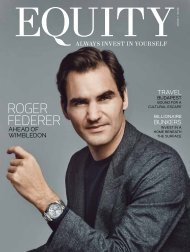

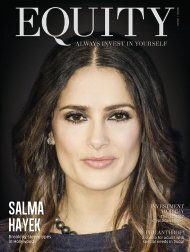

Equity Magazine November 2017

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

WEALTH MANAGEMENT<br />

UK IHT receipts increased from £2.3bn in<br />

2009/2010 to a staggering £4.8bn in<br />

2016/<strong>2017</strong>. This is expected to increase to<br />

£5.8bn around 2018/2019<br />

There are few taxes in life that are optional and<br />

inheritance tax is one of them. IHT can cost<br />

your family and loved ones a considerable sum<br />

of money in the event of your death. However,<br />

with a little forward planning, it is possible to legitimately<br />

avoid this tax. Therefore, it is a necessity to understand the<br />

basics and create a strategic plan. Here’s a brief look at<br />

IHT in the UK and some ways it can be minimised.<br />

IHT is a tax payable by a British domiciled individual on<br />

worldwide assets, in the event of their death. It is<br />

chargeable at a rate of 40 per cent on all assets, over the<br />

current Nil Rate Band (NRB) which is £325,000<br />

(Dhs1,574,677). Married couples or those in a civil<br />

partnership, each receive the NRB, thus increasing the<br />

threshold to £650,000. The NRB has not changed since<br />

2009 and is fixed at £325,000 until 2021.<br />

In the past, IHT was largely aimed at high net worth<br />

individuals, however more UK citizens are now paying<br />

significant IHT. Indeed, UK IHT receipts increased from<br />

£2.3bn in 2009/2010 to a staggering £4.8bn in 2016/<strong>2017</strong>,<br />

according to figures from Statista. This is expected to<br />

increase to £5.8bn around 2018/2019. London and the<br />

South-East account for a high proportion of IHT receipts,<br />

according to The Telegraph, which is not surprising, given<br />

that much of the UK’s property and business wealth is<br />

concentrated in these areas.<br />

Whether or not you can change your domicile to avoid<br />

the tax, is a complex area and often one that is<br />

misunderstood. Whilst many people who have lived<br />

abroad and have been non-residents for many years<br />

consider themselves no longer UK domiciled, the reality is<br />

very different. Being non-resident certainly does not imply<br />

non-domicile, and it is your address that determines where<br />

you pay IHT and not your residency. At birth, you receive<br />

your domicile of origin from your father (or mother if<br />

your parents were not married at the time). This will<br />

remain unless your parents lived abroad and changed their<br />

own domicile by choice before you were aged 16 – then<br />

you would also change to the domicile of dependency.<br />

After age 16, your domicile depends on your own<br />

circumstances. British expats may live abroad for many<br />

years without losing their UK domicile if they have not<br />

taken sufficient steps to break their ties with the UK.<br />

19<br />

EQUITY