cash flow from operations before cash flows of specific adjusting items less cash outflow<br />

on purchase of intangible assets and plant and equipment, plus proceeds from sale of plant<br />

and equipment<br />

Note 27<br />

Underlying operating cash conversion The ratio of underlying net cash from operations (post-capex) to underlying operating profit Note 27<br />

Specific adjusting items<br />

Amortisation of intangible assets arising from acquisitions; impairment of goodwill and intangible Note 4<br />

assets; gains/losses on business divestments and disposal of property and investments; net<br />

pension finance expense; transaction costs in respect of business acquisitions; tax impact<br />

of the preceding items; and significant non-recurring deferred tax movements