Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Focus Feature | Economy Review <strong>2018</strong><br />

planned value-added tax (VAT) as well<br />

as firmer housing and food inflation.<br />

Latest figures showed inflation gaining<br />

momentum, reaching an over one-year<br />

high of 2.4% y/y in October. After falling<br />

sharply in 4Q16 as the initial impact<br />

of subsidy cuts petered out, food price<br />

inflation returned to positive territory in<br />

mid-2017 and is expected to rise further<br />

on the back of planned excise duties on<br />

tobacco and soft drinks. At 5%, the VAT<br />

- which we assume will be introduced<br />

in the second half of <strong>2018</strong> - is projected<br />

to add around 2% to the overall inflation<br />

rate for one year. We see inflation rising<br />

from around 1% in 2017 to 2.5% in <strong>2018</strong>. We<br />

expect inflation to remain at or around<br />

that rate in 2019, given the economy’s<br />

decent underlying growth performance.<br />

Budget deficit is expected to gradually<br />

narrow though still high given ongoing<br />

fiscal consolidation efforts as well as<br />

some improvement in revenues.<br />

Fiscal reform has so far been<br />

centered on rationalizing subsidies.<br />

Unlike other GCC countries, government<br />

spending in Bahrain is virtually<br />

unchanged from 2014 levels, highlighting<br />

the challenges in cutting areas such as<br />

salaries and subsidies. The VAT should<br />

raise around $0.3 billion (approximately<br />

1% of GDP) in additional tax revenue per<br />

year. With the cumulative sum of GCC<br />

grant allocations currently standing<br />

at less than $1.3 billion year-to-date,<br />

according to the Economic Development<br />

Board, active projects are projected to<br />

continue to grow at healthy rates.<br />

Key current projects include Alba’s<br />

$3 billion expansion project, a $1.1<br />

billion airport expansion and a gas plant<br />

project worth $355 million. With the<br />

budget deficit hovering at high levels,<br />

the government will continue to look to<br />

domestic and international bond markets<br />

to plug the shortfall.<br />

Bahrain Tourism projects investment<br />

reaches US $ 13 Billion<br />

The Bahrain Economic Development<br />

Board (EDB) recently revealed investment<br />

in Bahrain’s tourism infrastructure<br />

reached over US $13 billion. The figure<br />

covers 14 prominent projects that will<br />

further boost growth in the Kingdom’s<br />

tourism and leisure sector.<br />

The sector witnessed rapid growth<br />

in the past year, with the total number of<br />

tourists visiting the Kingdom increasing<br />

by 12.8% in the first nine months of<br />

2017. The Kingdom is also witnessing<br />

further enhancement to its tourism<br />

infrastructure to support this growth,<br />

which plays a significant role in Bahrain’s<br />

economic diversification efforts.<br />

“The total number of tourists visiting<br />

Bahrain has reached 8.7 million during<br />

the first nine months of this year, a<br />

significant number considering our<br />

resident population of only 1.5 million<br />

people.” said Dr. Simon Galpin, Managing<br />

Director of Bahrain EDB.<br />

“The tourism sector is one of the<br />

key investment sectors we recognise as<br />

having a strong competitive advantage<br />

for Bahrain. It contributes 6.3% to<br />

the country’s GDP, and is set to grow<br />

significantly, as the number of visitors<br />

and leisure activities increase. Bahrain<br />

continues to reaffirm its position as a<br />

tourism destination of choice with a<br />

number of new hotels, retail and leisure<br />

developments currently underway.”<br />

The tourism investment projects<br />

are part of Bahrain’s large-scale<br />

infrastructure development across a<br />

wide range of sectors and are valued at<br />

over US $32 billion. This public-private<br />

sector investment consists of $10 billion<br />

of government funding, US $7.5 billion<br />

under the GCC Development Fund, and<br />

$15 billion worth of investment in the<br />

private sector.<br />

As part of these developments,<br />

Bahrain International Airport<br />

is undergoing a US $1.1 billion<br />

modernisation programme, set to<br />

increase passenger capacity from nine to<br />

14 million per year by 2020. This will go<br />

hand in hand with the new five and fourstar<br />

hotels and resorts in the tourism<br />

development pipeline that will cater to<br />

current and future demand.<br />

Other infrastructure investment<br />

projects include the development of<br />

a number of shopping malls such as<br />

Dilmunia Mall and the Marassi Galleria<br />

shopping complex, to join the recentlyopened<br />

US $159 million Avenues Mall at<br />

Bahrain Bay.<br />

Furthermore, Bahrain’s tourism<br />

strategy also extends to medical-tourism<br />

projects through King Abdullah Medical<br />

City, and mixed-use real estate projects<br />

such as Bahrain Bay, Bahrain Marina,<br />

Diyar Al Muharraq, Water Garden City,<br />

Dilmunia, and Marassi Al Bahrain<br />

where Emaar Hospitality brands such as<br />

The Address Hotel and Vida are under<br />

construction.<br />

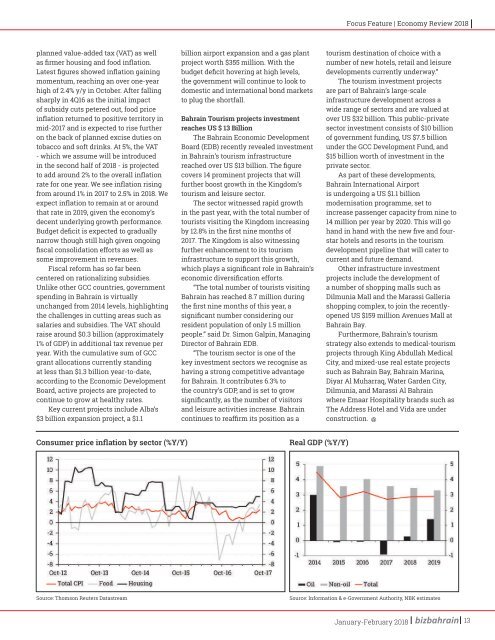

Consumer price inflation by sector (%Y/Y)<br />

Real GDP (%Y/Y)<br />

Source: Thomson Reuters Datastream<br />

Source: Information & e-Government Authority, NBK estimates<br />

January-February <strong>2018</strong><br />

13